new year, new skills – save 40% on all online courses

Margin Call

October 17, 2025

What is a Margin Call?

A margin call is a term that is typically used in leveraged finance and refers to the demand from a broker for additional funds. This usually occurs when the equity in a margin account falls below the required maintenance level.

As using leverage requires borrowing capital to increase market exposure by pledging existing securities as collateral, its primary objective is to enhance returns. However, it also significantly elevates the level of risk and magnifies losses. Should the decline in asset value be so large that it reduces the account equity to a degree that it breaches the maintenance margin threshold, then a margin call is issued. As a result, the investor will be required to top up their account, or the positions will be liquidated.

Key Learning Points

- A margin call occurs when the equity in a margin account drops below the broker’s maintenance requirement.

- A margin call requires the investor’s immediate action in order to avoid forced liquidation

- Margin calls can be a result of a decline in the value of the portfolio, the use of excessive leverage or high levels of market volatility

- Investors must typically take action and deposit cash, transfer marginable securities, or liquidate/sell existing holdings

- Margin calls can crystallize losses at unfavourable prices and therefore disrupt investor’s long-term planning

- To avoid a margin call, investors are advised to prudently monitor the levels of leverage they use and maintain liquidity buffers

What Triggers a Margin Call?

A margin call could be triggered by several specific events that lead to the value of all securities in the investor’s account (less than the outstanding borrowed amount) to fall below the maintenance margin requirement. This is determined as a percentage of the current market value of all securities in the account that must be maintained as a cushion.

Examples of such triggers include:

Adverse Market Conditions and Sharp Price Movements

In such instances, the investor’s equity drops in line with the decline in the value of the securities. Should the value of the assets go below the maintenance requirement, a margin call is issued.

Increase in Margin Requirements

This often happens during periods of higher market volatility. This is when brokers can up the maintenance margin levels for either individual securities or portfolios. Even if there are no price movements, the new requirement can cause equity to fall short of it.

High Leverage or Portfolio Concentration

The use of large, borrowed amounts (i.e. high loan-to-value) or holding a concentrated portfolio of highly volatile securities can magnify the sensitivity to adverse price movements. As a result, even a small decline in value can easily breach the maintenance threshold.

Regulatory Requirements and Margin Calls

Due to the high level of risk that leverage brings, regulators impose various requirements to ensure a baseline level of protection. For example, under the Financial Industry Regulatory Authority’s (FINRA) rules in the US, the maintenance margin for many equity securities is at least 25% of the current market value (Finra.org). However, in practice most firms implement even stricter requirements that can relate to either the total portfolio or individual positions. For example, imposing higher maintenance margins on volatile or thinly traded securities could help brokers manage counterparty exposure or reduce the likelihood of forced liquidations.

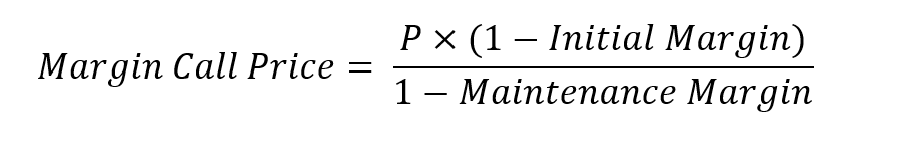

Formula for Margin Call Price

The price of a margin call represents the stock price at which the investor’s equity falls to the maintenance margin requirement.

This is calculated as per the formula below:

Where:

- P = the initial price at which the security was purchased

- Initial Margin = the fraction of the purchase that was paid with the investor’s own funds

- Maintenance Margin = the minimum equity fraction required to avoid a margin call

How to Calculate a Margin Call?

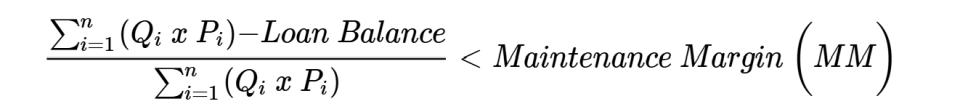

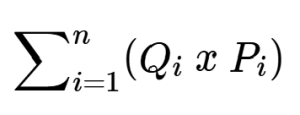

While we already described the standard single-security formula for a margin call price, in reality, investors would hold multiple securities in their portfolio. A margin call would occur when:

To put this into mathematical perspective, we need to apply the below formula:

Where:

- Equity = Market Value – Loan Balance

- Market Value (MV) =

- Qi = number of shares of security i

- Pi = the price of security i

- Loan Balance = the initial borrowing

Example of a Margin Call

Here is an example of a margin call using a portfolio of multiple securities. Download the free Financial Edge template and complete the calculations in Excel.

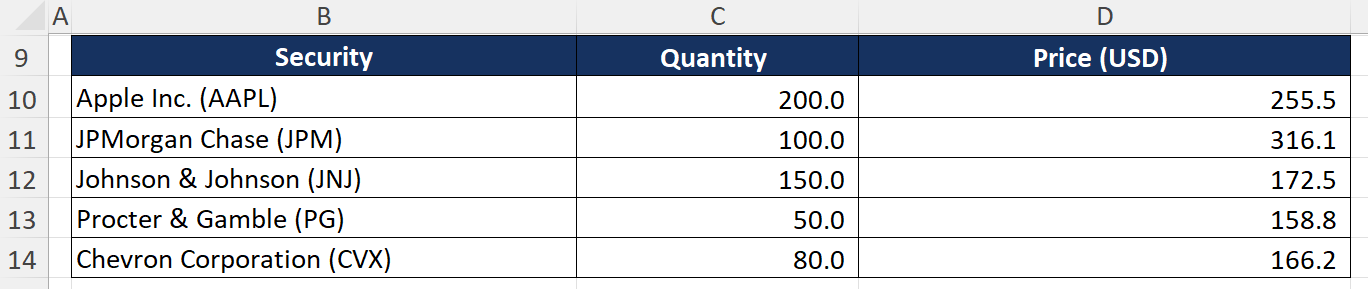

An investor is holding five different securities in a portfolio as shown below:

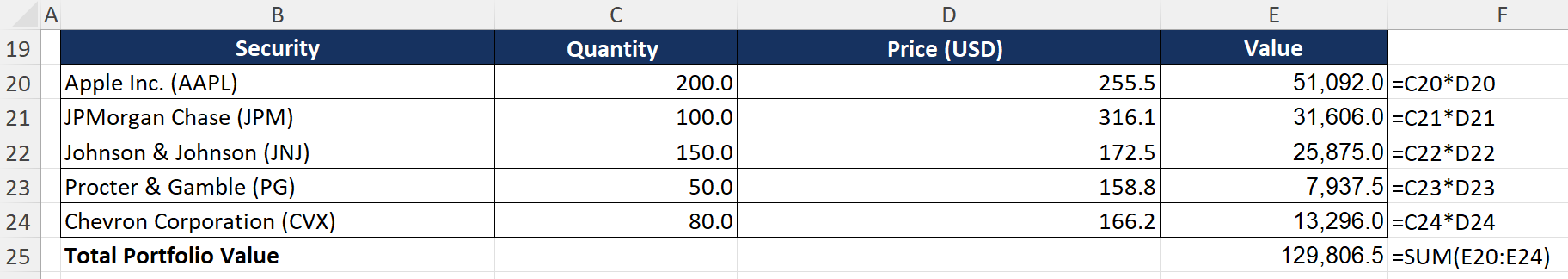

To see if a margin call is required, we can calculate the total value of the portfolio and then consider it against the margin maintenance requirements. This portfolio has a loan balance of $100,000.

To do this, we need to first calculate the value of the portfolio based on the prices and quantities provided.

We have been told that there is a margin maintenance level of 30% so we must calculate whether this has been exceeded using the calculations shown below:

In this instance, based on the current portfolio value, a margin call will be triggered.

How to Cover a Margin Call?

To cover a margin call, investors are required to restore their account’s equity to their broker’s maintenance margin requirement. Typically, there are three primary choices that investors have when a margin call is triggered.

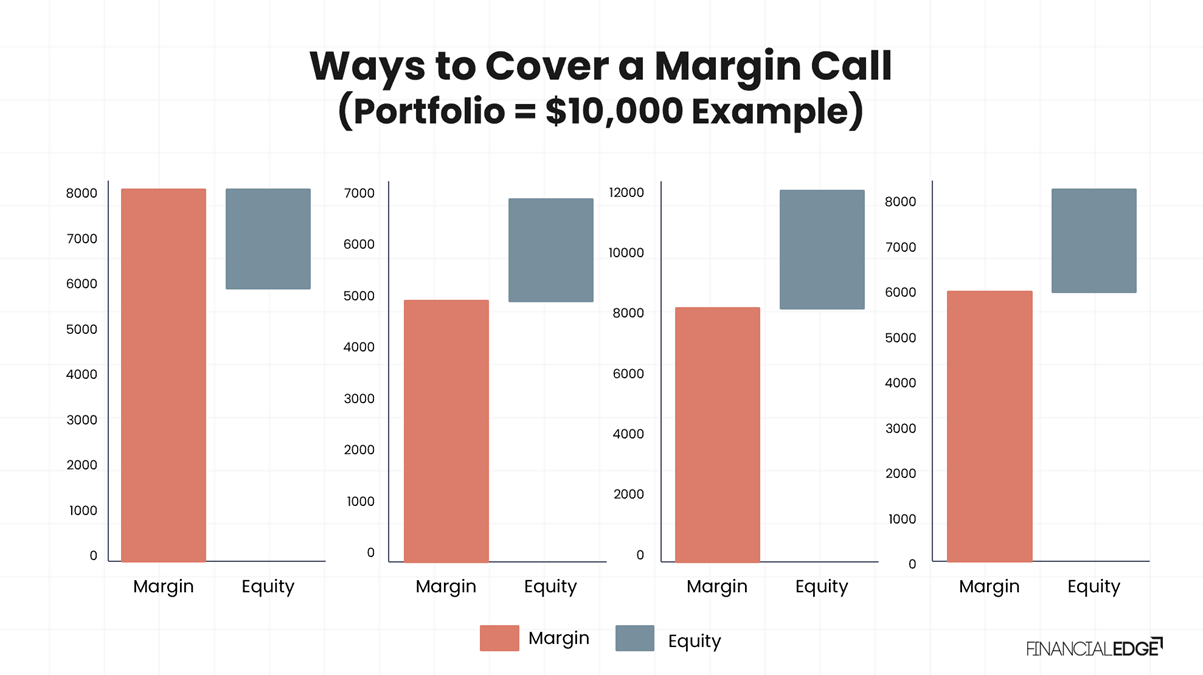

We explore them in the chart below:

In this example, the investor’s portfolio is modelled at an initial value of $10,000. After experiencing losses, the equity falls below the maintenance margin, and a margin call is issued. The three primary options that the investor has are:

- Option A – liquidating positions would lower the loan balance and bring it within the maintenance margin

- Option B – depositing cash/securities to boost the portfolio would restore compliance

- Option C – a combination of partial repayment and added equity together, would keep the portfolio within the margin requirements

How to Avoid a Margin Call?

To avoid a margin call, investors must maintain an adequate level of equity and diligently manage their leverage. This can be tricky to manage when markets are volatile.

Avoid Excessive Leverage: Avoiding the use of excessive leverage could be key – borrowing conservatively can create a buffer that reduces the probability of breaching maintenance levels, specifically in normal market conditions.

Maintain a Cash Reserve: alternatively, maintaining a cash reserve or liquid securities in the account could create a cushion that allows investors to absorb the negative effect of adverse price movements.

Portfolio diversification: This could also reduce the risk of a single security declining disproportionately.

Stop-loss orders or options hedges: these can also be deployed to limit downside exposure. Nevertheless, these tools may also cap upside potential

Conclusion

In conclusion, a margin call underscores the double-edged nature of leveraged investing; it could amplify gains, but on the other hand it could also magnify losses. To avoid the latter, investors should follow a disciplined approach by using leverage conservatively. It is also prudent to maintain liquidity buffers. Diligent monitoring and management could also prevent investors from forced selling and preserve their long-term investment strategy.