Beta

August 15, 2025

What is Beta?

Beta is a measure of the relationship between the rate of return of a company’s stock and the overall market return. It compares the volatility of a specific stock relative to the market. A beta will indicate how an asset’s value has reacted to either a movement up or a movement down in the market.

Beta is a theoretical measure of systematic risk, or the risk that applies to the entire market and cannot be diversified away. The beta of the market is always since this is measuring the volatility of the market relative to itself. A stock more volatile than the market average will have a beta greater than 1, while a less volatile stock will have a beta of below.

Key Learning Points

- Beta is a theoretical measure of systematic risk or the risk that applies to the entire market and cannot be diversified away

- A beta greater than 1 indicates that an investment has a higher systematic risk than the market

- A beta of below 1 indicates that an investment has a lower systematic risk than the market

- Companies with greater predictability in their earnings and dividends tend to have lower beta values – such as utilities, and food retail

- Beta is used in the Capital Asset Pricing Model (CAPM), and is used to calculate the cost of equity of an asset

- Regression analysis is the most common and practical method for estimating beta for listed companies

Beta & Systematic Risk Explained

Systematic Risk

Systematic risk, or market risk, is a risk that cannot be avoided at the firm level and is inherent in the overall market. It includes risk factors that impact the market as a whole. For investors it is non-diversifiable within a portfolio and all firms in the market are exposed to it. Factors constituting systematic risk include interest rates, economic cycles, natural disasters/pandemics, currency fluctuations, and inflation.

Unsystematic Risk

Unsystematic risk refers to the risks inherent in a specific company or an industry. It can potentially be avoided through diversification.

Capital Asset Pricing Model (CAPM)

Beta is an important component within the Capital Asset Pricing Model (CAPM). CAPM is an asset pricing model that explains the relationship between the expected return investment and the risk for a specific security. It is based on the assumption that only systematic risk should affect asset prices.

Beta & Systematic Risk

Beta measures systematic risk only and not unsystematic risk. For example, positive macro events such as economic booms are likely to result in greater gains for all companies. Likewise, negative macro events such as pandemics or natural disasters are likely to result in reduced gains for all companies.

A beta greater than 1 indicates that an investment has higher systematic risk than the market. It also indicates that the investment is likely to generate higher returns than the benchmark index in an up-market scenario. In comparison, the investment is also likely to deliver greater losses than the benchmark index in a down-market scenario.

Example Beta in Action

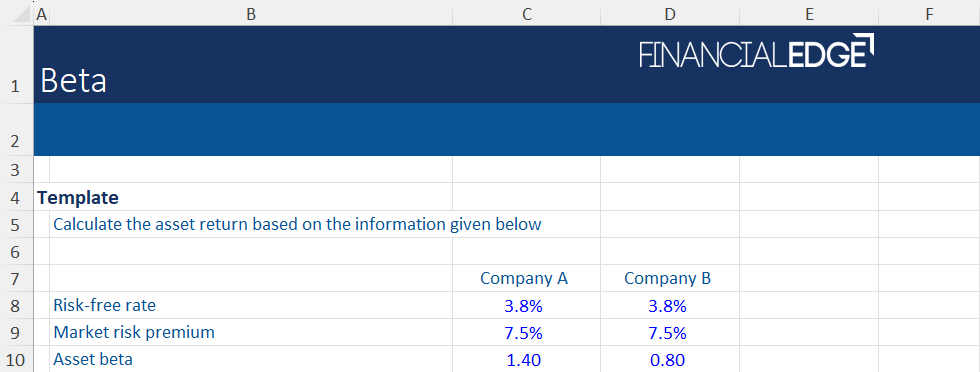

Let’s use the following information about two companies to further investigate beta. Download the free Financial Edge excel template to do the beta calculations yourself.

- Company A is a relatively smaller company that is more sensitive to economic fluctuations

- Company B is a larger company with more predictable earnings and dividends

We are asked to calculate the expected returns on the stocks of these two companies.

Company A has a higher beta of 1.4, indicating a higher systematic risk than the market. Company B has a lower asset beta of 0.8, indicating a lower systematic risk than the market.

Using CAPM, we get the following as expected returns on these two assets.

All things being equal, in an up-market scenario company A is likely to give a higher expected return as it has a higher beta. However, if the market were to go down, company A is likely to result in bigger losses for investors since it has a higher beta.

Companies with lower beta (such as company B) tend to underperform in bull market scenarios. However, they tend to perform better (or, at least, less bad) in a falling market. Insurance stocks, utilities, and food retail are examples of industries with lower beta values.

Regression Analysis

Regression analysis is the most common and practical method for estimating beta. The beta for any asset can be estimated by regressing the returns of that asset against the returns of the index chosen to represent the market portfolio. The slope of the linear regression is the beta of the security.

Slope Function

Beta calculations can also be carried out in Excel using the ‘slope’ function. In Excel, the SLOPE function is used to calculate the slope of the linear regression line through a set of data points. The formula for the slope function is:

=SLOPE(known_y’s, known_x’s)

Where:

- Known_y’s: the dependent data range (e.g. asset returns)

- Known_x’s: the independent data range (e.g. market returns)

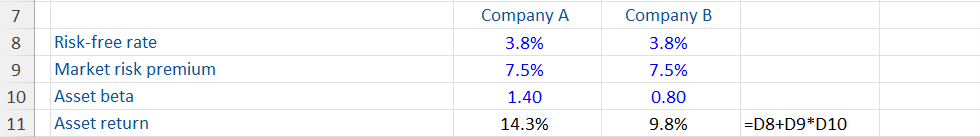

Beta Example

Here is an example of the beta for a list of US food production companies.

Taking the example of the Kellogg Company shown in the above graph, the returns from the market are shown on the horizontal axis and Kellogg’s returns on the vertical axis. Each blue diamond represents the return on the market and Kellogg’s for a particular period of time and the linear regression analysis then identifies the line of best fit all of the data points.

The slope (or gradient) of that line is the beta. The slope represents the level of movement in returns of a given security (in this case, Kellogg’s share price) for each unit of movement in the market.

In this case, the gradient is 0.55367, which means that for every 1% increase in the returns on the market, it would be expected that Kellogg’s would generate an extra 0.55367% return

Another way of looking at this is that, if the market returns are 7.0%, it would be expected that Kellogg’s would generate returns of around 4.0% (0.5537 x 7% + 0). If the market return is negative 3.0%, this analysis would suggest a Kellogg’s return of close to 2.0% (0.5537 x -3% + 0).

Generally, large brands (such as the Hershey Company) with greater predictability in their earnings tend to have lower beta values. Lesser-known brands are showing higher beta values as they typically have lower market share and less value.

Historical Betas by Sector

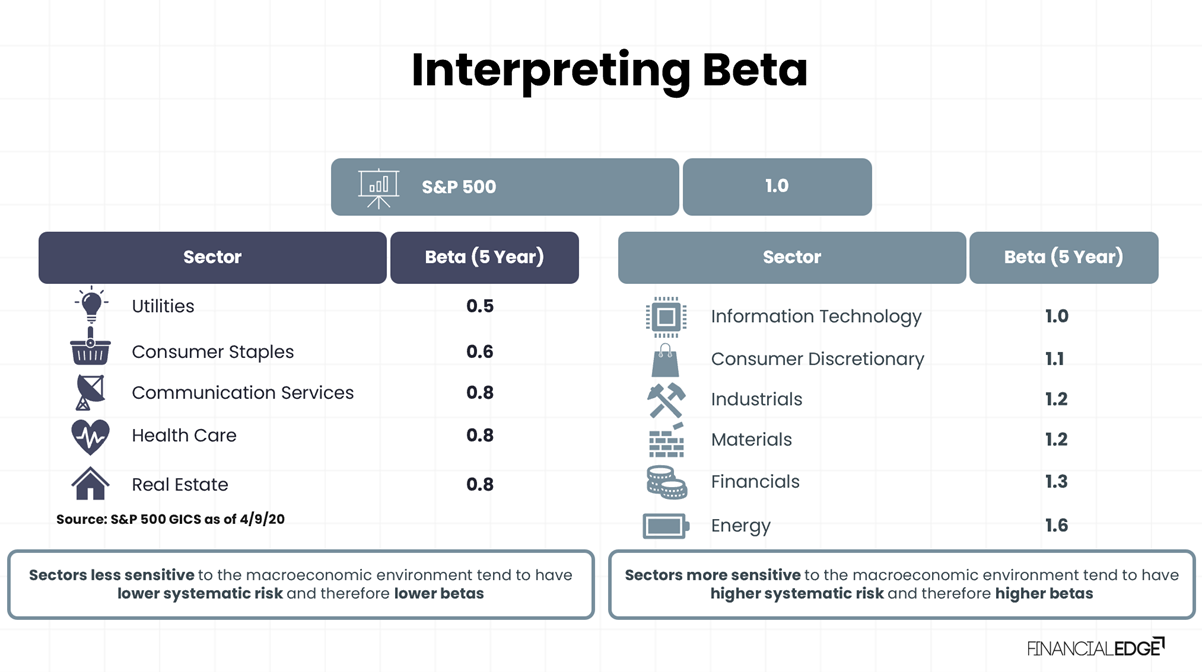

Here is a display of historical betas by sector. Beta measures sensitivity to the market in broad market factors, not total variation. Sectors that are less sensitive to the macroeconomic environment tend to have lower systematic risk and therefore lower betas.

Sectors that are more sensitive to the macroeconomic environment tend to have higher systematic risk and therefore higher betas.

Low Beta Stocks

Lower Beta sectors that are generally less volatile and less sensitive to macroeconomic changes include utilities, consumer staples, communication services, health care, and real estate.

High Beta Stocks

Higher Beta sectors tend to be more volatile and more responsive to economic shifts, and include information technology, consumer discretionary, industrials, materials, financials, energy. Consumption of non-essential goods such as white goods, technology and other items tend to slow down during economic downturns.

The opposite is true in times of economic prosperity when consumers can have a higher disposable income. Thus, the companies which manufacture or sell these goods (or services related to them) tend to have stock prices which are more volatile during times of change.

Conclusion

Understanding beta and its implications is crucial for investors and financial analysts. Beta measures the systematic risk of a stock in relation to the market, providing insights into the stock’s volatility and potential returns.

By incorporating beta into the Capital Asset Pricing Model (CAPM), investors can estimate the cost of equity and make informed investment decisions. Regression analysis, as a practical method for estimating beta, further enhances the accuracy of these calculations.

Ultimately, a thorough grasp of beta, systematic risk, and related concepts empowers investors to navigate the complexities of the financial market and optimize their investment strategies.