What Sets Financial Edge Credit Analyst Course Apart?

January 12, 2026

A credit analyst assesses the creditworthiness of companies, individuals, or entities seeking loans or credit. They analyze risk by evaluating financial statements, credit histories, and other relevant data. From this analysis, credit analysts make recommendations on lending decisions, credit limits, interest rates, and terms. Credit Analysts can work in different organizations, including commercial banks, credit rating agencies, and large corporations.

In this guide, we will walk you through the best credit analyst courses, from beginner fundamentals to advanced professional training, with a special focus on the highly regarded course offered by Financial Edge Training.

What Sets Financial Edge Credit Analyst Course Apart?

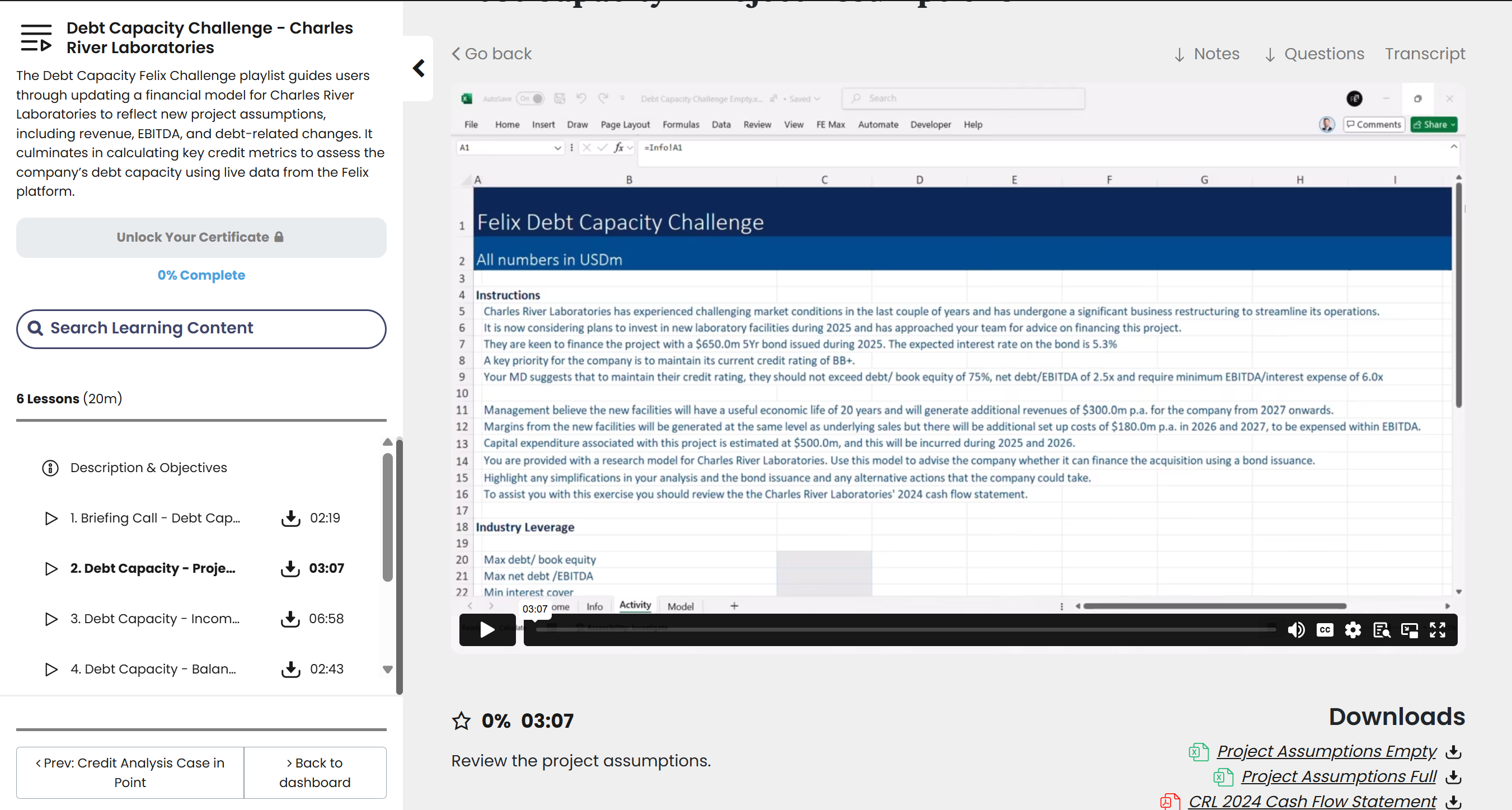

FE’s Credit Analyst course is not just another beginner online course; it’s the same technical training delivered to new hires at top investment banks. The curriculum is comprehensive, and built around real company data covering 26 topics, 209 practical exercises, and 34+ hours of content. Students learn everything from accounting foundations and financial statement analysis to credit risk, debt capacity, and distressed debt restructuring. Real company data and case studies bridge the gap between theory and practice.

Who is Financial Edge Credit Analyst Course For?

Our comprehensive Credit Analyst course is designed for students and new analysts working in credit or people looking to transition into the credit industry, as well as those in private equity and sponsor advisory groups. Credit Analyst roles require a foundation in accounting and credit, which this course provides. Students benefit from a hands-on approach to credit and leveraged credit analysis.

Core Concepts Covered in the Credit Analyst Course

1. Accounting Foundations (Beginner Level) – Understanding the Numbers

Some key topics covered include:

- Understand and analyze financial statements, including the income statement, balance sheet, and cash flow statement.

- Learn about working capital management, capital structure, and key accounting ratios.

- Learn specialized topics such as equity method investments, consolidation, deferred taxes, and structuring acquisitions.

- Learn to read, interpret, and assess a company’s financial health and risk profile using accounting principles relevant to investment banking and credit analysis.

Practical application:

These skills are used daily by credit analysts to assess financial statements, identify red flags, and evaluate a borrower’s financial health and risk profile in investment banking, commercial lending, and credit roles.

2. Financial Modeling & Forecasting (Intermediate Level) – Turning Data into Insight

Some key topics covered include:

- Learn to build and edit financial models from scratch.

- Learn how to create integrated three-statement models, perform scenario analysis, and check models for integrity and errors.

- Learn to forecast financials for research and credit analysis.

- Learn how to use Excel efficiently for financial modeling tasks.

Practical application:

These tools allow credit professionals to project cash flows, test debt sustainability, support credit memos, and evaluate how changes in assumptions impact a borrower’s ability to service debt.

3. Credit Analysis for Lenders (Advanced Level) – Making Real Credit Decisions

Some key topics covered include:

- Learn how banks and other financial institutions assess the risk of making loans.

- Learn about the credit process, including how banks evaluate borrowers using the “5 Cs of Credit”.

- Learn how lenders quantify credit risk by considering the likelihood of default and the potential loss if a borrower fails to repay.

- Learn how lenders control credit risk.

- Understand business and financial risk analysis.

- Determine a company’s debt capacity and use scenario analysis to test its ability to handle different financial conditions.

- Gain an insight into the internal lending process, from pitching a loan to monitoring and managing problem loans.

- Use practical case studies and exercises to help you apply these concepts, estimate credit quality, and assess the strength of a borrower’s credit profile.

Practical application:

This mirrors the real responsibilities of credit analysts, relationship managers, and lenders who must decide whether to approve, price, structure, and monitor loans while managing risk.

4. Distressed Debt & Restructuring (Expert Level) – Managing Downside & Recoveries

Some key topics covered include:

- Learn how to analyze, value, and restructure the debt of companies facing financial distress or bankruptcy.

- Explore forensic accounting, risk assessment, valuation, and practical restructuring strategies to help you manage troubled credits and minimize losses.

Practical application:

These skills are critical for professionals working in special situations, restructuring teams, workout groups, and distressed debt investing, where the focus shifts from growth to capital preservation and recovery.

For the full breakdown of the course view the Credit Analyst Micro-degree course.

Why Choose Us as Your Learning Provider

Stand Out from the Crowd

If you are a student preparing to apply for an internship or an analyst wanting to improve your understanding, online certificates give you flexibility to work at your own pace and set you apart as a standout candidate by demonstrating your initiative.

Real-world Examples

Apply real-world examples to the theory with practical examples and in-depth case studies modeling company data.

What Students Think

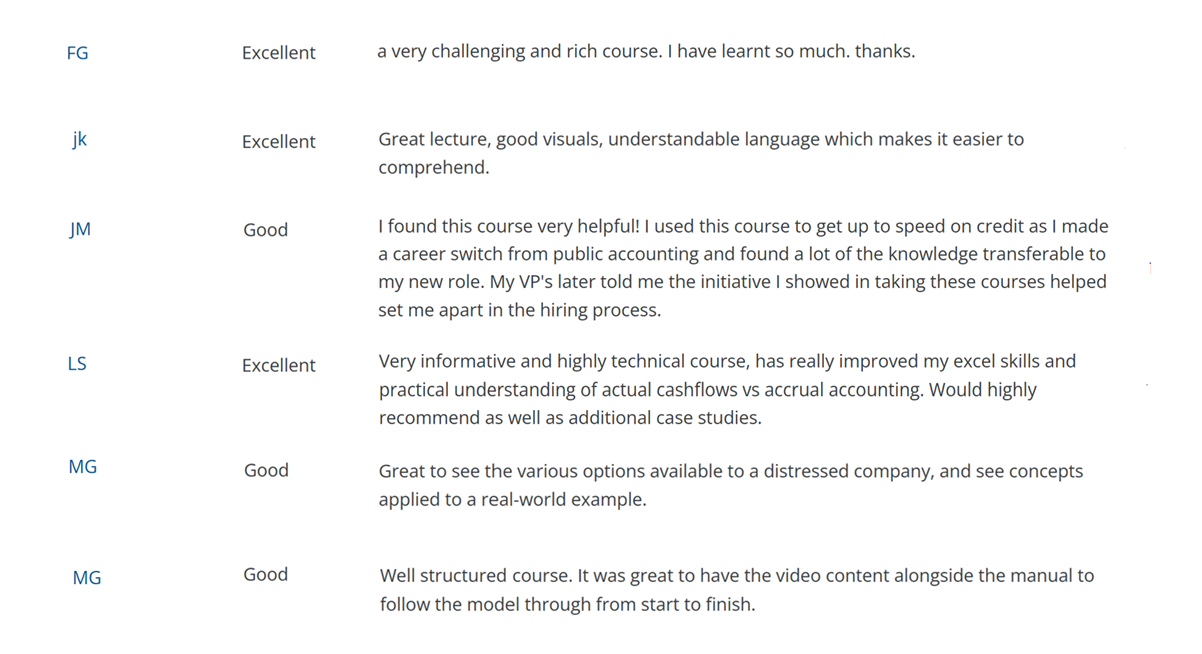

Students who have completed the Credit Analyst course found it “challenging and rich”, “well structured”, and “very informative and highly technical”. They have said it was great to “see concepts applied to a real-world example”. They have also said it was helpful to “get up to speed on credit” and taking the course showed initiative and “helped set [them] apart in the hiring process”.

Here is some of the internal feedback from students who have completed the course:

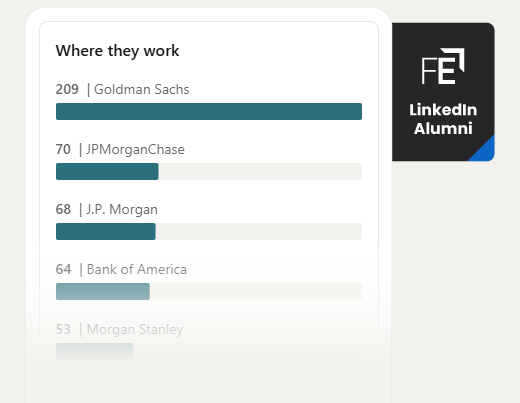

Join the World-Class Alumni

We proudly teach at the top firms across investment banking, private equity, asset management and more. Get the same training as the world’s best finance professionals. See who is among our verified alumni on LinkedIn.

Learners Accessibility

Videos in Felix are designed for accessibility and are accompanied by captions, transcripts, and adjustable playback speed functionality. The provision of captions and transcripts improves accessibility for all students and contributes to improved focus, making your studies more efficient.

Access to Expert Support

The Credit Analyst was developed by instructors who train analysts at top Wall Street firms. All students have access to continuous instructor support and feedback via the Felix platform. Ask community questions on specific questions or reach out to instructors directly for 1-2-1 support.

Is Financial Edge Only for Advanced Learners?

Financial Edge’s Credit Analyst is designed for a broad audience. The curriculum starts with the basics, no prior experience required, and builds up to advanced topics, ensuring that learners at all levels can benefit. With step-by-step modules, hands-on exercises, and continuous instructor support, even those new to credit analysis can develop the skills and confidence needed to succeed in finance. Whether you are a student, a career changer, or an aspiring analyst, Financial Edge provides the tools and guidance to help you thrive.

Comparison of Financial Edge vs. Coursera Credit Analysis Courses

| Feature | Financial Edge | Coursera – Starweaver |

| Course | The Credit Analyst | Fundamentals of Credit Analysis |

| Target Audience | Students

Aspiring credit analysts Credit analysts People working in private equity and sponsor advisory groups No prior credit analysis experience is required |

Students

Aspiring credit analysts Professionals in front, middle, and back-office functions No prior credit analysis experience is required |

| Course Structure | 34+ hours

26 topics 209 exercises 4 exams |

4 hours

8 modules 6 assignments |

| Core Modules | Financial accounting

Financial statement analysis Financial modeling Credit risk Business risk Financial risk Debt capacity 13-week cash flow modeling Distressed debt |

Credit analysis basics

Credit ratings Financial ratios Loan types |

| Practical Application | Real company data

Case studies Scenario-based modeling Excel assignments |

Basic case studies

Quizzes Introductory exercises |

| Certification | Wall Street-recognized micro-degree

Join Financial Edge’s world-class alumni |

Coursera shareable certificate of completion |

| Instructor Support | Ongoing expert instructor support

Ask the community questions on videos |

Peer forums

Limited instructor interaction |

| Pricing | £339–£679 lifetime access (discounts available), annual plans | Coursera subscription £45/month |

| Learning Format | On-demand videos

Quizzes Excel exercises Downloadable resources Graded exams |

On-demand videos

Quizzes Downloadable resources |

| Completion Time | Self-paced, typically completed in weeks to months | Self-paced, typically completed in days to weeks |

| Industry Recognition | Used by top banks for analyst training, recognized by major firms | Recognized as a solid introduction, less valuable for job seekers |

| Unique Selling Points | Accessible, beginner-friendly, technically rigorous, real-world modeling, direct alignment with analyst roles | Accessible, affordable, beginner-friendly |

Learn Finance with Felix by Financial Edge Training

Felix is the industry-leading platform that optimizes learning. With a library of searchable content, Felix has over 4,500 videos and 540 playlists, across 40 topic areas. Complete practical Excel exercises and quizzes within each playlist. Watch weekly live webinars, and find new content added each month.

Boost Plan

- 42 certificates, 59 skill certificates and 12 micro-degrees

- A searchable library of 4,500+ learning videos across 540+ playlists

- New content is added each month

- 40 topic areas

- 12 role-based pathways defined by level of experience

- Weekly live webinars

- Live expert instructor support – with questions answered within 24 hours

- Request new content

- Current and historic filings for over 7,000 firms globally

- Current and historic filings for over 4,000 US firms

Pro Plan

- On the Felix Pro Plan access everything available in the Boost plan plus:

- Annotate and manage company filings

- Streamlined company data (WACC. & EV bridge calculator, custom comparables)

- Regional and industry data sets

- Ready-to-use sector and transaction models

Ready to Get Started?

Enroll in the Credit Analyst micro-degree course and download the free Credit Analyst resume template from the download section.

Discounted Student Access

Financial Edge offers affordable plans and student discounts to make its services accessible to students. If you are studying in the UK, both undergraduates and postgraduates can visit Student Beans to verify their ID and claim a discount. Students outside the UK should contact the team for more information.

Conclusion

If you are a student weighing your options, start by completing free or low-cost courses to build foundational skills. When you are ready to specialize and pursue analyst roles, FE’s Credit Analyst course offers unmatched technical depth and industry credibility. Just be sure you are prepared for the intensity and the investment.