Save 40% on all online finance courses

Dual Currency Deposit

August 26, 2025

What is a Dual Currency Deposit?

A Dual Currency Deposit (DCD) is a structured financial product that offers a higher yield than standard deposits by embedding a foreign exchange (FX) option. DCDs are also known as dual currency investments, dual currency products, structured investment deposits, and deposit plus products.

The investor places a deposit in one currency and effectively sells an FX option, which determines the currency in which they will be repaid. This structure introduces FX risk; the investor may be repaid in a different currency at a potentially unfavorable exchange rate.

Key Learning Points

- Dual Currency Deposits (DCDs) are structured financial products that offer potentially higher yields by embedding an FX option, which introduces currency risk

- DCDs fall under the category of structured deposit products and involve speculation on currency movements

- The main risk in DCDs is currency depreciation, which can result in the investor receiving less value than if they had converted at the spot rate at maturity

Example of a Dual Currency Deposit

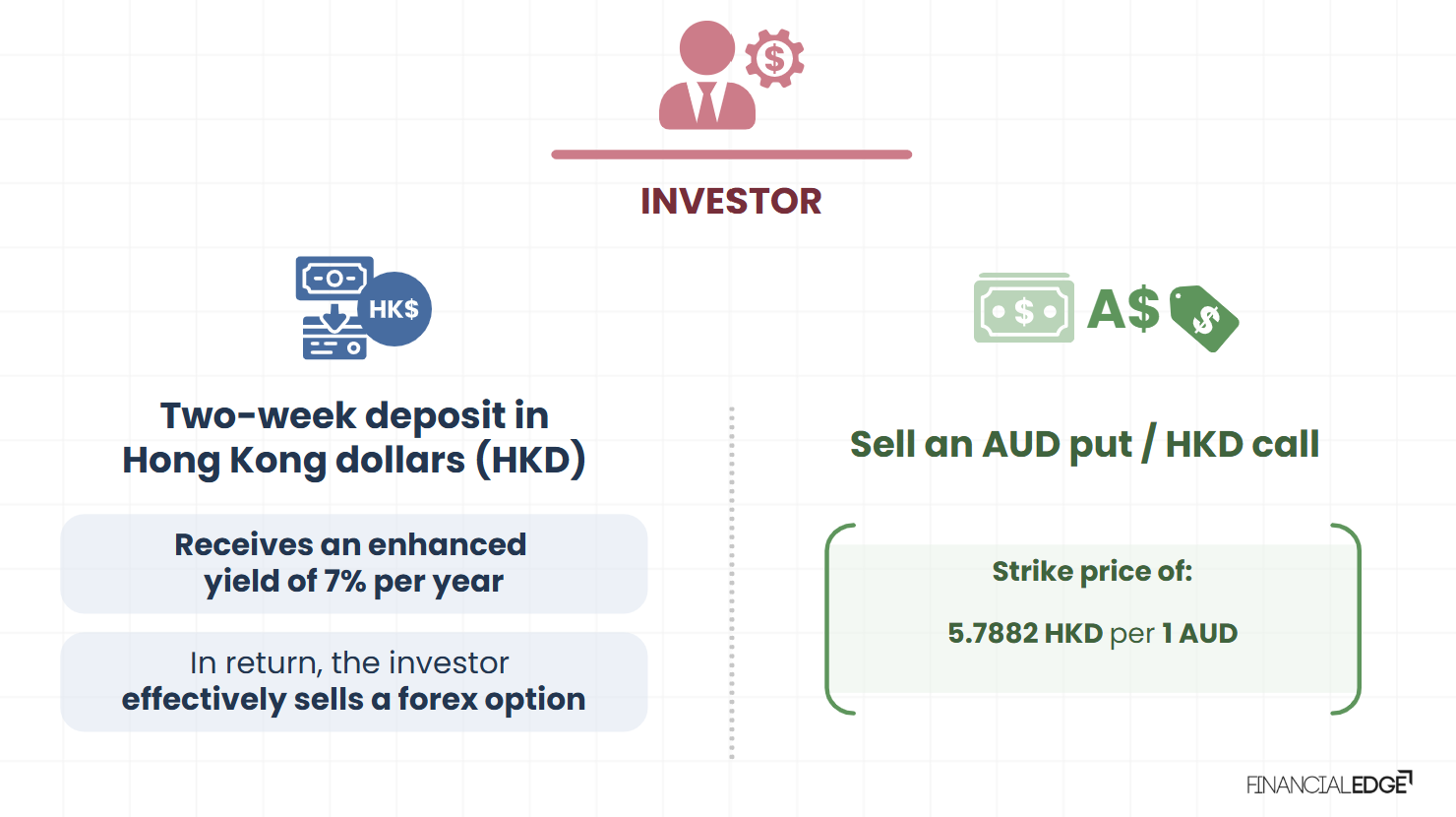

An investor deposits Hong Kong Dollars for two weeks and receives a 7% annual yield. In return, they sell an AUD put/HKD call option with a strike price of 5.7882. If the AUD/HKD exchange rate stays above this strike at maturity, the investor is repaid in HKD. If it falls below, the investor is repaid in AUD at the strike rate, which may be less favorable than the market rate.

Dual Currency Deposit Pricing

The embedded FX option influences the pricing of a DCD. The enhanced yield compensates the investor for the risk of being repaid in a potentially weaker currency. The strike price of the FX option and the spot rate at inception determine whether the option is ‘in’ or ‘out’ of the money.

Structured Deposit Products

DCDs fall under the category of structured deposit products. These are deposits that include embedded derivatives (in this case, an FX option) to enhance returns. The trade-off is that the investor assumes additional risk – in this case, currency risk.

High-yield Currency Deposits

DCDs are a type of high-yield currency deposit. Investors receive a higher interest rate than standard deposits, but in return, they take on FX risk. If the exchange rate moves unfavorably, the investor may be repaid in a different currency at a less favorable rate, potentially resulting in a loss compared to market conversion.

Foreign Exchange Investment

DCDs are a form of foreign exchange investment because they involve speculation on currency movements. The investor’s return depends on the FX rate at maturity relative to a pre-agreed strike price. If the market moves unfavorably, the investor may be repaid in a depreciated currency.

Currency-linked Deposits

DCDs are currency-linked deposits by design. The repayment currency is linked to the performance of a currency pair (e.g., AUD/HKD). The embedded FX option means that the investor’s return is directly tied to currency movements.

What are the Risks Involved in Dual Currency Deposits?

The main risk in dual currency deposits is currency depreciation. If the alternate currency (e.g. AUD) weakens significantly, the investor receives less value than if they had converted at the spot rate at maturity.

Dual Currency Deposit Reporting

Dual currency deposit reporting involves documenting and tracking structured financial products that combine a deposit with a foreign exchange (FX) option. These reports typically include transaction details such as the deposit currency, strike rate, and maturity, along with disclosures about FX risk and performance metrics.

The reporting process helps stakeholders understand how currency movements and the embedded FX option influence the final payout, especially when the repayment may occur in a less favorable currency.

Dual Currency Deposit Pricing Model

Dual currency deposit pricing models are built around the interest rate differentials between the deposit currency and the alternate currency, as well as the valuation of the embedded FX option. These models often use financial techniques such as Black-Scholes or binomial trees to price the option component.

The strike rate and spot rate are critical in determining whether the investor receives repayment in the original currency or the alternate one, directly impacting the yield and risk profile of the deposit.

What is the Dual Currency Strategy?

The dual currency strategy is a yield-enhancement approach used by investors who are willing to accept FX risk in exchange for higher returns than traditional deposits. This strategy is typically employed by those who have a view on currency movements or want to hedge existing exposures.

By using dual currency deposits, investors can speculate on FX trends while benefiting from elevated interest rates, though they must be prepared for the possibility of receiving repayment in a different currency than originally deposited.

Dual Currency Note Payoff

Dual currency note payoff refers to the final outcome of a dual currency note, or a power reverse dual-currency note (PRDC), which depends on FX rates at maturity. These instruments often feature higher initial yields and complex coupon structures that adjust based on currency movements. The payoff may include embedded options such as barriers or callable features, and the investor’s return is influenced by whether the FX rate triggers repayment in the base or alternate currency. These notes offer leveraged exposure to FX and interest rate differentials, making them attractive but risky investment vehicles.

Conclusion

Dual Currency Deposits (DCDs) offer an intriguing investment opportunity for those looking to achieve higher yields compared to standard deposits. By embedding a foreign exchange (FX) option, DCDs provide enhanced returns but also introduce significant currency risk.

Investors must be aware that while they can benefit from favorable exchange rate movements, they also face the possibility of being repaid in a less favorable currency, potentially resulting in a loss. Understanding the mechanics and risks involved in DCDs is crucial for making informed investment decisions. As with any financial product, it is essential to weigh the potential rewards against the risks and consider one’s risk tolerance and investment goals. If you want to learn more about sales and trading take our courses

Download the free Financial Edge one-page guide to Structured Financial Products.