Best Wall Street Certifications of 2026

November 24, 2025

For aspiring analysts, associates, and finance professionals, certification programs from Financial Edge Training have become the gold standard for finance training. Financial Edge has continued to train analysts at many of the world’s largest banks since 2016. Hence, our certifications are recognized by top investment banks, private equity firms, and corporate finance teams.

Investment Banker Micro-Degree

Our investment banking course provides training in core investment banking techniques. The certificate is structured to build the skills an investment banking analyst actually uses in their role, focusing on accounting foundations, financial modeling, valuation, and deal analysis.

Develop techniques to present financial results and confidently interpret data and statements accurately. Create high-quality reports using real company data. Learn how to build 3 statement models quickly and error free. Apply key valuation methods and calculations through real-world examples. Learn the fundamentals of M&A and LBO deal analysis, determine whether a deal is viable, how it should be financed, and whether it will give a good outcome to the buyer or seller.

Work through the Red Bull case study, real-world scenarios for accounting, modeling, valuation, and M&A, to understand key financial concepts and skills in context. Prepare for your investment banking interviews, learn from industry experts, watch successful mock interviews, and complete an interactive interview simulator.

The Investment Banker is suitable for aspiring investment bankers, junior analysts preparing for technical interviews, and professionals transitioning into corporate finance roles.

Private Equity Associate Micro-Degree

Our private equity course focuses on buy-side, investment analysis, and leveraged buyout modeling. Learn the specific tools needed to excel as a junior in private equity (PE).

The certificate covers the foundations of how private equity funds work and their core activities. Learn accounting techniques used in private equity and the legal structures and documents used in private equity acquisitions. Develop core and complex LBO modeling skills and learn key valuation methodologies. Discover how a private equity deal is completed from start to finish, including due diligence, debt products, and post-acquisition.

Learn what private equity is, the work involved, the activities that take place inside a private equity firm, and how to get into PE. Watch interviews with PE experts, including a PE partner and top PE recruiter, to find out what firms are looking for from successful candidates.

The Private Equity Associate is tailored for professionals pursuing private equity roles, preparing for on-cycle or off-cycle recruiting, or transitioning from investment banking to private equity.

Project Financer Micro-Degree

Our project finance certification provides training in project finance modeling from the firm hired to teach the top investment banks’ analysts. This certificate covers accounting, modeling, project finance, and renewable energy project finance.

Understand traditional project finance, learn fundamental accounting and modeling, as well as the mechanics behind financing and structuring projects, project risks, and calculating profitability. Build simple and advanced project finance models. Learn the difference between traditional project finance and renewable energy project finance. Describe the features of renewable energy project finance. Build a project finance model for a large-scale wind farm project.

The Project Financer is essential for anyone looking to enter project finance or renewable energy finance, and perfect for those looking to develop project finance skills that don’t have a strong background in finance.

Portfolio Manager Micro-Degree

Our portfolio management certification is designed for those currently working in or seeking to break into the asset management industry.

This certificate covers both the fundamentals of buy-side and advanced portfolio construction, focused on practical application, trading mechanics, and valuation techniques. Gain insights into asset management, including major players, regulations, and client investment goals. Evaluate how economic factors, central banks, regulations, and market trends affect investment choices. Understand portfolio theory, exposure, benchmarks, analysis, and behavioral influences. Learn methods for analyzing and valuing stocks and exploring a range of equity investment products. Discover techniques to build efficient, resilient portfolios, assess returns and risks, and evaluate portfolio manager performance along with the drivers behind it. Watch an expert interview with a portfolio manager and find out what it’s really like to work in the industry and their top tips for success.

Our certification is suitable for aspiring portfolio managers, asset management analysts, and professionals seeking to develop investment strategy capabilities.

Credit Analyst Micro-Degree

The credit analyst course focuses on corporate credit analysis, risk assessment and debt financing evaluation. Our credit analyst training reflects the training new analysts receive at the leading banks.

The certificate covers the credit process for the lenders of a loan. Identify the risks involved, the tools used to mitigate risks and analyze a borrower’s ability to meet future obligations. Identify different scenarios where a company might get into cash flow trouble. Build a 13-week cash flow model for a real company that filed for bankruptcy. Learn about the process of restructuring debt. Value a company nearing bankruptcy using industry and company analysis. Learn how to use cash flows to determine debt capacity. Develop techniques to accurately present financial results and confidently interpret data and statements. Create high-quality reports using real company data. Learn how to build 3 statement models quickly and error free.

The Credit Analyst is designed for analysts working in credit, as well as private equity and sponsor advisory groups, who want to better understand credit and leveraged credit analysis.

Research Analyst Micro-Degree

Our research analyst course prepares you to succeed on the sell side and the buy side preparing you for the dynamic role of a research analyst. With this certificate, access the same training we deliver to some of the largest global investment banks’ sell-side and buy-side research firms.

This certificate gives you all the essential skills required for a research analyst. Understand and analyze financial statements and build financial models. Learn to construct strong financial forecasts specifically for public companies. Value companies through both relative and fundamental approaches and develop investment recommendations while gaining insights into financial markets and products and ESG analysis. Watch an expert interview with an equity analyst to find out what it’s really like to work in the industry.

This Research Analyst is aimed at anyone looking to become a research analyst, either on the sell side or buy side. The certificate is also relevant to those with an interest in equity research or interested in a career in fixed income research.

Venture Capital Associate Micro-Degree

The venture capital course covers the VC capital process, valuation approaches used by top firms in the industry, an overview of pre- and post-money valuations at each round, the valuation parameters VCs look at each round. Understand how VC funds work, their life cycle, and the activities that these firms carry out. Learn about the start-up valuation methods and forecast models used in the industry. Understand how to complete a VC deal from start to finish including various stages of funding VC transactions, due diligence, exit strategies, and more. Build models quickly and error-free for decisions and recommendations in VC deals. Learn the VC valuation methodologies used and their supporting calculations. Watch a fascinating interview with a VC expert to learn what it’s like to work in the industry, and how to spot a great VC investment.

The Venture Capital Associate is suited for aspiring venture capital analysts and associates, startup operators, and individuals entering early-stage investing.

Restructurer Micro-Degree

Our restructuring course provides analytical training for distressed finance and restructuring scenarios. Developed by an expert restructuring and leveraged finance instructor with experience from small boutiques to bulge-bracket banks.

This certificate will give you a full picture of how a restructuring process works from end-to-end, from identifying a company’s early signs of distress, to negotiation, and implementation of restructuring deals. Understand key debt products and capital structures, focused on highly leveraged companies. Identify the red flags and early financial and non-financial warning signs of financial distress. Analyze operational and non-operational cash flows. Review restructuring options available to companies and advisors, including business turnaround, asset disposal, and liquidation. Watch an expert interview with an Investment Banker with experience in restructuring and leveraged finance, to find out what it is really like working in the industry and how to get into it.

This Restructurer is relevant for restructuring advisory professionals, distressed investors, turnaround consultants, and credit analysts focused on distressed situations.

Real Estate Analyst Micro-Degree

The real estate financial modeling course focuses on financial modeling, valuation, and deal evaluation. Real estate is a significant part of the investment banking, private equity and asset management portfolio.

Understand the fundamental real estate concepts. Learn how to analyze and interpret market data to make investment decisions. Build a cash flow model from purchase to sale for a real estate transaction. Learn about real estate investment trusts (REITs). Understand the concepts of FFO and AFFO, lease amortization, and the differences between US GAAP and IFRS. Build a comprehensive REIT operating model. Learn how REITS finance future growth and how to value REITs using NAV and DCF.

The Real Estate Analyst is perfect for those with fundamental modeling, valuation, and Excel skills who want to break into the commercial real estate industry, prepare for interviews, and prepare for an internship or new role in commercial real estate, private equity, or investment banking.

Trader Micro-Degree

The sales & trading course teaches how equity, fixed income, currencies and commodities sales and trading at an investment bank works. Learn the fundamental valuation techniques used. Understand the various mechanisms used to trade products. The course is challenging and gives you a comprehensive understanding of the practical skills required to succeed on Wall Street’s trading floors.

The Trader is built for aspiring traders, market analysts, and individuals preparing for sales and trading roles.

FIG Banker Micro-Degree

Our FIG Banking course provides specialized training for analyzing and valuing financial institutions. The certificate covers accounting, financial modeling, valuation, and the regulatory landscape for both bank and insurance companies. Learn how a commercial and investment bank works. Understand the relationship between bank performance and valuation. Understand the long and complicated financial statements of banking and insurance companies. Identify the main types of insurance business and products, company financials, and industry regulations. Learn to model and value each type of FIG business, including a commercial bank, life insurance company, and an insurance firm.

The certificate is essential for anyone involved in providing clients with expertise and knowledge of financial institutions, like banks and insurance companies. It is perfect for graduates looking to specialize in bank and insurance advisory, or a professional preparing for a new role.

Business Toolkit Micro-Degree

The Business Toolkit Micro-Degree provides foundational training on everything you need to know to be a successful employee, from helping you to master essential Excel skills all the way through to professional writing tips and tricks.

The certificate covers Excel efficiencies, creating impactful presentations in PowerPoint, brand management, effective communication, presentation and business writing, as well as the fundamentals of Python and machine learning. Gain practical skills applicable to general business roles and early-career finance positions.

The Business Toolkit is suitable for students, junior professionals, and non-finance managers seeking a structured understanding of business fundamentals.

Why Choose Financial Edge as Your Training Provider

Former JP Morgan, GS, Barclays, our expert instructors deliver unparalleled learning drawing on practical industry experience. Every year we teach over 20,000 finance professionals from the world’s biggest banks to the prestigious boutiques.

| Feature / Category | Financial Edge Training (FE) | CFI FVMA |

| Training Used by Real Wall Street Banks | Trusted by leading investment banks and corporates; curriculum mirrors real analyst programs for desk-ready skills | Popular among individual learners; less alignment with internal bank training programs |

| Micro-Degrees Designed for Real Jobs | Professional-grade micro-degrees in IB, PE, FIG, and Project Finance; multiple exams and practical modelling assignments | Broader coverage with general courses; a bias towards accountancy; limited job-specific pathways |

| Curriculum Created by Former Bankers | Designed and taught by former investment bankers and PE professionals; hands-on modelling identical to desk experience | Instructors vary; less emphasis on elite banking experience |

| Industry Recognition | Highly regarded by banking and investment teams; strong CV and LinkedIn signaling; trusted by hiring managers as a mark of credibility | Globally recognized for self-paced learning, but not widely adopted inside banks |

| Depth in Real Financial Modelling | Detailed Excel templates; step-by-step forecasts, valuations, M&A, and LBOs; grounded in accounting principles | Practical training in building financial models and performing company valuations |

| Platform, Support, and Learning Tools | Felix learning + analytics platform: expert instructor-led videos, role-based pathways, certified courses, practical exercises and real-world case studies, instructor Q&A, real-time company analytics, Excel add-in | Conventional video-based learning |

| Student Feedback | Rated excellent on Trustpilot rating; praised for clarity, real-world examples, instructor support, and modelling exercises | Positive feedback overall, but not at the same industry-recognized scale |

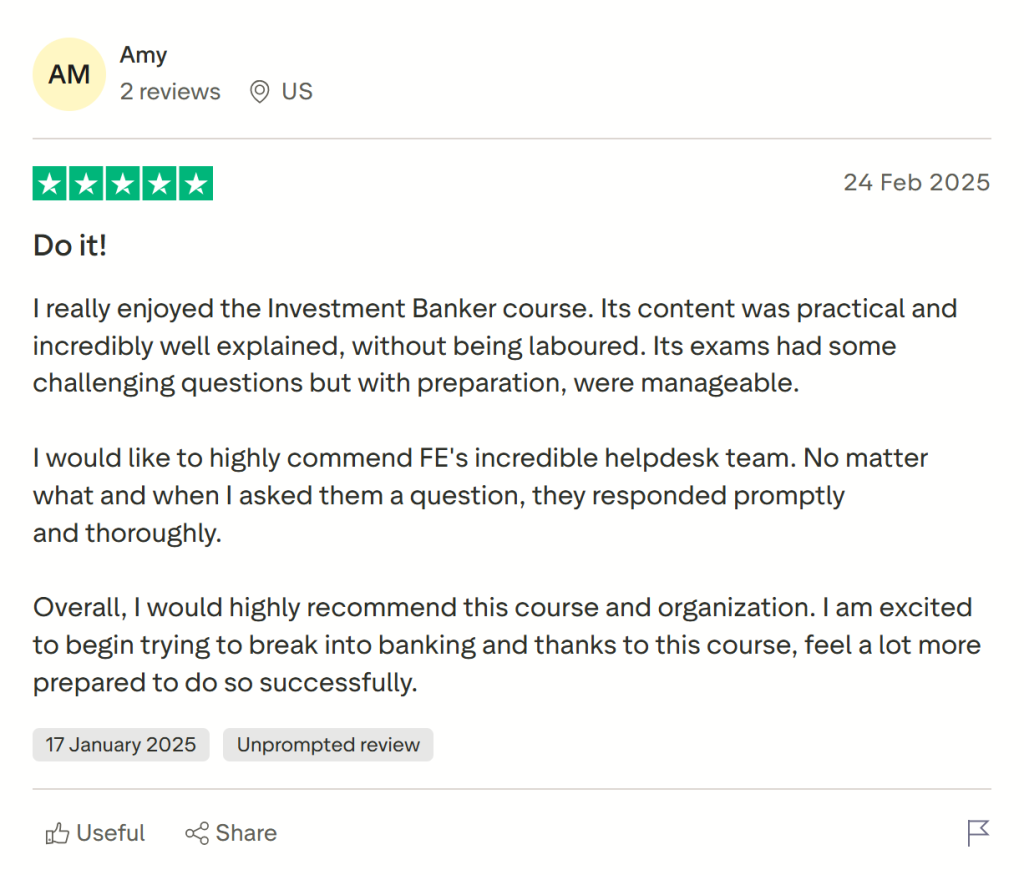

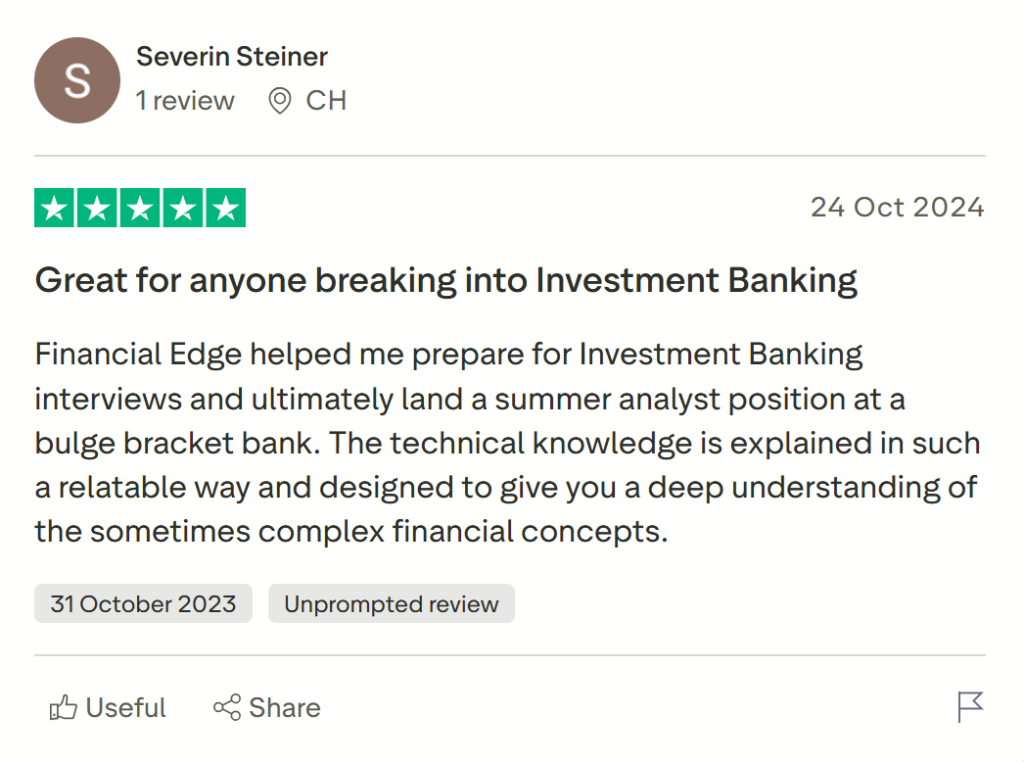

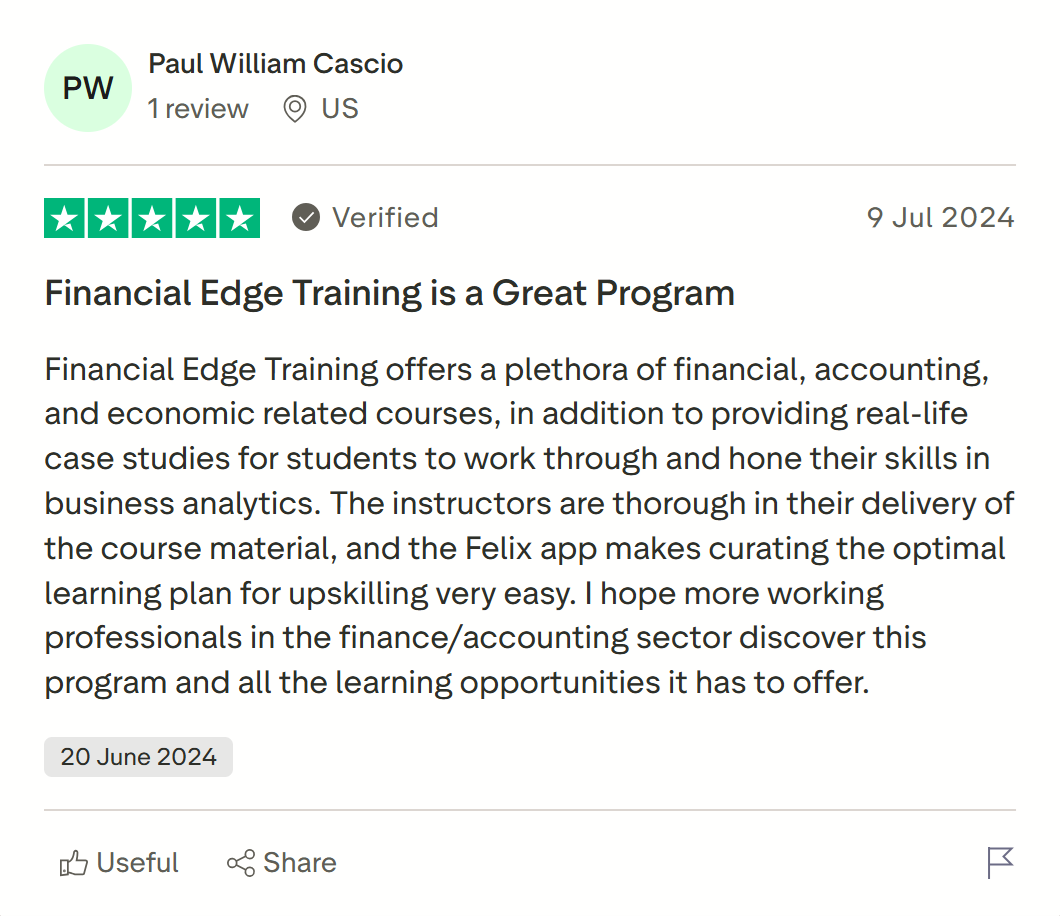

Financial Edge Training Reviews

“I really enjoyed the Investment Banker course. Its content was practical and incredibly well explained, without being labored. Its exams had some challenging questions but with preparation, were manageable. I would like to highly commend FE’s incredible helpdesk team. No matter what and when I asked them a question, they responded promptly and thoroughly. Overall, I would highly recommend this course and organization. I am excited to begin trying to break into banking and thanks to this course, feel a lot more prepared to do so successfully.”

“Financial Edge training provides easy to understand, yet detailed courses I could do in between my collage lectures, allowing me to understand advanced topics and learn useful skills long before my classmates.”

“Financial Edge Training offers a plethora of financial, accounting, and economic related courses, in addition to providing real-life case studies for students to work through and hone their skills in business analytics. The instructors are thorough in their delivery of the course material, and the Felix app makes curating the optimal learning plan for upskilling very easy. I hope more working professionals in the finance/accounting sector discover this program and all the learning opportunities it has to offer.”

“Financial Edge helped me prepare for Investment Banking interviews and ultimately land a summer analyst position at a bulge bracket bank. The technical knowledge is explained in such a relatable way and designed to give you a deep understanding of the sometimes complex financial concepts.”

“I love how FE instructors will instantly reply to my questions posted under course video. and I also love that FE has resources on various high finance topics (such as ones focused on asset management) that other training platforms do not provide.”

Summary

Live Support

Live expert instructor support for content and assessment queries, with questions answered within 24 hours.

Career Resources

Prepare for interviews, watch examples of successful interviews, and practice with an interview simulator. Get insider knowledge from experts on what it is really like working in the industry.

Structured Learning

Follow structured courses built of technical micro-learning videos, practical exercises, financial models, interactive case studies, integrated quizzes and challenging exams.

Stand Out from the Crowd

Whether you are a student, preparing to apply for an internship, or wanting to brush up on your finance knowledge around work, online certificates allow you flexibility to complete them at your own pace and become a standout candidate.

Real-world Examples

Practical exercises apply real-world examples to the theory, and in-depth case studies to model real company data.

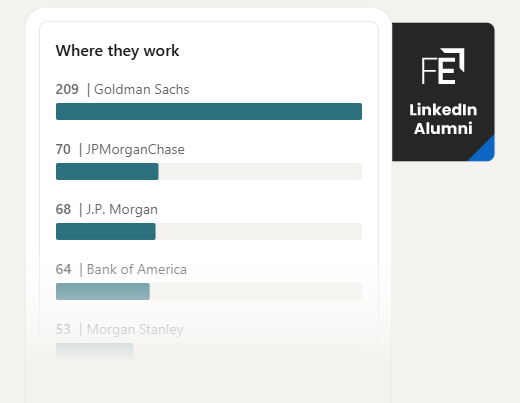

Join the World-Class Alumni

Get the same training as the world’s best finance professionals. We proudly teach at the top firms across investment banking, private equity, asset management and more. See who is among our verified alumni on LinkedIn.

How You Can Access the Courses

Single Course

- Purchase micro-degrees or our other certifications to get lifetime access to materials for continuous learning

Learn Finance with Felix by Financial Edge Training

The industry-leading Felix platform optimizes learning. Felix has a searchable library of content, 4,400+ videos across 520+ playlists, across 40 topic areas. Complete practical Excel exercises and quizzes embedded in each playlist. Access weekly live webinars, and new content added each month.

Boost Plan

- 42 certificates, 59 skill certificates and 12 micro-degrees

- A searchable library of 4,400+ learning videos across 520+ playlists

- New content is added each month

- 40 topic areas

- 12 role-based pathways defined by level of experience

- Weekly live webinars

- Live expert instructor support – with questions answered within 24 hours

- Request new content

- Current and historic filings for over 7,000 firms globally

- Current and historic filings for over 4,000 US firms

Pro Plan

- On the Felix Pro Plan access everything available in the Boost plan plus:

- Annotate and manage company filings

- Streamlined company data (WACC. & EV bridge calculator, custom comparables)

- Regional and industry data sets

- Ready-to-use sector and transaction models

Conclusion

In summary, Financial Edge Training distinguishes itself as a leading finance training provider of Wall Street certifications, offering a comprehensive range of programs designed to meet the evolving needs of finance professionals. With 42 certificates, 59 skill certificates, and 12 micro-degrees, learners can tailor their development to specific career goals, whether that’s breaking into investment banking, mastering private equity, or excelling in asset management. The curriculum’s practical focus, industry recognition, and robust support resources ensure that candidates not only gain technical expertise but also the confidence to apply these skills in real-world scenarios. By choosing Financial Edge, professionals and aspiring analysts alike position themselves to stand out in a highly competitive industry and to advance their careers with credentials trusted by leading global institutions