Save 40% on all online finance courses

Activity Ratio

January 30, 2026

What is an Activity Ratio?

Activity ratios are financial metrics that offer investors insight into how efficiently a company turns various balance sheet accounts into revenue. They essentially assess the capability of a business to use its assets to support operations (or inventory management) and achieve its sales or cash generation goals. While profitability ratios focus on earnings and margins, activity ratios look into operational efficiency. They are key in understanding the overall health of day-to-day business activities by indicating things like how quickly a company collects cash from customers or how effectively it uses its inventory.

Key Learning Points

- Activity ratios, also known as efficiency ratios, are designed to help investors evaluate how effectively a company manages its assets and liabilities to generate sales and maximize returns

- They are calculated using income statement and balance sheet items, usually averaged over a specific time period to allow investors to evaluate resource utilization and cash flow management

- Activity ratios are very useful for industry comparisons, trend analysis over multiple periods, and identifying operational strengths or weaknesses

- High activity ratios normally suggest strong operational efficiency, but they should be considered alongside profitability ratios to assess the firm’s overall financial performance more accurately

Understanding Activity Ratios

Evaluating the efficiency with which a company translates its receivables into cash or its ability to use assets in generating sales are the primary uses of activity ratios. In addition, they can also show whether inventory turns over quickly or remains idle, and if assets are being utilized well relative to revenue. Activity ratios are very useful for comparing competing businesses within the same industry and creating a peer analysis since they explore the relationship between sales and the assets that generate those sales. An example could be a retailer with a high inventory turnover, which is typically operating more efficiently than a competitor with slower inventory movement.

Activity ratios can also be tracked over multiple reporting periods to allow investors to monitor a company’s financial progress. This would help them identify changes in operational efficiency over the longer term and build a forward-looking assumption of its future performance.

How to Calculate Activity Ratios?

Activity ratios are calculated by dividing figures from the company’s income statement (such as sales or cost of goods sold) and balance sheet (for example, receivables or total assets). In most cases, formulas require dividing sales or cost figures by asset or liability balances.

In this video, we provide a detailed explanation of current assets and current liabilities.

In order to smooth seasonal fluctuations and get a more accurate perspective of operational performance, investors would typically use quarterly or annual figures. The ratios can be expressed as:

- Multiples – for example, accounts receivable turnover of 12 means receivables turn over 12 times per year

- Days – for example, days inventory outstanding or days sales outstanding, which convert turnover into average time periods

Further, in the blog below, we discuss in more detail the most commonly used activity ratios and how to calculate them.

Activity Ratio Formula

Since each type of ratio measures a different aspect of efficiency, there is no universal formula for an activity ratio. Below are the standard formula examples that aid investors in breaking down operational effectiveness into measurable terms:

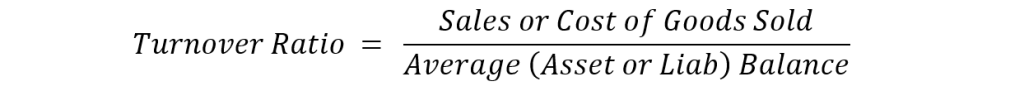

Turnover Ratio Formula

Turnover Ratio = Sales or Cost of Goods Sold / Average (Asset or Liab) Balance

The turnover ratio basically compares a flow from the income statement (for example, sales or cost of goods sold) to a relevant asset or liability balance, depending on what aspect of efficiency is being measured. Although many activity ratios focus on assets (such as accounts receivable or inventory), others such as accounts payable turnover (which measures how quickly a company pays its suppliers) are based on liabilities.

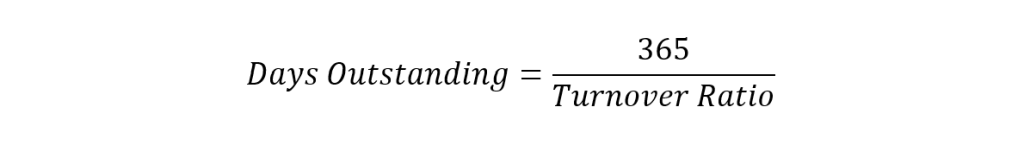

Days Ratio Formula

Days Outstanding = 365 / Turnover Ratio

What is a Good Activity Ratio?

There are several factors that investors would consider when evaluating whether an activity ratio is “good”. These normally include:

1. Industry Standards

Different industries operate with different asset structures. For instance, a consumer staples business such as a supermarket, will naturally have a much higher inventory turnover than a consumer discretionary company such as a luxury watch manufacturer, because of differences in product type and sales velocity

2. Historical Performance

Comparing the company’s current ratios to its historical performance allows investors to assess operational trends. Consistently improving activity ratios generally suggests improving efficiency

3. Relative Comparison

Comparing a company’s ratios to a specific competitor or an industry average is key for external benchmarking

As a rule of thumb:

- Higher turnover ratios (such as receivables or inventory) suggest efficient operations

- Lower days outstanding indicate quicker conversion of assets into cash

However, extremely high or low values may also signal problems. For example, very high inventory turnover might imply stock shortages that prevent sales. On the other hand, a very low accounts receivable collection period may lead to overly strict credit policies that are not attractive for potential customers.

Types of Activity Ratios

There is a range of metrics that are categorized as activity ratios. Here are some of the most popular:

Accounts Receivable Turnover Ratio

Accounts receivable turnover ratio measures how effectively a company collects outstanding credit from customers.

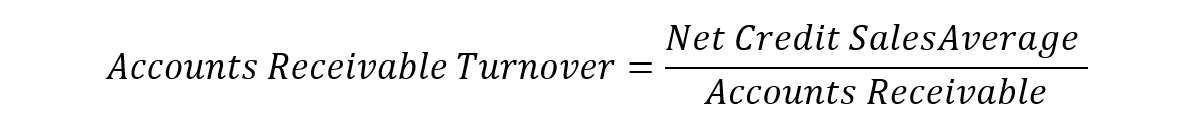

Accounts Receivable Turnover Ratio Formula

Accounts Receivable Turnover = Net Credit Sales Average / Accounts Receivable

A higher reading indicates that receivables are collected more frequently (in other words, customers pay quickly), which supports strong cash flow. Conversely, a low ratio suggests that the company may have difficulty collecting payments.

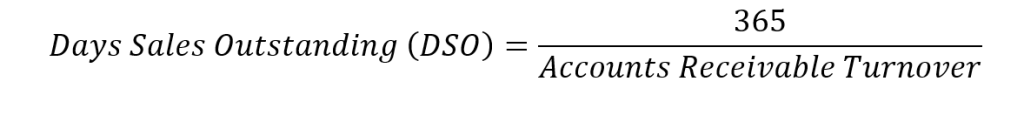

Days Sales Outstanding Formula

The days sales outstanding formula below converts this into an average collection period:

Days Sales Outstanding (DSO) = 365 / Accounts Receivable Turnover

Accounts Payable Turnover Ratio

Accounts payable turnover ratio measures how quickly a company pays its suppliers and manages its short-term obligations.

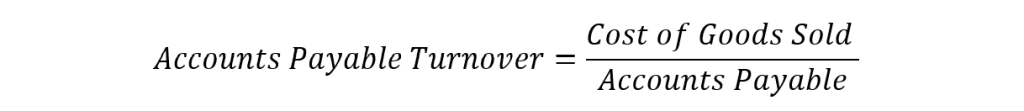

Accounts Payable Turnover Ratio Formula

Accounts Payable Turnover = Cost of Goods Sold / Accounts Payable

A higher ratio suggests that suppliers are paid more frequently. This may reflect strong liquidity, but could reduce available cash. On the other hand, a lower reading indicates slower payments (potentially improving short-term cash flow but increasing reliance on supplier credit).

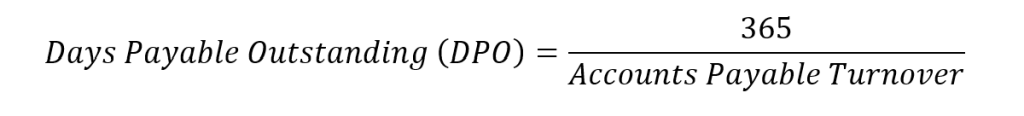

Days Payable Outstanding Formula

The formula below converts this into an average payment period:

Days Payable Outstanding (DPO) =365 / Accounts Payable Turnover

Inventory Turnover Ratio

Inventory turnover ratio measures how efficiently a company manages and sells its inventory over a given period. It shows how quickly inventory is converted into sales and helps assess inventory management.

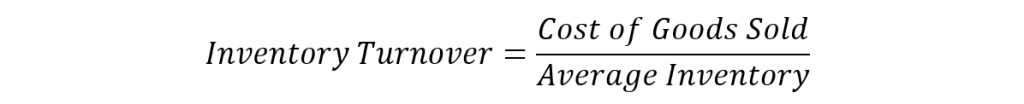

Inventory Turnover Ratio Formula

Inventory Turnover = Cost of Goods Sold / Average Inventory

A higher inventory turnover means that inventory is sold quickly – this could signal effective inventory control. Conversely, a low ratio indicates excess stock, weak sales or inefficient inventory management.

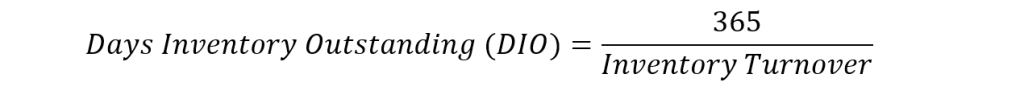

Days Inventory Outstanding Formula

Days inventory outstanding formula converts inventory turnover into an average holding period:

Days Inventory Outstanding (DIO) = 365 / Inventory Turnover

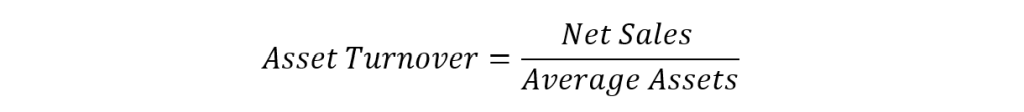

Asset Turnover

Asset turnover ratio explores how well a firm uses its assets to produce sales.

Asset Turnover Ratio Formula

Asset Turnover = Net Sales / Average Assets

Often investors use average total assets in the denominator, which results in the total assets turnover ratio. However, the same framework can be applied to specific asset categories, such as fixed assets, when a more focused analysis is required.

For example, fixed asset turnover isolates how efficiently long-term tangible assets are used to generate sales, which is typical in capital-intensive industries like oil and gas, or heavy manufacturing.

A higher asset turnover ratio indicates that the company generates more sales per unit of assets, whereas a lower reading suggests underutilized assets or excess investment relative to revenue generation.

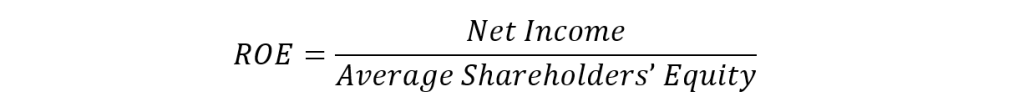

Return on Equity (ROE)

Although the return on equity ratio is typically categorized as a profitability ratio, it also carries operational implications, as it shows how effectively a company uses its equity to generate net income.

Return on Equity (ROE) Formula

ROE = Net Income / Average Shareholders’ Equity

Although not strictly referred to as an activity ratio, ROE is often included in efficiency reports due to its role in measuring return relative to the capital invested by shareholders.

Activity Ratios vs. Profitability Ratios

Both activity and profitability ratios evaluate company performance, but they focus on different aspects of the financial strength of a company. While activity ratios help analyze the operational efficiency of a business (i.e., how well its assets are used to generate sales/cash flow), profitability ratios measure the company’s ability to generate profits relative to revenue, assets, or equity.

This means that essentially, activity ratios provide insight into the firm’s operations and asset management, whereas profitability ratios focus on earnings and margins.

For example, a company might have highly efficient asset turnover, but low profitability resulting from high operating costs. On the other hand, a business could generate high profits but still be inefficient in using its assets. Therefore, a comprehensive financial analysis typically includes both types of ratios as they complement each other.

Operating Assumptions

There are a few underlying assumptions when analyzing activity ratios that help investors avoid misinterpretation and support building more consistent views/forecasts. These include:

- Stable operations: activity ratios assume that business operations are relatively stable from period to period. Sudden disruptions (like supply chain shocks) can distort comparisons

- Consistent accounting methods: changes in inventory valuation or revenue recognition can affect activity ratios as they alter the reported values of inventory and cost of goods sold

- Industry comparability: direct comparison across different industries is usually misleading due to fundamentally different business models

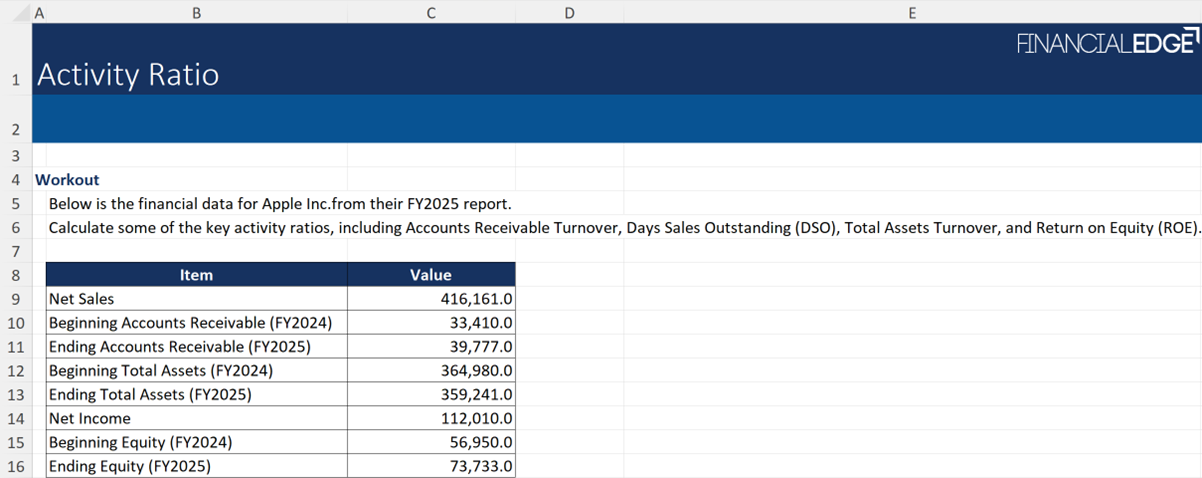

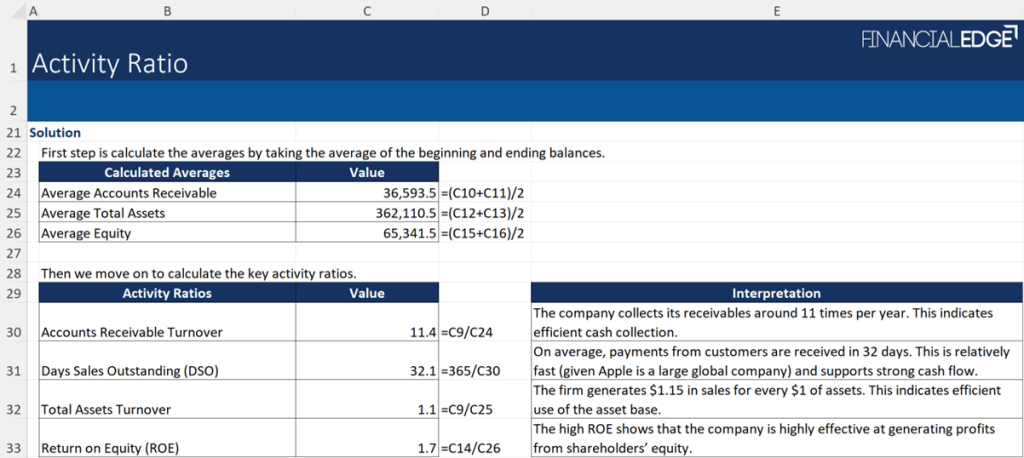

Activity Ratios Calculation Example

Below is a practical, real-world example of how to analyze key efficiency metrics for Apple’s FY2025 financial performance.

The workout calculates averages for accounts receivable, total assets, and equity, and then use these values to compute essential activity ratios, such as Accounts Receivable Turnover, Days Sales Outstanding (DSO), Total Assets Turnover, and Return on Equity (ROE).

Conclusion

To sum up, activity ratios are a key component in financial analysis that offer insights into how effectively a company uses its assets to generate revenue and cash flow. They are useful for comparing companies within the same sector or industry and tracking efficiency trends over time. When used alongside profitability and liquidity ratios, they help provide a good perspective of a company’s financial performance.