Accounting Equation

September 8, 2025

What is the Accounting Equation?

The accounting equation is an accounting principle that stipulates a company’s assets must equal its liabilities and shareholders’ equity. This double-entry bookkeeping method ensures that a balance sheet always balances, hence the term, accounting equation.

Assets = Liabilities + Equity

The balance sheet is the linchpin of the structural integrity of the three key financial statements. It must always balance and the fundamental accounting equation, assets equals liabilities plus equity, provides the basis for the recording of all business transactions. Each transaction must be recorded so that the equation is in balance once the processing has taken place.

Financial analysis often involves using or analyzing historic information and forecasting forward-looking financial statements. A thorough understanding of the engineering behind financial statements is essential for a valuation assignment or an M&A transaction.

Key Learning Points

- The accounting equation is the basis of the balance sheet, which provides a snapshot of a company’s financial position

- The equation must always balance, as it highlights the impact of a transaction on at least two sets of accounts

- An asset is a resource controlled by an entity with the expectation of producing future economic benefits

- A liability is a present financial obligation as the result of a previous transaction, and equity is the ownership interest in the business

Understanding the Accounting Equation

Accountants use debits and credits to record transactions, but it is also important to understand how they impact assets, liabilities and equity. A business may take out a bank loan of $5m, so cash will increase by $5m, and liabilities will also increase by $5m.

Accountants describe this as: debit cash and credit bank debt.

The loan will create $5m of cash to spend, but it also creates a liability of $5m as it will need to be repaid at the end of the term.

It’s important to understand the definitions of each component in the equation:

What are Assets?

An asset is a resource, controlled by the business, that is expected to provide benefits in the future. Common examples include inventory, account receivables and PP&E (property, plant and equipment).

What are Liabilities?

Liabilities are obligations as a result of a past transaction. These items provide a source of funding to run the operations of the business. For example, accounts payable are monies owed to suppliers as a result of that supplier delivering goods or services at some time in the past.

What is Equity?

Equity is the ownership stake in the business. It too provides a source of funding but is different from a liability because no repayment obligation exists. Retained earnings are all the cumulative profits made to date but unpaid to the owners in the form of dividends. Because profits are generated for the shareholders, any retained earnings are theoretically due to the business owners. However, there is no obligation to pay this amount out to the owners, it can be held within the company.

Examples of the Accounting Equation in Practice

Let’s imagine a business has been set up and enters into a series of transactions over the first period. All transactions are recorded by the accounting system and used to produce an income statement, balance sheet and cash flow statement.

Download the free Financial Edge template to follow these entries in excel.

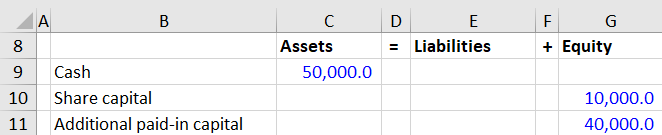

Initial Investment

A business is set up with a $50,000 investment by the owners

The investment by the shareholders is structured as a share issue of 10,000 shares, issued at $5.00 each. The nominal (or par) value is $1.00, and the accounting rules require the par amount to be reported separately from the additional above par. The additional amount above par is reported in an account called additional paid-in capital or share premium.

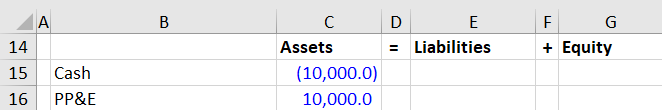

Buying Property, Plant and Equipment

Next, property, plant and equipment (PP&E) was purchased for $10,000.

This was paid for with cash. The accounting engineering records the new asset valued at $10,000 and the cash amount is reduced by $10,000.

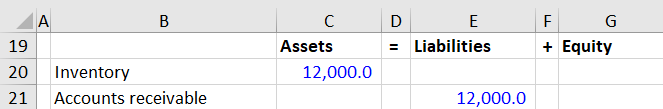

Buying Inventory

The company then purchased inventory. This purchase was made on credit from suppliers for $12,000.

The inventory asset is recorded and the obligation to pay the suppliers is reflected as a liability.

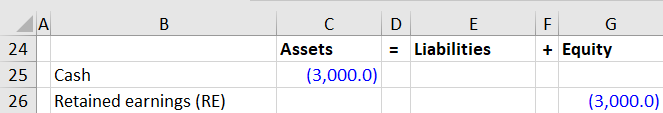

Paying Salaries

Finally, the company paid salaries which were in cash amounting to $3,000.

First, the cash account is decreased by the $3,000 spent.

However, an asset cannot be recorded because of the uncertainty of future benefits accruing from the salary expenditure. It is, in fact, an expense and all expenses reduce retained earnings which is part of the shareholder’s equity. The balancing entry is a reduction in the equity of the shareholders.

The process of recording these transactions will continue across the financial period. In reality, a business may have thousands of these transactions taking place, with each one affecting at least two accounts.

Producing the Financial Statements

To produce the balance sheet at the end of the period, all transactions are processed for each line item. For a start-up business, the beginning amounts for all accounts are zero. The cumulative impact of all the additions and subtractions gives the ending amount, which appears in the balance sheet at the end of the period.

An income statement will also be produced and explain the changes in retained earnings during the period. Net income increases the retained earnings balance. When dividends are paid out it will decrease it.

Finally, a cash flow statement can be produced for the period and reports the change in cash balances between periods. It is presented into operating, investing and financing flows.

You can download our free Excel workout to test your understanding of the accounting equation.

Comparing the Accounting Equation vs. the Balance Sheet

The accounting equation is a simple formula that represents the relationship between a company’s assets, liabilities, and equity. The balance sheet is a detailed financial statement that provides a comprehensive view of a company’s financial position at a specific point in time, listing all assets, liabilities, and equity.

While the accounting equation is a fundamental concept, the balance sheet is a practical application of this equation, providing detailed information about each component.

Real-World Applications of the Accounting Equation

Here are some examples of when the accounting equation is most useful:

Financial Analysis

Analysts use the accounting equation to assess a company’s financial stability and performance. Understanding the assets, liabilities and shareholders’ equity in a company can be a key indicator of future growth prospects and also any potential red flags in the business model.

Budgeting

Companies use the accounting equation to plan and control their budgets, ensuring that they have enough assets to cover their liabilities. This can cover a wide range of activities from the day-to-day running of the company – primarily the working capital element of the business – to larger scale projects. Management will be keen to utilize all assets on its balance sheet, including cash, without accumulating too many liabilities.

Investment Decisions

Investors use the accounting equation to evaluate the financial health of a company before making investment decisions. By examining it in more detail and using ratios and year-over-year comparatives, investors can determine how a company is performing relative to expectations and market conditions.

Conclusion

The accounting equation is a fundamental concept that underpins the structure of financial statements. By understanding the relationship between assets, liabilities, and equity, businesses can ensure their financial records are accurate and balanced. This equation not only provides a snapshot of a company’s financial position but also highlights the impact of transactions on various accounts.

Whether you’re an accountant, a financial analyst, or a business owner, mastering the accounting equation is essential for making informed financial decisions and maintaining the integrity of your financial statements.