Dividend Cover

What is “Dividend Cover”?

Dividend cover, otherwise known as dividend coverage ratio, indicates an organization’s capacity to pay dividends from the profit attributable to shareholders. In other words, it indicates the number of times that a company can pay dividends to shareholders from net income.

A company that reports a high dividend coverage ratio is capable of maintaining the current dividend levels due to its net income being sufficient to meet the dividend expectations created. A dividend coverage ratio of 2 means that a company has enough earnings to pay dividends amounting to twice the present dividend payout during the period.

A low dividend ratio implies that a company has paid a large portion of its earnings as dividends. If a company’s dividend coverage ratio is less than 1, it might be borrowing funds to pay dividends. The dividend coverage ratio is the opposite of a dividend payout ratio.

Key Learning Points

- Dividend cover is a metric that indicates a company’s ability to cover its dividend payments from its profit attributable to common shareholders

- Dividends are payments that publicly-listed companies or funds make to their shareholders as a reward for their investment in the company

- Dividend cover helps to assess the sustainability of a company’s dividend payments

- The metric is calculated as net income divided by dividends

The Formula

When a company calculates its dividend coverage for ordinary share capital, it deducts dividends paid on preference shares from the net profit earned during the period to calculate the earnings attributable to ordinary shareholders.

Dividend Cover Ratio = (Profit after tax – Dividend paid on preference shares) / Dividend paid to ordinary shareholders

Example Calculation

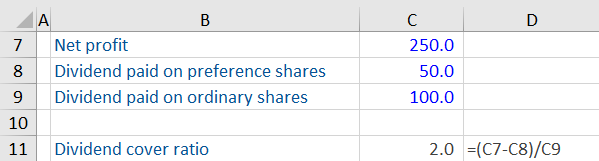

Company A reports the following information. Calculate its dividend cover ratio.

The calculation is as follows:

The example shows that Company A’s ratio of 2.0 indicates it has a healthy dividend cover, implying it has an adequate amount of financing for dividends through retained earnings.

Importance of Dividend Cover Ratio

The dividend cover ratio helps investors to gauge the level of risk associated with the receipt of dividends on their investment. A company that has a low dividend cover will struggle to sustain the present level of dividends if the company’s profits decrease.

One of the key aspects that investors need to keep in mind is that net income doesn’t necessarily equate to cash flow. A company can report high earnings but have no cash to make dividend payments.