Exit Cap Rate Vs. Going Cap Rate

August 13, 2025

What are Cap Rates?

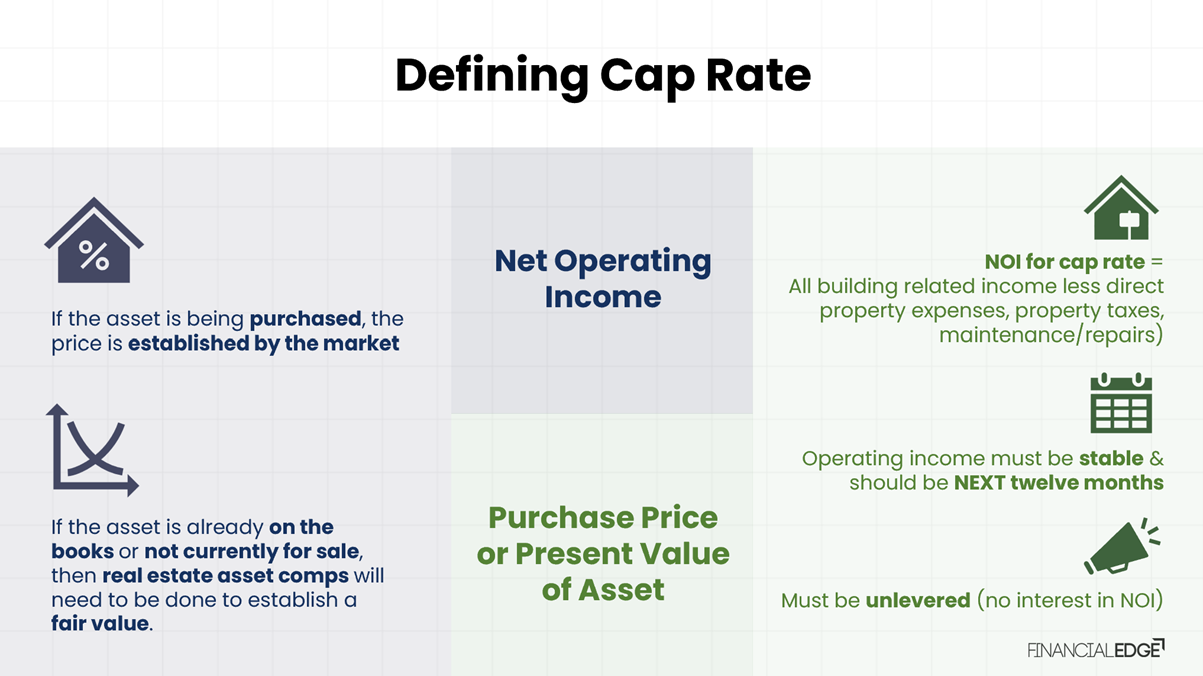

Cap rates or capitalization rates are critical metrics used in evaluating new opportunities in real estate. They represent the return expected on a property, expressed as a percentage of the expected or forward net operating income from that asset over the purchase price or present market value of the asset.

The cap rate is calculated using net operating income (NOI), which includes all building-related income minus direct property expenses, property taxes, maintenance, repairs, etc. The cash flows used in this calculation must be unlevered, meaning they should not be affected by the current or proposed financing of the building. In Europe, this is referred to as the yield, but it does not represent the investor yield in the same way as an internal rate of return (IRR) does.

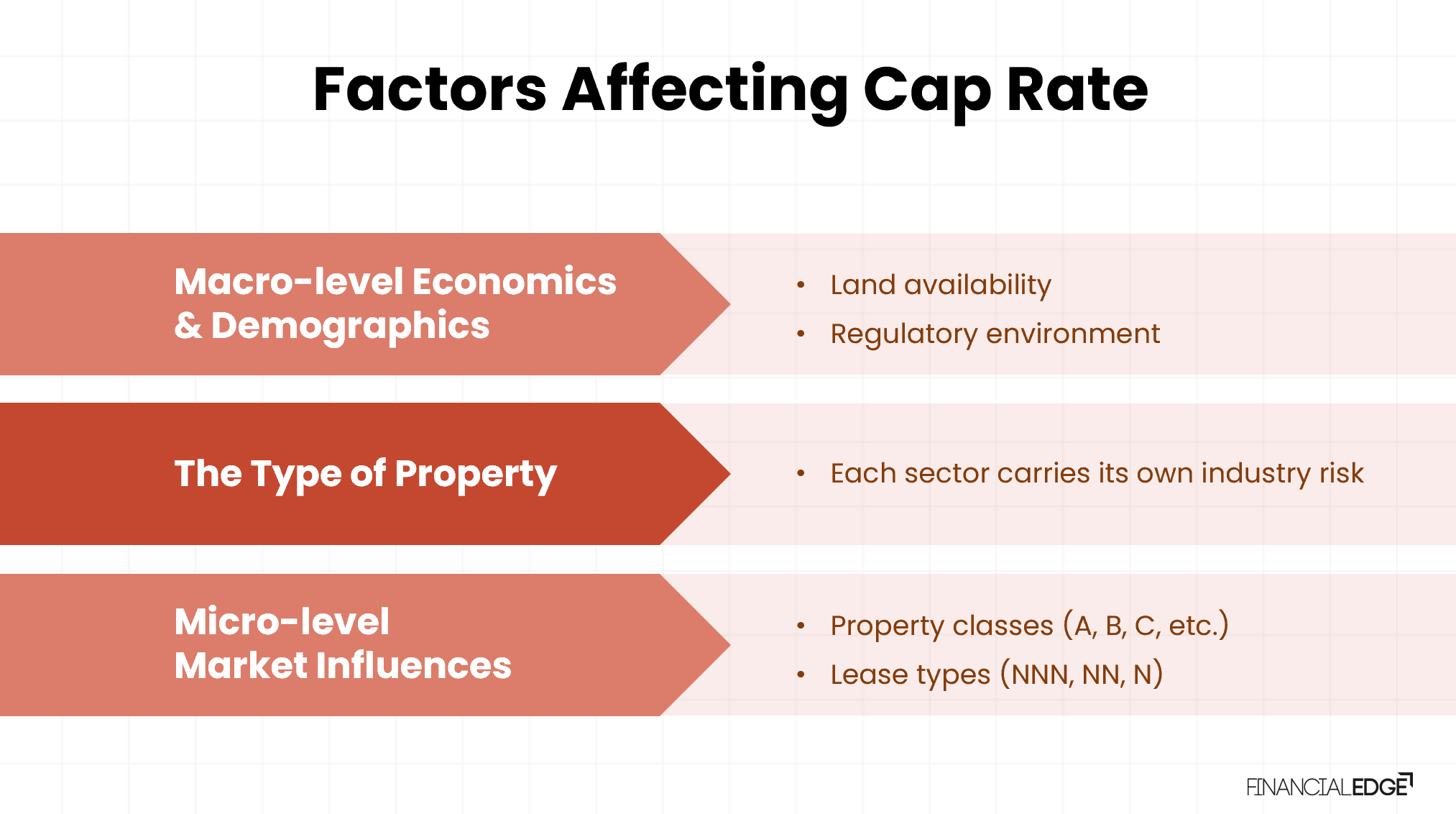

A high cap rate indicates a higher initial return on the property, while a low cap rate indicates a lower initial return. Cap rates are typically expressed as a percentage. Cap rates are influenced by various factors, including market conditions, property type, and location. They act similarly to the cost of capital, reflecting the risk of the overall building.

What is a Going-In Cap Rate?

A going-in cap rate is the cap rate on acquisition. It is the initial return expected on a property, expressed as a percentage of the expected or forward net operating income from that asset over the purchase price or present market value of the asset.

If a potential investment had a going-in cap rate of 5.5% it would suggest that the property would deliver a 5.5% return on the initial investment (before financing costs).

What is an Exit Cap Rate?

The exit cap rate is the cap rate on exit, which is the expected return on a property at the time of sale. It is used to estimate the resale value of a property at the end of the holding period and is a forward-looking cap rate.

Key Learning Points

- Cap rates, or capitalization rates, are critical metrics used in evaluating new opportunities in real estate

- There are various types of cap rates, including going-in cap rate, exit cap rate, stabilized cap rate, development cap rate, and reversionary cap rate.

- Each type serves a different purpose and is calculated at different stages of the investment cycle

- The going-in cap rate represents the initial return expected on a property at the time of acquisition, while the exit cap rate is the expected return at the time of sale

- The going-in cap rate is calculated by dividing the projected first-year net operating income (NOI) by the purchase price or total project cost

- The exit cap rate is calculated by dividing the expected NOI at exit by the terminal value

Types of Cap Rates

Let’s look at each type of cap rate in turn:

Going-In Cap Rate

The going-in cap rate is the cap rate on acquisition. It represents the initial return expected on a property, expressed as a percentage of the expected or forward net operating income from that asset over the purchase price or present market value of the asset.

Exit Cap Rate

The exit cap rate is the cap rate on exit, which is the expected return on a property at the time of sale. It is used to estimate the resale value of a property at the end of the holding period and is also known as the terminal cap rate. It is essentially a calculated estimate of the property’s future yield after a point in time when it is sold.

Stabilized Cap Rate

A stabilized cap rate is used for properties that have reached a stable level of occupancy and income. It reflects the return on a property once it has been stabilized and is generating consistent income for the investors.

Development Cap Rate

A development cap rate is used for properties that are under development or redevelopment. It reflects the expected return on a property once the development is completed and the property is generating income.

Reversionary Cap Rate

A reversionary cap rate is used to estimate the future value of a property based on its expected income at the end of the holding period. It is similar to the exit cap rate but focuses on the property’s future income potential.

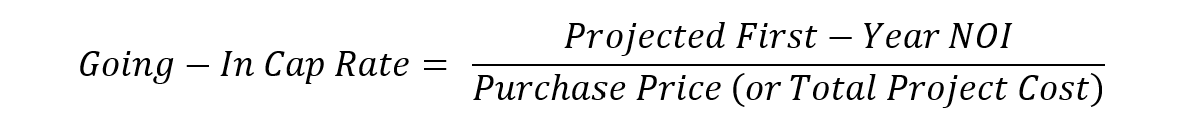

Going-In Cap Rate Formula

The going-in cap rate formula is used to calculate the initial return expected on a property. It is expressed as a percentage of the expected or forward net operating income from that asset over the purchase price or present market value of the asset.

Going-in Cap Rate = Projected First-Year NOI / Purchase Price (or Total Project Cost)

How to Calculate Going-In Cap Rate

To calculate the going-in cap rate, you need to follow these steps:

Calculate the total income generated by the property, including rental revenue and other income sources like parking lot revenue, minus any vacancy and collection losses.

This is calculated by taking the effective gross income and subtracting operating expenses, property taxes, and management fees. Interest on loans is not included as it is not an operating expense.

Once you have the stabilized net operating income, you divide it by the purchase price of the property to get the cap rate.

For example, if the net operating income is $2.58m and the purchase price is the office building’s asking price of $35m, the cap rate would be 7.37%.

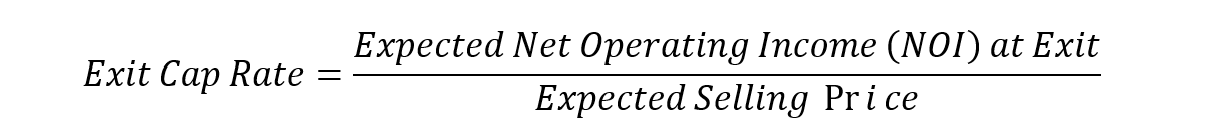

Exit Cap Rate Formula

This is the formula for the exit cap rate:

Exit Cap Rate = Expected Net Operating Income (NOI) at Exit / Expected Selling Price

How to Calculate Exit Cap Rate

To calculate the Exit Cap Rate, you need to follow these steps:

1. Commercial Real Estate (CRE) Building Assumptions

This involves making assumptions about the future performance of the property, including rental income, operating expenses, and market conditions. These assumptions will need to be used in the calculations.

2. Terminal Value Calculation Example (Sale Price)

The terminal value is calculated by dividing the stabilized net operating income (NOI) at the end of the holding period by the exit cap rate.

For example, if the NOI is 300 and the exit cap rate is 6%, the terminal value would be 300 / 0.06 = 5000.

3. Exit Cap Rate Calculation Example

Once you have the terminal value, you can calculate the exit cap rate by dividing the NOI by the terminal value.

For example, if the NOI is 300 and the terminal value is 5000, the exit cap rate would be 300 / 5000 = 6%.

Download the free Financial Edge template to calculate a real-life cap rate example

Exit Cap Rate vs. Entry Cap Rate: What is the Difference?

When comparing exit cap rate vs. entry cap rate, the entry cap rate (or going-in cap rate) is the initial return expected on a property at the time of acquisition, while the exit cap rate is the expected return at the time of sale. The difference between the two can indicate the expected change in property value and market conditions over the holding period.

How to Project Cap Rates

To project cap rates, you need to consider factors such as market trends, property performance, and economic conditions. This involves analyzing historical data, making assumptions about future performance, and using financial models to estimate future cap rates.

Exit Cap Rate vs. Going Cap Rate

The exit cap rate and the going-in cap rate are both important metrics used in real estate investing, but they serve different purposes and are calculated at different stages of the investment cycle.

The going-in cap rate is the cap rate on acquisition. It represents the initial return expected on a property, expressed as a percentage of the expected or forward net operating income from that asset over the purchase price or present market value of the asset. This metric helps investors evaluate new opportunities by providing a yield ratio, which can be inverted to understand the relationship between the value and the earnings of the property.

On the other hand, the exit cap rate is the cap rate on exit, which is the expected return on a property at the time of sale. It is used to estimate the resale value of a property at the end of the holding period 1. The exit cap rate is calculated by dividing the stabilized net operating income (NOI) at the end of the holding period by the terminal value.

The going-in cap rate is used to assess the initial return on a property at the time of acquisition, while the exit cap rate is used to estimate the return at the time of sale. The difference between the two can indicate the expected change in property value and market conditions over the holding period.

Conclusion

The going-in cap rate represents the initial return expected on a property at the time of acquisition, calculated by dividing the projected first-year net operating income (NOI) by the purchase price or total project cost. It helps investors evaluate new opportunities by providing a yield ratio.

The exit cap rate, on the other hand, is the expected return on a property at the time of sale. It is used to estimate the resale value of a property at the end of the holding period and is calculated by dividing the stabilized NOI at the end of the holding period by the terminal value. This metric helps investors understand the potential future value of the property and the expected market conditions at the time of sale.

By comparing the going-in cap rate and the exit cap rate, investors can gain insights into the expected change in property value and market conditions over the holding period. A higher exit cap rate compared to the going-in cap rate may indicate a decrease in property value or a less favorable market. A lower exit cap rate may suggest an increase in property value or more favorable market conditions.