Liabilities

What is a Liability?

Liabilities are the present legal obligations of a company as a result of its borrowing activities or other fiscal obligations.

A liability arises from previous business transactions, events, sales, exchange of assets or services that would provide future economic benefit. A liability may also arise if the company identifies a probable future outflow of cash.

Thus a liability is defined as:

- Any borrowing to increase business income payable at a later date.

- A duty or responsibility enforced by law to another party.

- A duty to another entity involving settlement by transfer or use of company assets, provision of services or other transactions at a specified future date or on-demand.

- A transaction or event that has occurred currently and obligates the entity.

Types of Liabilities

The types of liabilities are recognized in terms of their duration and characteristics.

Current Liabilities

Current liabilities, or short-term liabilities, are debts or obligations that are due and payable within one year. Current liabilities are an essential component for measuring the short-term liquidity of a company. These are the key ratios used in the financial analysis of companies:

Current ratio = Current assets / current liabilities

Quick ratio = (Current assets – inventory) / current liabilities

Cash ratio = Cash and cash equivalents / current liabilities

Non-current Liabilities

Non-current liabilities, or long-term liabilities, are debts or obligations that are payable over more than one year and are an important source of a company’s long-term financing.

Contingent Liabilities

Contingent liabilities depend upon the outcome of a future event occurring or not; they are potential liabilities that may or may not become real. A company reports that there is a possible liability from an event, transaction or incident that has already taken place. However, the company is uncertain whether or not its resources will be impacted.

Companies are legally obligated to report contingent liabilities which are recorded in notes attached to a company’s financial statement. If the potential loss moves from being possible to probable, the company must recognize a liability on its balance sheet.

Examples of Liabilities

| Current Liabilities | Long-term Liabilities | Contingent Liabilities |

| ● Accounts payable

● Commercial paper payable ● Trade notes payable ● Short-term notes payable ● Operating costs: salaries, wages, interest payable, income tax, the current balance of long-term debt due in a year ● Long-term debt like bonds |

● Long-term bonds payable

● Long-term notes payable ● Deferred tax liabilities ● Pension obligations ● Mortgage payable ● Capital Lease

|

● Lawsuit Payable (where the outcome is uncertain)

|

The Accounting Equation

The accounting equation is a statement of a company’s financial position and establishes the relationship between the financial activities of a business. The accounting equation is expressed as:

Assets = Liabilities + Equity

The shareholders’ equity is the residual claim after liabilities to third parties have been settled. Equity is the residual interest in the assets of a company after deducting all liabilities.

Reporting Liabilities

Example 1

A company wants to purchase equipment worth $8,500. It makes the purchase using a bank loan facility to pay off the new asset over 12 months. A liability of $8,500 will reflect on the company’s financial statement.

Example 2

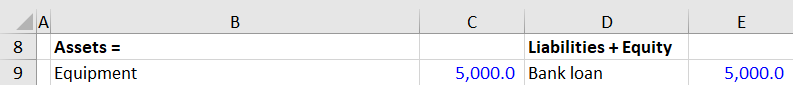

A second company needs to buy equipment. They purchase the equipment with a bank loan for $5,000 balance.

The transaction is reflected on the balance sheet as follows:

Where “shareholder equity” represents the total shareholder equity of the company.