EBITDA Margin

What is EBITDA Margin?

EBITDA margin shows the recurring operating profit before the impact of depreciation and amortization as a percentage of sales. It is a measure of profitability and is used as a metric to compare a company’s profitability from one year to the next or with a competitor for the same period.

EBITDA margin also has applications in valuation and credit analysis.

Key Learning Points

- EBITDA margin shows the recurring operating profit before the impact of depreciation and amortization as a percentage of sales. It is calculated as EBITDA/Sales and is expressed as a percentage

- The margin measures the operational profitability of a company before the impact of depreciation and amortization (D&A)

- EBITDA is normalized to remove non-recurring and non-operational items. This helps understand the recurring earnings generated by the core operations of the business

The Formula

The margin is calculated as follows:

EBITDA margin = EBITDA / Sales

EBITDA is earnings before interest, taxes, depreciation, and amortization. It can be calculated as:

Operating profit or EBIT +/- Non-recurring items + Depreciation + Amortization

For many companies, operating profit is equal to EBIT.

The most common source for finding depreciation and amortization is in the cash flow statement under operating activities.

Compared to EBIT, EBITDA excludes non-cash expenses such as depreciation and amortization. Companies may have different depreciation and amortization policies for these assets, resulting in a larger (or smaller) expense. This will in turn reduce (or increase) their EBIT. Adding back these expenses can make it easier to compare with competitors.

Sales (or revenues) is reported in the income statement.

Example Calculation

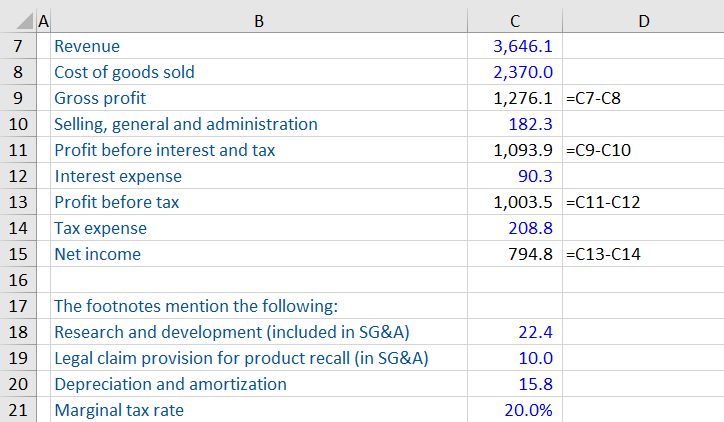

Calculate EBITDA and EBITDA margin for the following company:

We have been provided with an income statement along with additional information in the footnotes. The first step is to calculate EBITDA.

The calculation should always start at operating profit. Use this as your anchor if you are ever unsure of the next step. In this example it is labelled “Profit before interest and tax”.

Checking above and below this line, look for any non-recurring items or items which should be included as part of the operations of the business. There are none to be added.

Next, check the footnotes for any embedded items which need to be cleaned from the operating profit. The footnote says there is an R&D expense and a provision related to a legal claim, both included in SG&A. These have already been included to arrive at operating profit, however, a legal claim provision is not part of the operations of the business and must be added back. R&D are expenses related to the discovery of new technology and are ignored.

This provides the following calculation:

Revenues are reported at the top of the income statement and can be referenced in the calculation of EBITDA margin.

It is important to note that margins should always be compared to an industry benchmark, comparable company or over a period of time. Standalone figures provide only a snapshot and are in some way meaningless without an appropriate comparison.

Applications of EBITDA Margin

Valuation

Key metrics are calculated for industry peers and are used to extrapolate the value of the business being considered. EBITDA margins, along with other such as gross margin, EBIT margin, and net margin, are useful for comparison to peers.

Credit Analysis

Lenders and credit agencies look into several factors before giving a loan or assigning a credit rating to a company. EBITDA margins are one of the factors considered in credit analysis. Decreasing EBITDA margins can negatively affect the creditworthiness of a borrower.