Property, Plant and Equipment (PP&E) Net

What is Property, Plant and Equipment?

Property, plant and equipment are tangible assets (with physical substance) often abbreviated to PP&E. They are expected to be used by the business for more than one year and, consequently, categorized as non-current assets. They are initially included at cost, which is purchase price plus any incidentals associated with their acquisition. This can be summarized by all costs which bring the asset to its working condition for its intended use. Delivery, inspection, handling and installation costs will all be included in the items initial value.

If PP&E is constructed rather than purchased, all costs of construction, including interest, are added to arrive at the PP&E work in process amount. It is presented as one line item but can be made up of the following components:

- Land and buildings

- Plant and machinery

- Fixtures, fittings and vehicles

- Assets in the course of construction

PP&E is part of the cost of doing business and produces economic benefits over several periods. Therefore, its cost is allocated into the income statement over time using a process called depreciation. Depreciation represents the consumption of benefits over time and matches the revenues in any period with the PP&E cost of producing those revenues. Depreciation is a cost allocation system and does not represent a decline in the market value of assets.

Key Learning Points

- Property, Plant and Equipment or PP&E is represented as one line in the balance sheet but is often comprised of many non-current assets associated as part of the cost of doing business and producing economic benefits

- It is reported at the net book amount which accounts for depreciation (an accounting cost allocation method) and Capex which may vary from its market value

- Depreciation only represents the accounting cost of using long term assets over their useful life and does not represent a decline in market value

- PP&E can suffer impairment expenses which represent an extraordinary loss of value and the asset must be written down to its fair value

- Impairments are unpredictable and never included in financial forecasts and are treated as non-recurring items

How do Companies Report PP&E?

PP&E is presented in the balance sheet at the net book amount (net of accumulated depreciation). The footnotes break this down into the component parts. See example below:

General Motors Co. – Extract from notes to accounts 2018

Depreciation and Capex

There are many methods of calculating depreciation. The two main systems are straight line and reducing balance. Straight line is the most common method and is quick and easy to calculate. The formula for straight-line depreciation is the following:

Depreciation Expense = (Cost – Salvage Value) / Useful Life of Asset

The expense incurred is the same for each period of the asset’s life. In the income statement, this is not a cash flow. The cash flow is the initial purchase, called capital expenditure (capex).

Capital expenditure or capex increases the PP&E balance and represents the investing activities of the business. Over the financial year, a business may want to purchase more assets or maintain current ones with the aim to increase their economic benefit (revenues).

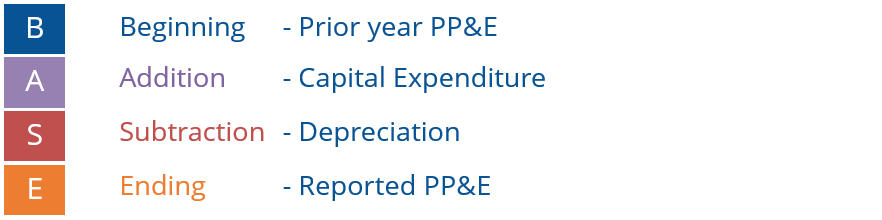

The net PP&E base calculation is:

What Else Affects the Reported Balance?

If an item of PP&E is not being consumed over time or if its useful life is very long, then it is not depreciated. Land is the most common example of this but if the land is “wasting”, such as a quarry or mine, then it is depreciated like any PP&E asset.

When the business believes that the carrying amount of PP&E is overstated, it should impair or write down the book value of the asset to fair value. This may be due to an unexpected change in market conditions or other circumstances. Fair value is the anticipated recoverable amount. This process is called an impairment and is fundamentally like unscheduled depreciation. The carrying amount of the assets is reduced and the income statement is expensed. These charges or expenses can be significant, are certainly hard to forecast, and normally considered to be non-recurring when calculating normalized profits. Restructuring and reorganization costs frequently include some element of impairment.