new year, new skills – save 40% on all online courses

Capital Buffer vs. Liquidity Buffer

October 24, 2025

Difference between Capital and Liquidity Buffers in Banking

Capital and liquidity buffers are both designed to increase the resilience of financial institutions during economic shocks, but they serve different purposes.

Components of a Capital Buffer

A capital buffer is used to absorb losses and protect depositors when the value of a bank’s assets decreases, such as during a recession. This allows the bank to maintain enough assets to cover its liabilities.

Components of a Liquidity Buffer

A liquidity buffer helps a bank meet its obligations during sudden large withdrawals of deposits or when debt investors are unwilling to refinance debts. It allows the bank to use readily liquid assets to meet these obligations without impacting other long-term assets.

Key Learning Points

- Capital buffers are used to absorb losses and protect depositors when the value of a bank’s assets decreases

- Liquidity buffers help a bank meet its obligations during sudden large withdrawals of deposits or when debt investors are unwilling to refinance debts

- A capital buffer acts as a safeguard during poor economic times, ensuring the bank can cover its liabilities and protect depositors, maintaining stability and trust in the financial system

- Liquidity buffers allow banks to meet sudden large withdrawals or refinancing needs without impacting other long-term assets, preventing bankruptcy risk and ensuring continued operation during financial stress

- Basel III sets out global regulatory standards for capital and liquidity buffers to enhance the resilience of banks, ensuring they hold sufficient capital to absorb losses and maintain a liquidity buffer to meet short-term obligations

What Does a Buffer Mean in Banking?

A buffer in banking refers to additional capital or liquidity that banks are required to hold above minimum regulatory requirements. These buffers are designed to absorb losses during periods of financial stress and ensure the stability of the financial system.

Importance of Capital Buffer for Financial Institutions

Capital buffers are used to absorb losses and protect depositors when the value of a bank’s assets decreases. This allows the bank to maintain enough assets to cover its liabilities

The capital buffer is crucial for financial institutions as it acts as a safeguard during poor economic times. When the value of a bank’s assets decreases, the capital buffer absorbs these losses, ensuring that the bank can still cover its liabilities and protect depositors. This helps maintain the stability and trust in the financial system.

Why Liquidity and Capital Buffers Matter

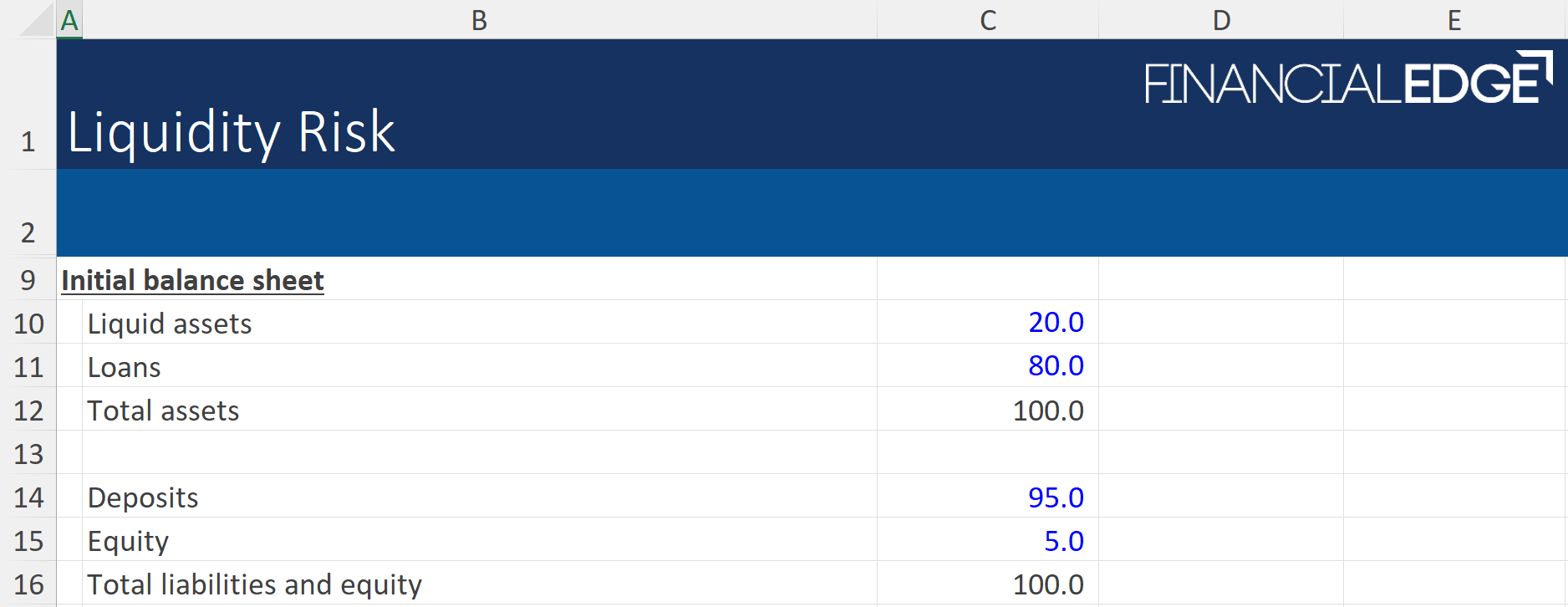

Here is an example of showing how a bank’s balance sheet altered when various liquidity events take place.

Download the free Financial Edge excel download and calculate the movements in assets and liabilities.

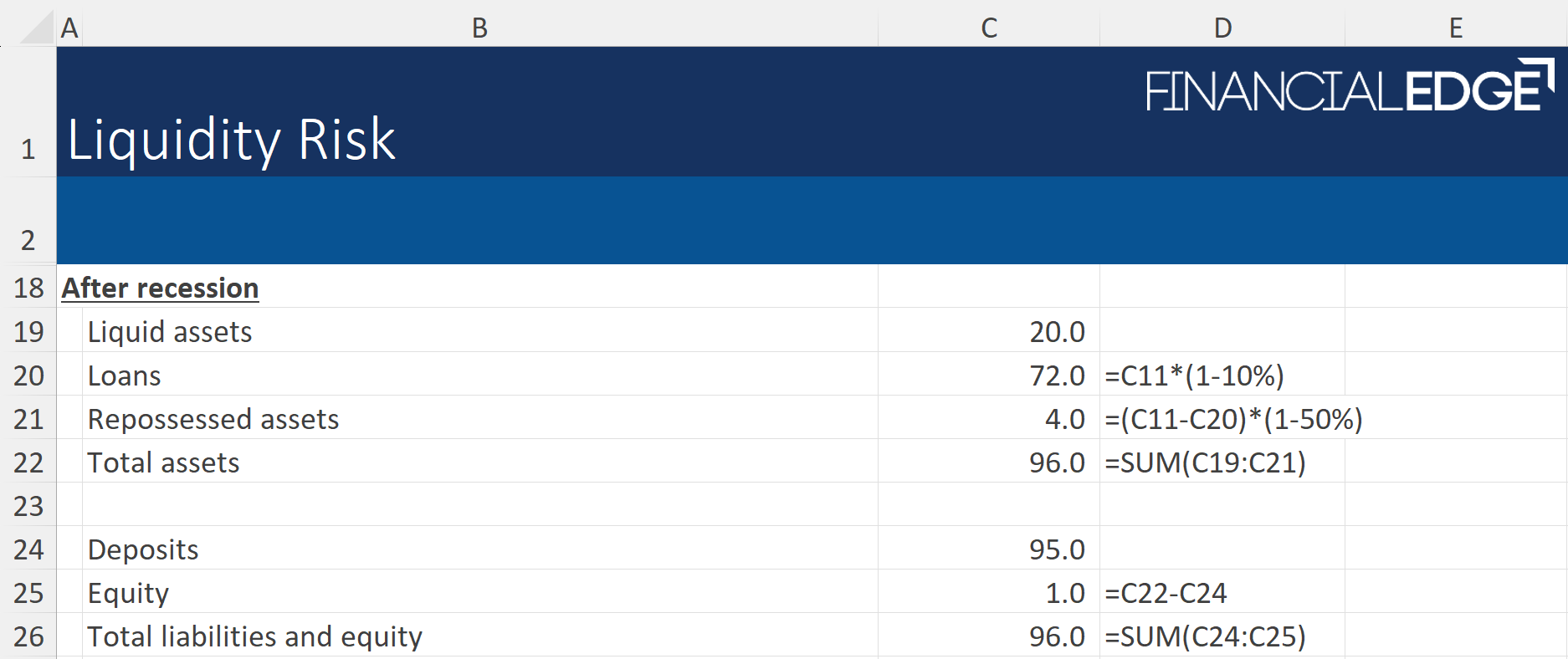

Example of Loan Default During a Recession

In this first example, we have a simple balance sheet for the bank. We are told that a recession has hit and 10% of the bank’s loans will default and only 50% of the assets will be recouped from the defaulted loans.

We can see the banks loans are currently 80, so 10% loss would mean the loans reduce to 72. The bank has lost loans of 8, but 50% can be recouped so we can add a new line on the balance sheet to show the recouped assets. This will be 4 to reflect only half the defaulted assets being recouped.

As a result, total assets have fallen from 100 to 96. Thus, the equity on the lower half of the balance sheet will be reduced to show this shift.

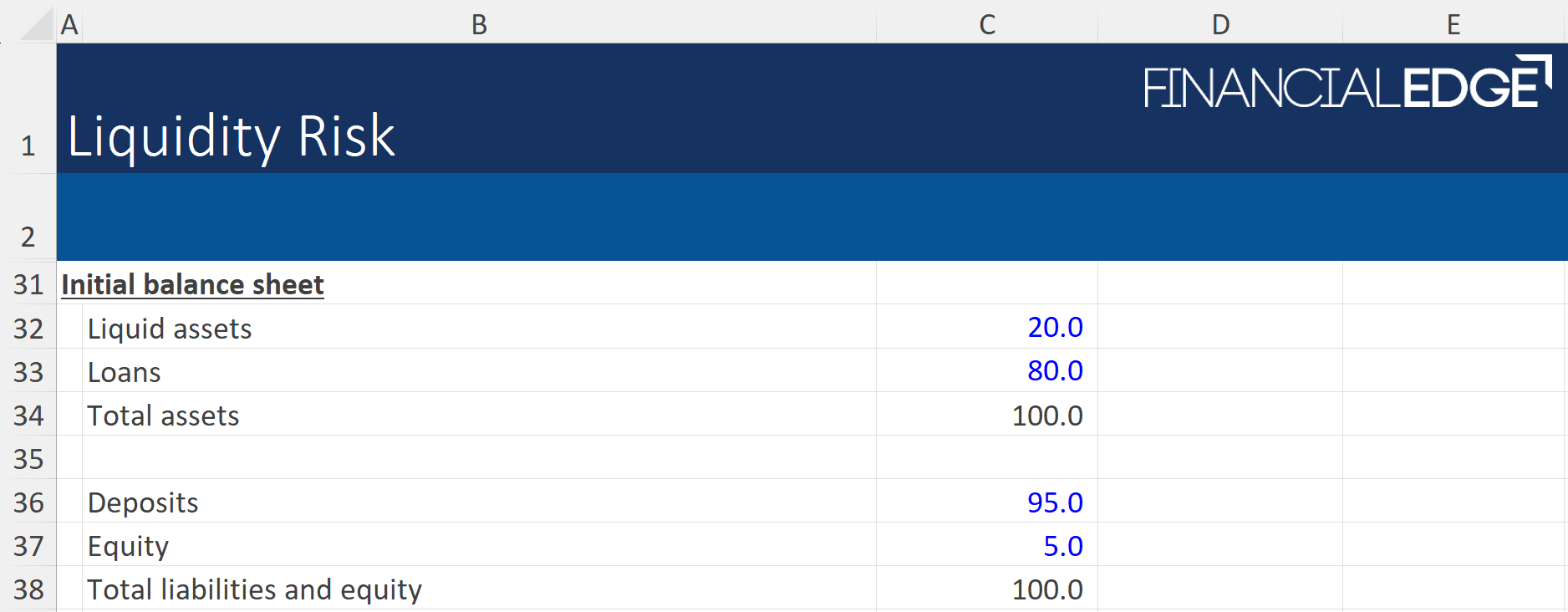

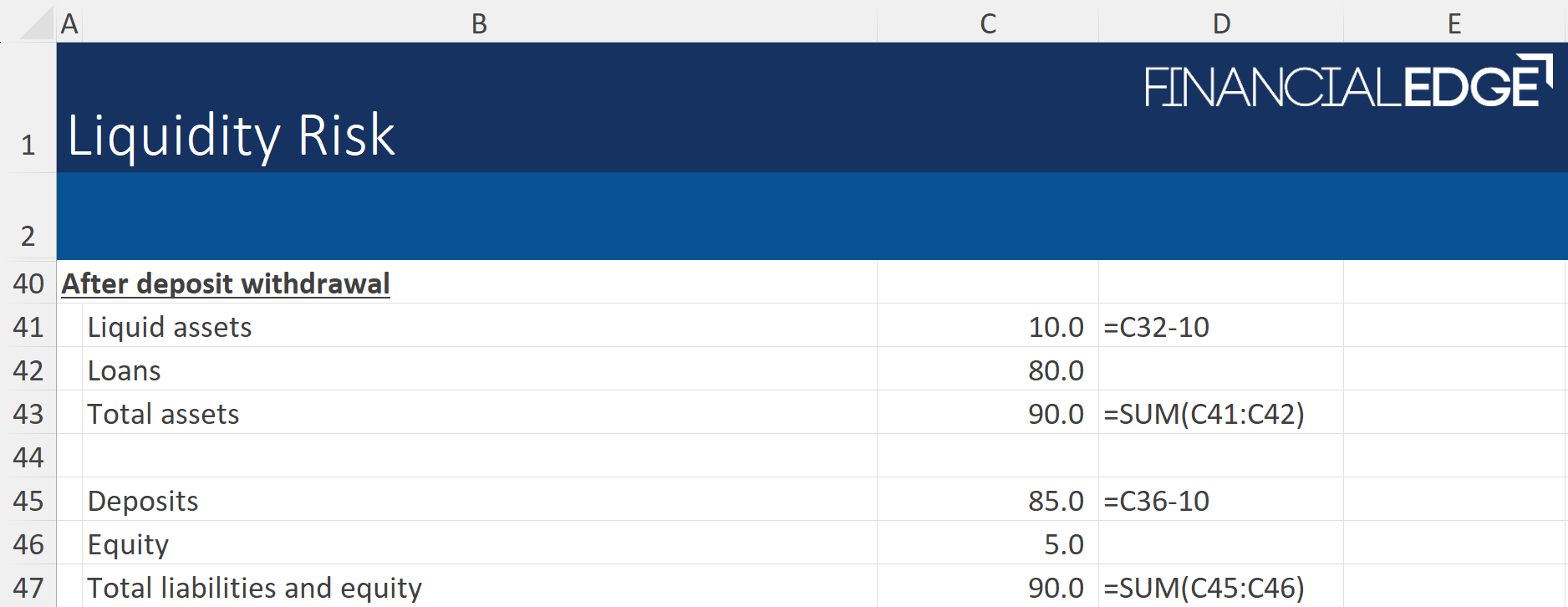

Example of a Liquidity Issue in a Withdrawal Event

In our second example, we are told that a bank’s customers have withdrawn 10 of deposits very quickly.

The bank held 20 in liquid assets, so this quickly shrinks to 10. This reduces total assets by 10 to 90.

The withdrawal also reduces the bank’s deposits, which are available to use as loans for other clients, by 10 to 85. In this instance, equity remains the same, but we have an overall reduction in the bank’s assets and liabilities of 10 respectively.

This type of rapid movement can have an immediate impact on the bank’s buffer ratios and regulatory requirements.

How Liquidity Buffers Protect Banks During Crises

Liquidity buffers protect banks during crises by allowing them to meet sudden large withdrawals of deposits or refinancing needs without impacting other long-term assets. By holding a sufficient amount of readily liquid assets, banks can shrink the asset side of their balance sheets to meet obligations on the liability side without affecting other assets. This helps prevent bankruptcy risk and ensures the bank’s continued operation during financial stress.

Basel III Capital And Liquidity Buffer Requirements

Basel III set out global regulatory standards for capital and liquidity buffers to enhance the resilience of banks. It is a core part of the Basel Accords which are international banking regulations designed to ensure banks and the finance industry remain stable at all times.

Basel III regulations introduced several capital buffers to strengthen banks’ resilience. These buffers were designed in response to the 2008 Global Financial Crisis, where many banks lacked sufficient capital to absorb losses, leading to widespread failures.

The Basel III requirements ensure that banks hold sufficient capital to absorb losses and maintain a liquidity buffer to meet short-term obligations. The aim is to strengthen the banking sector’s ability to withstand economic shocks and reduce the risk of financial crises.

What is Basel III Capital Buffer?

There are two main Basel III capital buffers – the capital conservation buffer and the countercyclical capital buffer. Both were instigated to ensure banks were more resilient in times of economic crisis or downturn.

Capital Buffer Examples

Capital Conservation Buffer

The capital conservation buffer requires banks to hold an additional 2.5% of Common Equity Tier 1 (CET1) capital. This buffer is meant to be used during periods of financial stress without triggering regulatory penalties, although it may restrict dividends and bonuses.

Countercyclical Capital Buffer (CCyB)

The countercyclical capital buffer (CCyB) is adjusted based on macroeconomic conditions to counteract excessive credit growth. For example, during a boom, regulators may increase the buffer to ensure banks build up capital that can be drawn down in a downturn.

Liquidity Buffers Examples

In the 2008 Financial Crisis, most of the banks that went into liquidation did so because of funding and liquidity issues. During this period, the commercial paper markets dried up, and no other banks were prepared to lend to them, leading to major intervention by national governments and banks.

Liquidity ratios try and prevent firms from having a liquidity shortfall. If the banks maintain a supple of cash and high-quality assets, then it is prepared in the event of needing it to meet immediate commitments. Historically financial institutions would not seek cash assets, as they could earn a higher rate of interest in more long-term or complex assets.

Liquidity Coverage Ratio (LCR)

Liquidity coverage ratio (LCR) ensures that banks have enough high-quality liquid assets to cover their total net cash outflows over a 30-day stress period. High-quality liquid assets are those which are easily saleable if required. The liquidity coverage ratio requires institutions to hold enough HQLA to cover all the net cash outflows that may occur over a 30-day period, particularly if a turbulent time.

Net Stable Funding Ratio (NSFR)

The net stable funding ratio (NSFR) requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities.

This is calculated as:

NSFR =(Available Stable Funding)/(Required Stable Funding)

Banks should target having a ratio of at least 100% to ensure resilience during a crisis.

This video helps to explain more about this ratio.

Liquidity Buffer and Its Importance

A liquidity buffer is crucial for ensuring that a bank can meet its short-term obligations, especially during periods of market stress. Liquidity is a key pressure faced by banks (and all companies) in an economic downturn or event. Being unable to return cash to a bank’s investors and savers can cause a huge knock-on impact throughout the economy.

What Constitutes a Good Buffer Rate?

Regulatory frameworks such as Basel III set out specific buffer rates. A “good” buffer rate is one that meets or exceeds these regulatory requirements, providing sufficient protection against potential losses.

- Capital Conservation Buffer: at least 2.5% of risk-weighted assets (RWA)

- Countercyclical Capital Buffer: ranges from 0% to 2.5% of RWA, set by national regulators depending on the level of risk in the financial system

- Common Equity Tier 1 (CET1) Ratio: minimum of 4.5% of RWA

- Total Capital Ratio: minimum of 8% of RWA

- Leverage Ratio: minimum of 3% (Tier 1 capital to total exposure)

Definition of a Tier 1 Capital Buffer

The Tier 1 capital buffer is the core measure of a bank’s financial strength, consisting primarily of common equity and disclosed reserves. It is the highest quality capital, intended to absorb losses while the bank remains a going concern.

Definition of a Tier 2 Capital Buffer

A Tier 2 capital buffer is the second layer of a bank’s regulatory capital, consisting of less reliable and more difficult to implement instruments than Tier 1 capital.

Distinction Between Tier 1 and Tier 2 Capital

Tier 1 capital comprises common equity, retained earnings, and other reserves. It is considered the most stable and reliable form of capital. Tier 1 capital is permanent and readily available to absorb losses.

Tier 2 capital includes subordinated debt, hybrid instruments, and other less permanent capital items. It also provides additional loss-absorbing capacity but is considered less secure than Tier 1. Tier 2 capital is supplementary, less permanent, and may not be as readily available in times of stress

Conclusion

Capital buffers serve as a safeguard during economic downturns, ensuring that banks can absorb losses and protect depositors. On the other hand, liquidity buffers enable banks to meet sudden large withdrawals or refinancing needs without impacting their long-term assets. Both buffers are essential components of a bank’s risk management strategy, helping to maintain trust and confidence in the financial system.

By adhering to regulatory requirements such as Basel III, banks can enhance their resilience and better navigate financial challenges. As the banking landscape continues to evolve, staying informed about these buffers and their implications will be vital for both financial professionals and the general public.