Corporate Training

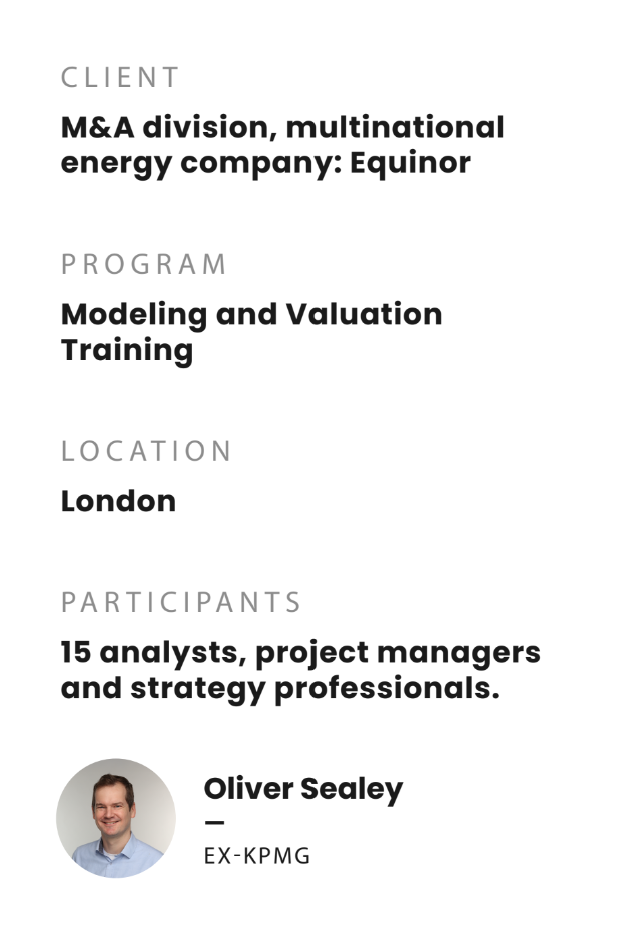

Corporate M&A Training

We’ve worked with this large energy company for several years to help ensure their London M&A team possess a rigorous technical skill set. They need to be confident in assessing potential acquisitions and creating value for the firm.

The Challenges

Diversity of experience

There was a diversity of experience within the cohort. Those who had moved to the team from industry needed to improve their technical finance skills. Participants who came from a traditional finance background needed help to apply knowledge practically, in a specific acquisition context.

Time pressure

As participants were already on the desk, there was increased time pressure. They needed to quickly upskill and develop a buy-side mindset.

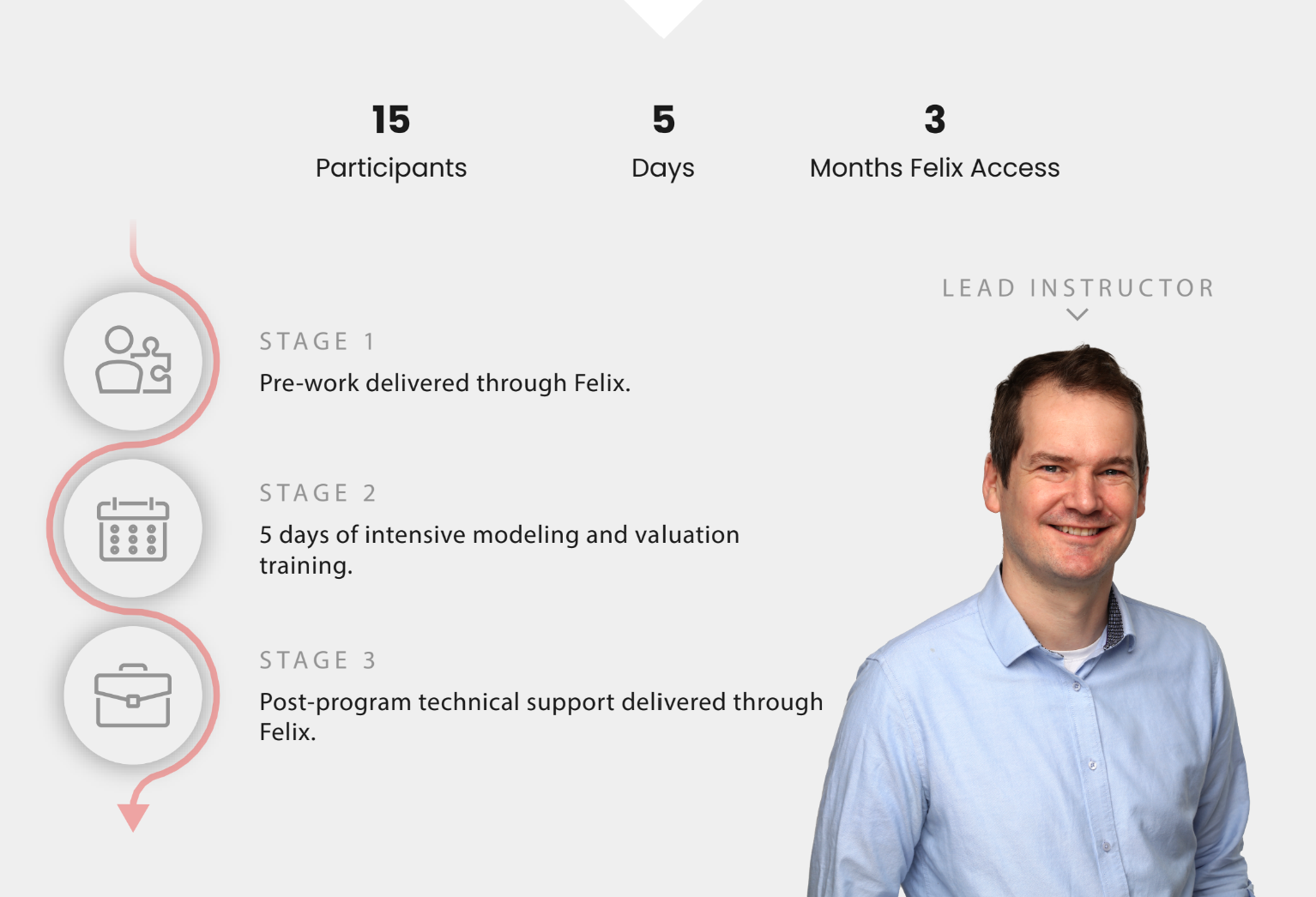

The Solution

Customization

The curriculum was customized to reflect the specific challenges of the energy sector, with a focus on both oil and gas, and renewables. Industry-specific content was embedded into Felix and the live sessions, ensuring that valuation techniques and modeling exercises were directly relevant to the team’s strategic goals.

Modification

Trainers were in constant communication with internal teams, adjusting the content to meet evolving needs. Senior front-office staff regularly checked in, helping to prioritize the most relevant topics and remove less critical ones to manage time pressure. The teaching team modified the agenda to address gaps identified during the first few days.

Support

Participants who were pulled away from training, or who struggled with specific content in in-person sessions, could access direct instructor help through Felix.

The Impact

Desk-ready Analysts

By the end of the program, analysts had significantly improved their technical confidence and practical understanding. They were better equipped to contribute to live deals, with a clearer grasp of not just how to apply financial techniques, but why they matter in a buy-side context.

Closed skill gaps

Feedback from both participants and the firms’ program managers was overwhelmingly positive. The client particularly valued Financial Edge’s adaptability and responsiveness throughout the engagement. Skill gaps were effectively addressed, and the team emerged more confident, well-rounded, and capable of delivering value in a fast-paced M&A environment.