Credit-Linked Note (CLN)

August 27, 2025

What is a Credit-linked Note?

Credit-linked notes (CLNs) are structured financial instruments that combine a traditional bond with the credit risk of a third-party reference entity. This is achieved by embedding a credit default swap (CDS) into the bond structure. The investor receives regular coupon payments and the return of principal at maturity, unless a credit event occurs with the reference entity, in which case the principal is reduced based on the recovery rate.

Key Learning Points

- Investors in CLNs receive higher coupon payments in exchange for assuming the credit risk of the reference entity

- Exposure to the reference entity’s default is a significant risk associated with CLN

- If the CLN is issued by a bank, investors are also exposed to the bank’s credit risk

- The complexity of the product and embedded derivatives can obscure true risk exposure

- For banks, CLNs serve as tools for credit risk transfer, allowing them to hedge risk and raise capital simultaneously

Credit-Linked Notes as Investments

Investors in CLNs typically receive higher coupon payments (e.g. 7.5% annually) in exchange for assuming the credit risk of the reference entity (e.g. Car Co). If no credit event occurs, they receive full principal at maturity. If a default does occur, they bear the loss based on the post-default value of the reference entity’s bonds.

Credit-linked Note Risks

The key risks to credit-linked notes include:

- Credit Risk: exposure to the reference entity’s default which will be specific to the entity involved and the prevailing market conditions during the note’s tenure

- Counterparty Risk: if the CLN is issued by a bank or financial institution, investors are also exposed to their credit risk

- Structural Risk: the complexity of the product and embedded derivatives can obscure the true risk exposure

To mitigate counterparty risk, CLNs can be structured using high-rated bonds and CDSs placed in a special purpose entity (SPE), isolating the structure from the bank’s balance sheet.

Structured Credit Products

CLNs are a type of structured credit product that allows banks to transfer credit risk and raise funds simultaneously. They are tailored to meet specific investor preferences and risk-return profiles, often involving complex combinations of bonds and derivatives.

Credit Default Swap Instruments

The CDS embedded in a CLN is the mechanism through which credit risk is transferred. The investor effectively sells credit protection to the issuer (e.g., a bank) and thus agrees to absorb losses if the reference entity defaults. The CDS premium is implicitly deducted from the coupon paid to the investor.

Fixed Income Structured Products

CLNs fall under the broader category of fixed income structured products. They offer fixed or floating coupon payments and are designed to provide enhanced yield by incorporating credit risk components. Their performance depends on both interest rate movements and credit events.

High-Yield Credit Investments

CLNs offer higher yields compared to traditional bonds due to the embedded credit risk. This makes them attractive to yield-seeking investors willing to assume the risk of a credit event affecting the reference entity.

Credit Risk Transfer Instruments

For banks, CLNs serve as tools for credit risk transfer. If a bank has exposure to a borrower (e.g., Car Co) and wants to hedge that risk, especially in illiquid CDS markets, it can issue a CLN to transfer the risk to investors while raising capital.

Credit Linked Notes (CLN) Example

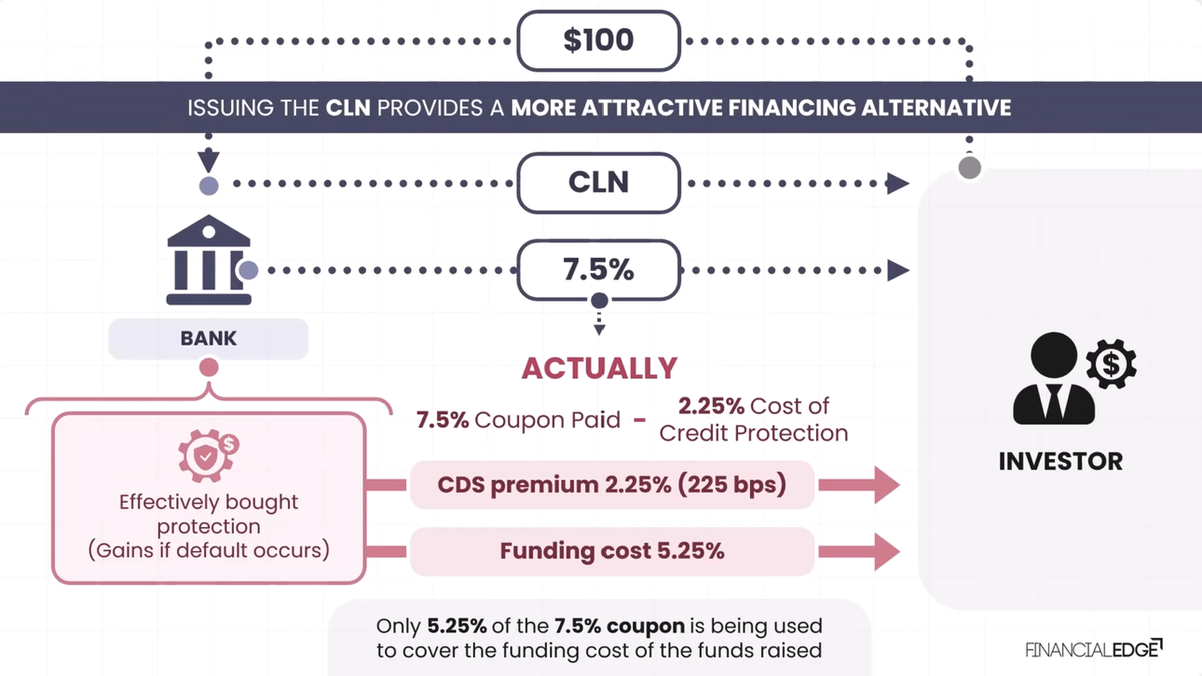

Credit Linked Notes (CLN) Diagram

In this example, let’s assume the $100 CLN pays a 7.5% annual coupon to investors and is linked to a company called Car Co. Since the structure embeds a CDS on Car Co, the investor is effectively selling credit protection to the bank. The investor has agreed to suffer a loss if there is a default event for Car Co for which they would otherwise require a payment referred to as the credit spread. This means the bank is buying protection on Car Co’s credit risk while simultaneously raising funds.

If the five-year CDS spread for Car Co is 225 basis points, the bank effectively raises funds at a net cost of 5.25%. This is the 7.5% coupon paid to investors minus the 2.25% cost of credit protection. This means that only five and a quarter percent of the 7.5% coupon is being used to cover the funding cost of the funds raised with the other two and a quarter percent paying for the credit protection.

If the bank’s usual funding cost from long-term deposits or bond issuance are higher than five and a quarter percent, issuing the CLN provides a more attractive financing alternative.

What is the Difference between CDS and CLN?

Credit Default Swap (CDS)

A CDS is a financial derivative that allows an investor to “swap” or offset their credit risk with that of another investor. Essentially, the buyer of the CDS makes periodic payments to the seller and, in return, receives a payoff if the underlying financial instrument defaults.

It is used primarily for hedging purposes, allowing investors to protect themselves against the risk of default by a borrower.

Credit-Linked Note (CLN)

A CLN is a structured financial instrument that combines a traditional bond with the credit risk of a third-party reference entity. This is achieved by embedding a CDS into the bond structure.

Investors in CLNs receive regular coupon payments and the return of principal at maturity, unless a credit event occurs with the reference entity, in which case the principal is reduced based on the recovery rate.

Credit Linked Note vs. Credit Default Swap

A CLN is a bond with an embedded CDS, while a CDS is a standalone derivative contract. CLNs offer higher yields due to the embedded credit risk, whereas CDSs are primarily used for hedging credit risk. CLNs are used by investors seeking higher yields and willing to assume credit risk, while CDSs are used by investors looking to hedge against credit risk.

Conclusion

Credit-Linked Notes (CLNs) offer a unique investment opportunity by combining traditional bonds with the credit risk of a third-party reference entity. While they provide higher yields compared to conventional bonds, investors must be aware of the associated risks, including credit risk, counterparty risk, and structural risk.

By understanding these risks and the mechanisms behind CLNs, such as the embedded credit default swaps (CDS), investors can make informed decisions that align with their risk tolerance and investment goals. As with any investment, thorough research and consideration of one’s financial situation is critical before diving into the world of structured credit products.

Download the free Financial Edge one-page guide to Structured Financial Products.