Corporate Training

Markets Training

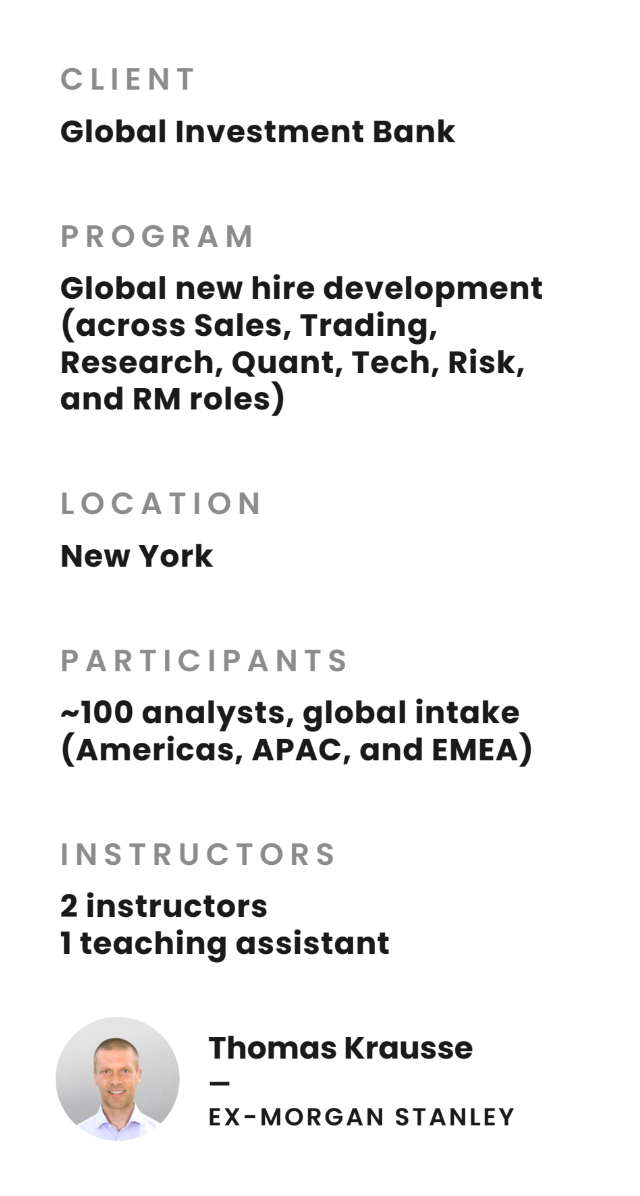

Previously, this global client with strong capabilities in fixed income, equities, and electronic trading had rotated through multiple vendors without success. Despite heavy investments in training, new hires were not desk ready.

We were asked to create a program that could succeed where others had not: prepare a highly diverse, global cohort for a wide range of front-office roles across asset classes.

The Challenges

Broad Spectrum of Roles

The program needed to serve participants across an unusually broad spectrum of roles: sales and trading across multiple asset classes, research analysts, quants, technologists building trading applications and algorithms, risk managers, and relationship managers.

Varied Backgrounds

Knowledge levels varied significantly. Some participants had finance degrees and prior internships, while others came from computer science or liberal arts. As this was a global intake, many participants had English as a second language.

The Solution

Adaptive Pre-learning

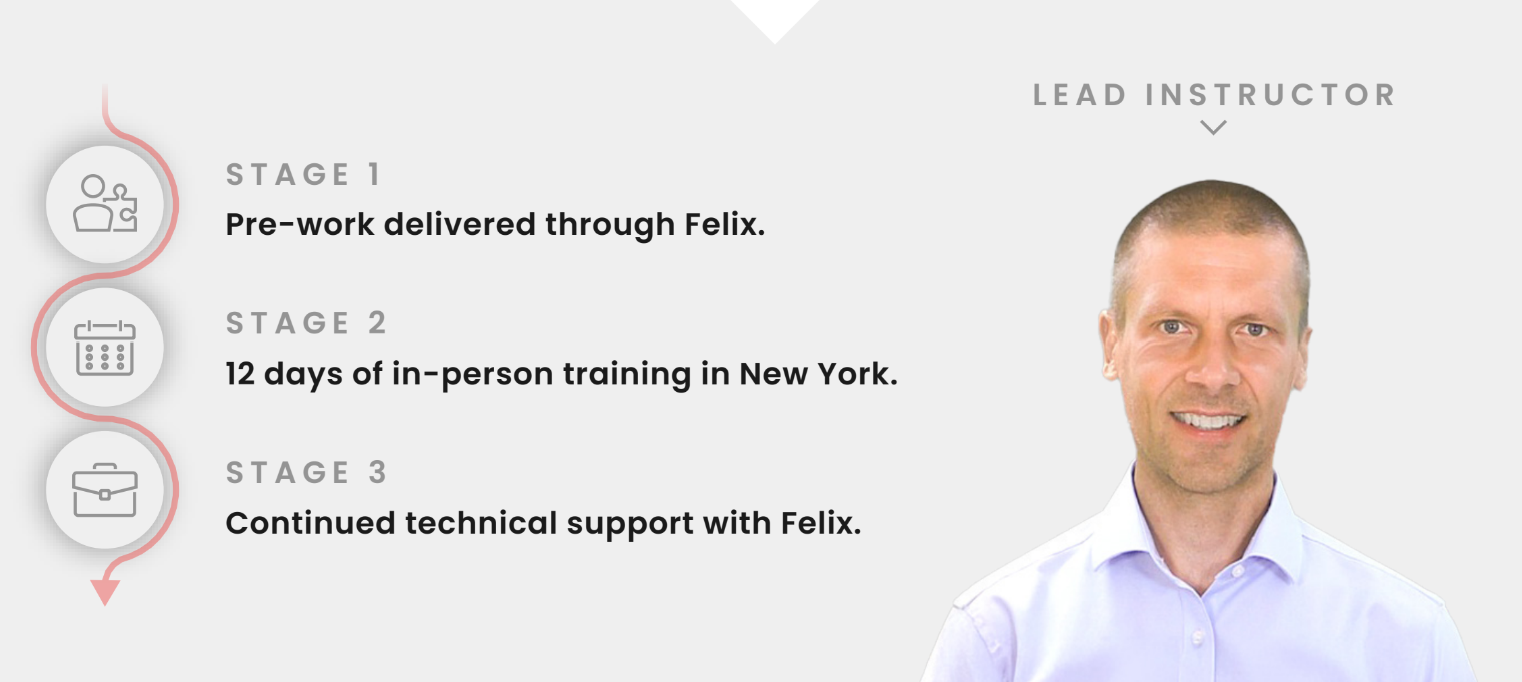

We created fully adaptive online pre-learning pathways to teach the fundamentals of financial markets. A “test-out” feature allowed experienced learners to skip material they already knew, while others could learn at their own pace before the live training began.

In-person Program

In close partnership with the client’s business representatives and L&D team, we built a 12-day in-person program covering:

• Macroeconomics and market structure

• Money and bond markets

• Cash equities and equity trading

• Derivatives across credit, equity, FX, and rates

• Trading and execution, including algorithms

• Trading strategies (directional and volatility-based)

• Practical communication skills

Interactivity

Throughout the program, we embedded interactive elements to keep engagement levels high. Recognizing that participants learn in different ways—some thrive on competition, others prefer reflection—we built multiple reinforcement tools directly into the experience, including a macro master asset allocation game, a deep dive challenge and self-paced try-outs. These layers of interactivity also allowed people from varied geographies and asset classes to work together as a team.

Role-specific

We provided optional, role-specific video modules for participants who wanted to go deeper into their specialism – whether in exchange-traded funds, FX options pricing, or specific types of government bonds.

The Impact

Desk-ready Analysts

Client stakeholders highlighted a clear step up in the quality and relevance of training, noting that new analysts were better prepared for their desk roles and able to contribute more quickly. The program has since become a trusted part of the global graduate development strategy.

Training Excellence

Participants echoed this impact, praising the trainers for their excellence, practical experience, and approachability, as well as the direct relevance of the content to their day-to-day responsibilities.

Constant Improvement

The program has now been delivered for the second year running, with only marginal refinements. These improvements were initiated by us – not requested by the client – as we saw opportunities to make an already strong program even better.