Learn certified financial modeling skills and much more from the instructors trusted to train Wall Street’s top firms every year.

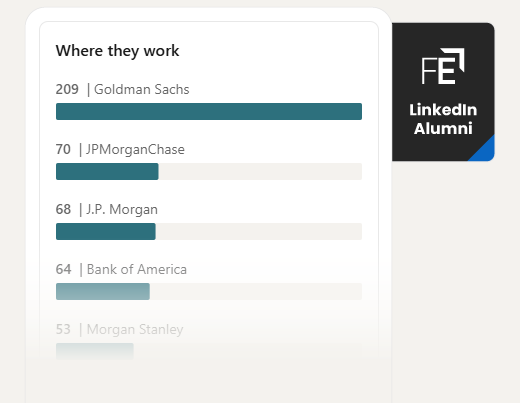

See where our alumni work now.

100K+

People trained globally

4K+

Finance training videos

50+

Online finance certifications

1M+

Searchable finance filings

4K+

In-house courses delivered

Certified courses recognized on Wall Street

Get the same training we offer analysts at the top banks with our online Micro-degrees. With Felix, you can access every single course we offer and master the skills you need to break into any industry in finance.

The Investment Banker

The Private Equity Associate

The Project Financier

The Portfolio Manager

The Research Analyst

The Venture Capital Associate

The Restructurer

The Business Toolkit

The Real Estate Analyst

The Trader

The FIG Banker

The Credit Analyst

Get the same training as new hires to the top 4 investment banks. Our investment banking course covers accounting, financial modeling, valuation (including discounted cash flow), plus M&A and LBO analysis.

3441

reviews

Whether you're considering a career in private equity or have recently joined, this private equity course will teach you the practical skills for role success.

1148

reviews

Learn project finance from the firm hired to teach the top 4 investment banks' incoming analysts. Includes accounting, financial modeling, project analysis, project accounting, project risks, and both simple and advanced project modeling.

1785

reviews

Earn you portfolio management certification from the firm chosen by the top 4 investment banks. Master all aspects of the asset management industry including topics covering economics, financial analysis, financial markets and products, ESG, portfolio construction, and more!

2745

reviews

Master the technical skills needed to succeed as a research analyst with real case studies and an expert interview with an equity analyst.

980

reviews

Whether you're considering a career in private equity or have recently joined, this private equity course will teach you the practical skills for role success.

17

reviews

Earn The Restructurer micro-degree. Learn the skills needed to break into commercial restructuring and more from the firm chosen by the top investment banks.

34

reviews

Whether you're a graduate looking to secure a job or a professional wanting to become more efficient, this course will teach you everything you need to become business savvy.

577

reviews

Earn your real estate analyst micro-degree. Learn the skills needed to break into commercial and more from the firm chosen by the top 4 investment banks.

46

reviews

Learn how global markets really work with our online sales and trading course. Build a deep understanding of financial products, pricing, and trading floor mechanics.

Gain the knowledge, vocabulary, and confidence to discuss and analyze any major financial instrument or market.

298

reviews

Master the skills necessary to make a direct impact in any FIG investment banking team. This online program covers the accounting, financial modeling, valuation (including discounted dividend model), and regulatory landscape for both bank and insurance companies.

52

reviews

Learn the in-demand accounting, modeling, and cash flow analysis techniques used by credit analysts. Get the same training as new hires to the top 4 investment banks in this course designed by expert Wall Street instructors.

1758

reviews

Get the same training, trusted by the world's best!

The proof is in our alumni.

We are proud to teach the world’s best finance professionals across investment banking, private equity, asset management and more.

You too can access the benchmark in financial training with our certified online courses.

See our verified alumni on LinkedIn and access the same training we deliver to the world’s top firms.

Learn your way with flexible payment options

Single Courses

Single Courses

Get lifetime access to a course!

Single purchase includes:- Lifetime access

- Expert instructor support

Most popular

Boost Plan

Boost Plan

Includes full access to all certified courses.

Expand skills

Boost includes:- 266+ hours of instructor-led learning

- Search across 520+ playlists, 4400+ videos and Q&As

- Role-focused pathways

- Expert instructor support

Pro Plan

Pro Plan

Full Felix access including all learning content and data features.

Maximize potential

Pro includes:- Everything in the Boost plan

- Streamlined company data

- Current and historic filings for over 7000 companies

- Market and industry data

- Ready-to-use sector and transaction models

Master core investment banking and finance skills

Understand and gain essential skills in any topic with our comprehensive playlists, and prepare yourself with tailored practical exercises and working files included in Felix.

Rated excellent on Trustpilot & by thousands of finance professionals

Explore our most popular courses

bestseller

Get the same training as new hires to the top 4 investment banks. Our investment banking course covers accounting, financial modeling, valuation (including discounted cash flow), plus M&A and LBO analysis.

updated

Whether you're considering a career in private equity or have recently joined, this private equity course will teach you the practical skills for role success.

The

Private Equity Associate

updated

Earn you portfolio management certification from the firm chosen by the top 4 investment banks. Master all aspects of the asset management industry including topics covering economics, financial analysis, equity, FICC markets and products, ESG, portfolio construction, and more!

The

Portfolio Manager (Legacy)

Whether you're considering a career in private equity or have recently joined, this private equity course will teach you the practical skills for role success.

The

Venture Capital Associate

updated

Learn project finance from the firm hired to teach the top 4 investment banks' incoming analysts. Includes accounting, financial modeling, project analysis, project accounting, project risks, and both simple and advanced project modeling.

updated

Master the technical skills needed to succeed as a research analyst with real case studies and an expert interview with an equity analyst.

Earn The Restructurer micro-degree. Learn the skills needed to break into commercial restructuring and more from the firm chosen by the top investment banks.

updated

Whether you're a graduate looking to secure a job or a professional wanting to become more efficient, this course will teach you everything you need to become business savvy.

Earn your real estate analyst micro-degree. Learn the skills needed to break into commercial and more from the firm chosen by the top 4 investment banks.

Learn the markets and products for both equities and fixed income, currencies and commodities and the relevant derivatives with our sales and trading micro-degree.

Master the skills necessary to make a direct impact in any FIG investment banking team. This online program covers the accounting, financial modeling, valuation (including discounted dividend model), and regulatory landscape for both bank and insurance companies.

updated

Learn the in-demand accounting, modeling, and cash flow analysis techniques used by credit analysts. Get the same training as new hires to the top 4 investment banks in this course designed by expert Wall Street instructors.

Learn from our expert instructors

Meet our world-class faculty. With experience from all corners of the finance world, our instructors are the heart and soul of Financial Edge's reputation as the industry's most trusted training provider.

Learn more about our full faculty

Explore our free resource library

With over 700 articles and growing, read up on any area of banking and finance you’re interested in.

Solutions for students, professionals, corporate teams, and universities

Individuals

Advance your career with self-paced online programs in Felix

Businesses

Drive results with tailored L&D solutions trusted by the world’s top firms

Universities

Give your students and society members exclusive opportunities and discounts.

Industry Partners

Work with us to help drive innovation and diversity for the next generation of finance professionals.

Single Courses

Single Courses

Boost Plan

Boost Plan

Pro Plan

Pro Plan