Liquid Vs. Illiquid Assets

July 24, 2025

Liquidity Vs. Liquid Assets: An Overview

Liquidity in assets relates to how quickly an asset can be converted into cash (i.e. liquidated or sold), without its market price being significantly affected. It is an asset characteristic that is always considered by investors in their risk assessment and portfolio decision-making.

Liquidity is a key concept in the world of investment portfolio management. In terms of specific asset classes, some of the most liquid investments include cash and cash equivalents such as money market funds, treasury bills and “blue chip” equities (shares of well-established large cap companies). All can be swiftly traded in to accessed from deposit accounts to turn into cash when required.

When distinguishing between liquidity and liquid assets, we should note that the former is often more dynamic and context-dependent. Liquidity can be influenced by many aspects such as the depth of the market, trading volumes (as measured by the total number of transactions executed during a given period), or the prevailing market conditions. On the other hand, how liquid or illiquid an asset is depends on the combination of both its inherent features and the current market climate.

Key Learning Points

- Liquidity relates to how quickly an asset can be converted into cash without significantly affecting its price

- Highly liquid assets include cash and cash equivalents (such as money market instruments), short-term government bonds or listed stocks with large market capitalization

- Portfolio liquidity is often assessed using metrics like the average daily volume (ADV), with fund managers applying various market and trading assumptions

Understanding Liquidity and Liquid Assets

Liquidity, at its core, measures how marketable a security or an asset is. The prevailing market climate is always an important component of assessing liquidity and liquidity risk. Under normal market conditions, liquid assets could typically be turned into cash within a very short time frame – in less than three trading days. Highly liquid assets such as stocks that feature in the S&P 500 index (listed on a stock exchange) would usually allow to be liquidated on the same day. This can be the case even for large positions taken by institutional investors, due to the equity markets deep market and high transaction volumes. The multinational tech leader Apple (which is one of the “magnificent seven” stocks that have been driving market returns over the past two years) has an average daily trading volume of over 50 million shares (Source: Apple.com. Data as of 06/26/2025).

Liquid Vs. Illiquid Assets

Assets that are usually considered to be relatively illiquid include more sophisticated investments that are not publicly traded and may require lock-in periods. These include private equity investments or hedge funds, or others such as physical real estate. These less liquid valuations can be a difficult and sometimes long process as there is no real time updated price for many illiquid assets.

From a more traditional investment perspective, thinly traded bonds that would normally fall within the “high yield” grade (or “junk”) or small and micro-cap listed companies are normally categorized as less liquid purchases.

The below table shows examples of assets and how they are classified in terms of liquidity:

| Liquid Assets | Less Liquid (or Illiquid) Assets |

| Money Market Funds | Physical Real Estate |

| Government Bonds | Private Equity |

| Short-term Certificates of Deposit | Venture Capital |

| Large Cap Publicly Traded Stocks | Direct Loans and Private Debt |

| Exchange Traded Funds | Hedge Funds |

| Mutual Funds | Infrastructure or Project Finance |

All the liquid assets should be relatively simple to buy and sell for any investor. The less liquid assets can take more time to understand as they are traded far less frequently and may require more investigation to decide a price and valuation.

Private equity is typically a longer-term investment proposition, usually 3-7 years. It is focused on wholly acquiring usually privately held companies (but can be listed companies), instigating improvements and then selling for a profit. Exiting such investments requires all the collective investors either being able to leave together or else to purchase the position of the exiting investor.

Portfolio Liquidity

There is also another form of liquidity that investors use to determine the overall ability of a portfolio to generate cash quickly. It is widely used by firms involved in managing portfolios such as asset managers in monitoring the liquidity levels of their own funds – this is critical in managing large redemptions. Institutional investors may invest in third party (i.e. externally managed) funds such as pension funds or insurance companies and be keen to know the liquidity of the fund when considering buying a stake. Investment professionals that are not directly involved in managing money such as consultants, researchers and advisers, will also closely monitor the liquidity levels of the products recommended to clients.

Maintaining adequate liquidity in the portfolio is very important and could support investors in manoeuvring through periods of market stress without the need to force sell assets at unfavourable prices. For example, during the global financial crisis in 2008, some hedge funds with large exposure to illiquid assets faced redemption pressures, which resulted in substantial losses. Institutional investors often use liquidity buckets by allocating a portion of the portfolio to highly liquid assets such as government bonds, and others to longer-term and less liquid areas of the market. Stress testing and scenario analysis are among the commonly used tools to assess potential liquidity shortfalls under unusual market conditions.

Example of Liquidity

Fund managers regularly perform liquidity stress testing on their portfolios. This is typically done on a daily basis and is part of the ongoing investment monitoring process. Managers use the trading capacity assumptions tied to a security’s ADV (the Average Daily Volume) and a common industry practice is to assume that:

- In normal market conditions they can sell up to 20% of ADV without materially impacting the price or execution

- During periods of market stress, they can sell only up to 5% of ADV to reflect thinner markets (as markets are less liquid in such cases), wider spreads and higher impact on price

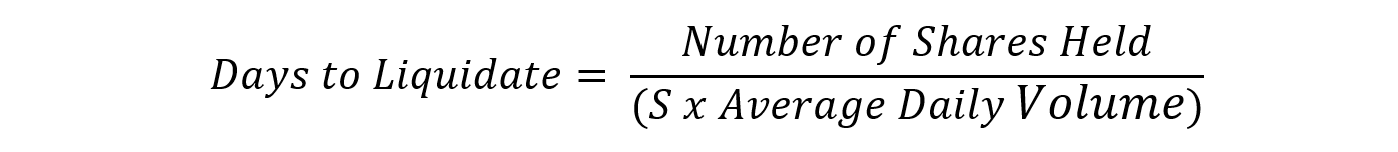

The total number of days to liquidate a position is calculated by using the below formulas

Where “S” refers to the scenario used, for example 20%.

Let’s assume that an equity portfolio manager has 250,000 shares of a mid-cap stock with an average daily volume of 1 million shares. Running the two scenarios:

- Under normal conditions, which we assume is 20% ADV, the manager can sell 200,000 shares per day – therefore, the entire position can be entirely liquidated in around 1.25 trading days

- Analysing liquidity under market stress, which for this example is considered at 5% ADV, the manager can only sell 50,000 shares per day, taking 5 days to fully exit the position

Download the free Financial Edge template showing a real example of an investment portfolio and how to calculate average daily volume.

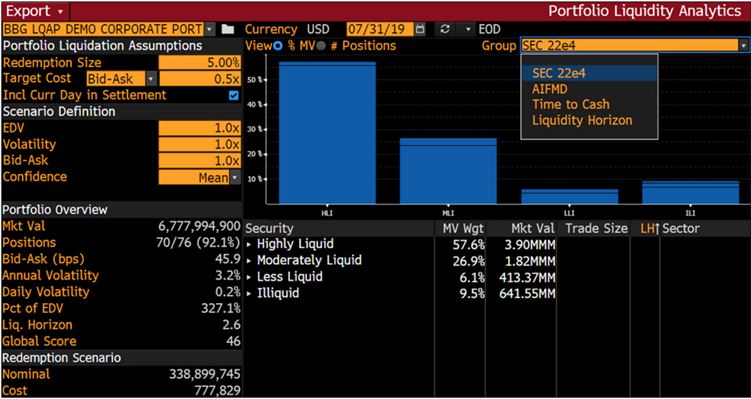

Having ADV information can improve how the manager classifies the portfolio’s underlying securities into different liquidity buckets. Depending on the type of strategy and the market it invests in, the buckets can look like the below:

- “Highly liquid” – can be liquidated in less than 1 trading day under stress conditions

- “Moderately liquid” – can be sold within 2 to 7 days

- “Illiquid” – it will take more than 7 days to sell

At a portfolio level, managers run these calculations across all holdings and also simulate redemption scenarios. This helps to assess whether sufficient assets can be sold to meet the outflows without significant disruption. In addition, they would typically keep a relatively small cash position (this is subjective, but for example it would rarely exceed 5% for most mutual funds) to help manage redemptions without impacting the portfolio’s holdings.

Managers may also regularly provide liquidity updates to their clients and would publish their analysis in various client materials such as RFPs (request for proposal) that outline the key features of their fund.

Below is an example of what this may look like.

| Highly liquid

(<=1 day) |

Liquid

(1 to 3 days) |

Fairly liquid

(3 to 7 days) |

Less liquid

(7+ days) |

Unknown* | |

| ABC Emerging Markets Fund | 55% | 25% | 15% | 4.5% | 0.5% |

*this would typically account for stocks that may not have sufficient trading history such as recent IPOs

Investors can also use various data platforms such as the Bloomberg Terminal to assess and model liquidity. Below is an example of what a portfolio liquidity analysis looks like:

Source: Bloomberg

Conclusion

Liquidity in finance refers to how quickly an asset can be turned into cash. Quantifying this can be fundamental to investing and portfolio managers pay great attention to it. Calculating and modelling liquidity of listed assets is normally done by using trading volumes data. Higher levels of liquidity allow greater flexibility and could also prevent selling at unfavourable terms during periods of high market volatility.

Illiquid assets are usually less traded or unlisted and will require closer analysis of the individual assets and their peer group (as well as current market conditions) to determine valuation.