Expected Return Template

November 13, 2025

Download the Free Expected Return Template

Download the free expected return template, to calculate the expected return for an investment and the expected return for a portfolio.

What is Expected Return

The expected return on an investment is the anticipated profit or loss over a specific period, expressed as a percentage of the initial investment. It considers both the appreciation (or depreciation) of assets and any income received, such as dividends or interest. Expected returns are typically calculated using historical performance data, which means they should be viewed as guidance for probable future outcomes—not as guaranteed results. Actual returns can be influenced by market volatility, economic changes, sector or industry trends, and company-specific issues (idiosyncratic risk).

How to Calculate Expected Return

Calculating Expected Return for a Single Investment

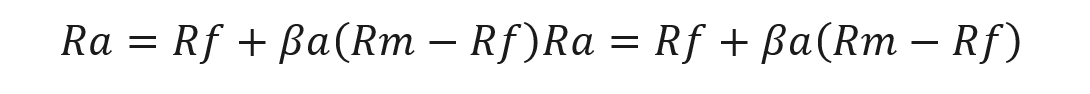

The formula to calculate the expected return on an individual security uses the Capital Asset Pricing Model (CAPM), which adds the product of beta and the equity risk premium (the return of the market less the risk-free rate) to the risk-free rate.

Where:

- Ra = the expected return of an investment

- Rf = the risk-free rate of return

- Βa = the beta of the investment

- Rm = the expected market return

- (Rm-Rf) = equity risk premium

Calculating Expected Return of a Portfolio

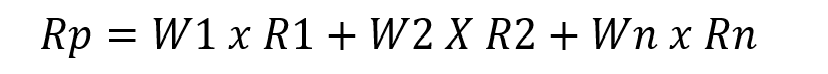

The formula to calculate the expected return on a portfolio requires multiplying the weight of each asset by its expected return.

Calculating Expected Return of a Portfolio Formula

Where:

- Rp = the expected return of the portfolio

- Wn = the portfolio weight of each asset

- Rn = the expected return of each asset