Deferred Tax Asset

August 6, 2025

What Is a Deferred Tax Asset?

A deferred tax asset arises when a company pays more tax upfront than the accounting expense suggests. The overpayment is considered a prepaid tax asset, which will provide a future economic benefit to the company. The opposite of a deferred tax asset is a deferred tax liability.

Key Learning Points

- A deferred tax asset arises when a company overpays taxes or pays taxes in advance, leading to future tax benefits

- Deferred tax assets are typically presented as non-current assets on the balance sheet

- Deferred tax assets are recognized when it is probable that future taxable profits will be available against which the temporary differences can be utilized

- A deferred tax liability occurs when a company underpays taxes due to temporary differences, resulting in future tax obligations

Deferred Tax Asset Accounting

A deferred tax asset arises when a company pays more tax upfront than the accounting expense suggests, leading to future tax benefits. This overpayment is considered a prepaid tax asset, which will provide future economic benefits. This needs to be recorded on the balance sheet. Eventually, the overpayment will be netted off or returned to the company in a form of tax relief.

Deferred Tax Asset in Balance Sheet

Deferred tax assets are typically presented as non-current assets on the balance sheet. They cannot be recognized on the income statement as it is still waiting to be used. They represent future tax benefits that will be realized when the temporary differences reverse. For example, deferred tax assets can be seen in the balance sheet under long-term assets.

Recognition Of Deferred Tax Asset

Deferred tax assets are recognized when it is probable that future taxable profits will be available against which the temporary differences can be utilized. This recognition is based on the expectation of future profitability and the ability to utilize the tax benefits.

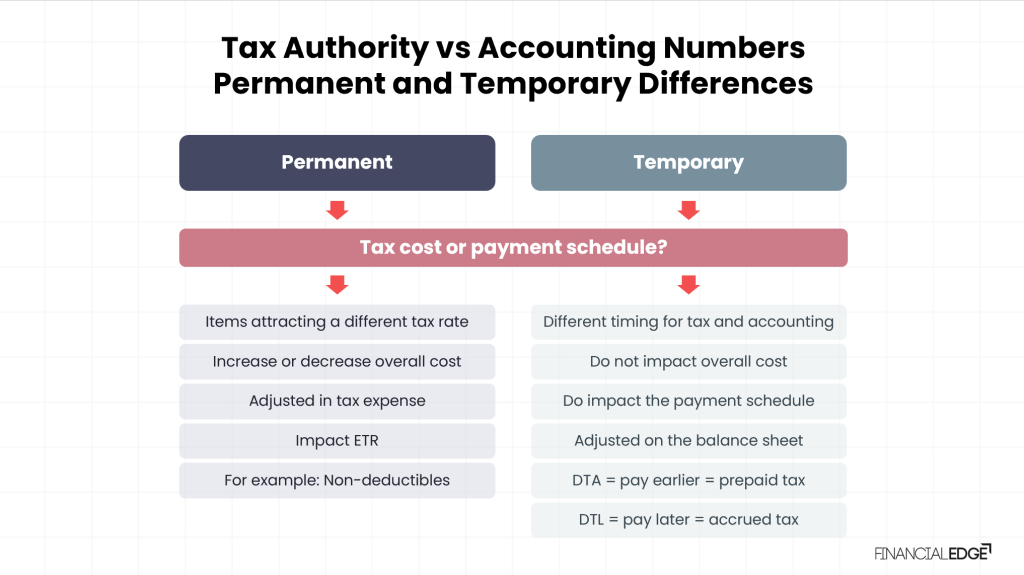

Deferred Tax Asset Vs. Deferred Tax Liability

A deferred tax asset arises when a company overpays taxes or pays taxes in advance, leading to future tax benefits. In contrast, a deferred tax liability occurs when a company underpays taxes due to temporary differences, resulting in future tax obligations. This over or underpayment needs to be stated on the balance sheet.

Deferred Tax Asset Examples

Common examples of deferred tax assets include carry-forward losses, pension and post-retirement benefits, and stock-based compensation. These items create future tax benefits that are recognized as deferred tax assets.

Temporary Differences in Accounting

Temporary differences in accounting arise when there are discrepancies between the tax base of an asset or liability and it’s carrying amount in the financial statements. These differences occur due to the different timing of recognition for tax and accounting purposes.

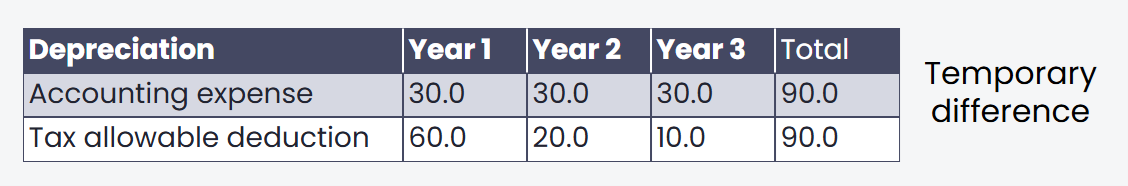

Temporary differences are primarily due to the different timing of expense recognition between tax authorities and accounting standards. For example, depreciation expense might be spread evenly over three years for accounting purposes, while the tax allowable deduction for depreciation might be front-loaded or accelerated.

These differences do not affect the overall cost but do impact the payment schedule. For instance, if the tax authorities allow a higher expense in the first year, it reduces taxable profits and thus the tax paid in that year. Conversely, the accounting expense might be lower initially, leading to higher taxable profits and tax payments.

The adjustment for temporary differences is made on the balance sheet through the creation of deferred tax assets and liabilities. This reconciliation ensures that the tax expense in the financial statements aligns with the tax payable calculated by the tax authorities.

Examples of Temporary Differences

Depreciation

Different methods of depreciation for tax and accounting purposes can create temporary differences. For instance, accelerated depreciation for tax purposes versus straight-line depreciation for accounting purposes.

Companies set their own accounting policies, which may not always be in line with the tax authority in that jurisdiction.

Revenue Recognition

Differences in the timing of revenue recognition between tax and accounting standards can also create temporary differences. This can also be industry specific as there can be longer lead times for payments and services. For example, airline tickets can be booked up to a year in advance, but the revenue is not recognized until the flight takes place.

Causes Of Deferred Tax Liability

Deferred tax liability is caused by temporary differences between the tax base and the carrying amount of assets and liabilities. Common causes include asset step-ups during acquisitions, differences in depreciation methods, and recognition of internally generated intangibles.

Deferred Tax Liability Journal Entry

To record a deferred tax liability, the company would debit the tax expense account and credit the deferred tax liability account. This entry recognizes the future tax obligation arising from temporary differences.

Deferred Tax Asset Vs. Liability

A deferred tax asset (DTA) arises when a company overpays taxes or pays taxes in advance, leading to future tax benefits. In contrast, a deferred tax liability (DTL) occurs when a company underpays taxes due to temporary differences, resulting in future tax obligations.

How To Calculate Deferred Tax Liability

To calculate deferred tax liability, identify the temporary differences between the tax base and the carrying amount of assets and liabilities. Multiply these differences by the applicable tax rate to determine the deferred tax liability.

Deferred Tax Calculation

Deferred tax calculation involves identifying temporary differences between the tax base and the carrying amount of assets and liabilities. These differences are then multiplied by the applicable tax rate to determine the deferred tax liability or asset.

Step-by-Step Deferred Tax Calculation

Firstly, we need to identify any temporary differences which arise when there is a discrepancy between the tax base of an asset or liability and it’s carrying amount in the financial statements.

These differences can be due to various reasons such as different depreciation methods for tax and accounting purposes, asset step-ups during acquisitions, or recognition of internally generated intangibles.

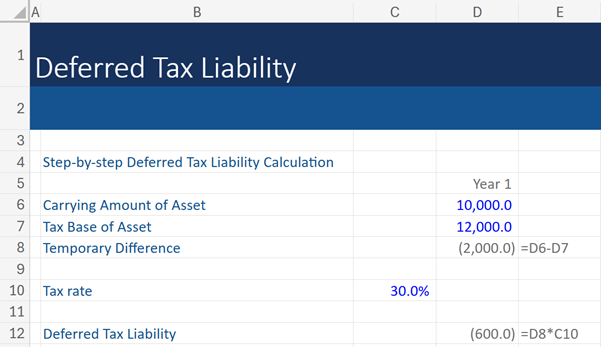

Here are the steps to follow to calculate the deferred tax liability using the example below:

Step 1: Calculate the Tax Base

The tax base of an asset or liability is the amount attributed to that asset or liability for tax purposes. For example, if an asset’s carrying amount is higher than its tax base due to a step-up in value, the tax base will be lower.

Step 2: Determine the Carrying Amount

The carrying amount is the value of the asset or liability as reported in the financial statements. This amount may differ from the tax base due to various accounting adjustments. In this example it is $10,000.

Step 3: Compute the Temporary Difference

The temporary difference is calculated by subtracting the tax base from the carrying amount of the asset or liability. For example, if the carrying amount of an asset is $10,000 and the tax base of the asset is $12,000, the temporary difference is $2,000.

Step 4: Apply the Tax Rate

Multiply the temporary difference by the applicable tax rate to determine the deferred tax liability or asset. For instance, if the tax rate is 30%, the deferred tax liability for a $2,000 temporary difference would be $600.

Download the free Financial Edge template to follow this calculation in excel.

Deferred Tax Liability IFRS Vs. GAAP

Both IFRS and GAAP require the recognition of deferred tax liabilities for taxable temporary differences. However, there may be differences in the specific rules and calculations under each standard. Analysts must check this and adhere to the appropriate rules.

Deferred Tax in Financial Statements

Deferred tax liabilities are presented as non-current liabilities in the financial statements. They represent future tax obligations arising from temporary differences between the tax base and the carrying amount of assets and liabilities.

Tax Base Vs. Carrying Amount

The tax base of an asset or liability is the amount attributed to that asset or liability for tax purposes. The carrying amount is the value of the asset or liability as reported in the financial statements. Differences between these two amounts lead to the creation of deferred tax assets or liabilities.

Recognition and Derecognition: Is Deferred Tax Debt or Working Capital?

Deferred tax is not considered working capital. Working capital typically includes current assets and current liabilities that are used in the day-to-day operations of a business. Deferred tax, on the other hand, represents future tax obligations or benefits arising from temporary differences between the tax base and the carrying amount of assets and liabilities.

Are Deferred Taxes a Debt-like Item?

Deferred taxes can be considered a debt-like item because they represent future tax obligations that the company will need to settle. However, they are not classified as traditional debt since they do not involve a contractual obligation to pay a fixed amount of money. Instead, they arise from temporary differences between the tax base and the carrying amount of assets and liabilities.

Is Deferred Tax Liability in Net Debt?

Deferred tax liabilities are not typically included in net debt calculations. Net debt usually comprises interest-bearing liabilities such as loans and bonds, minus cash and cash equivalents. Deferred tax liabilities, while representing future tax obligations, do not bear interest and are therefore not included in net debt.

Conclusion

Deferred tax liabilities represent future tax obligations arising from temporary differences between the tax base and the carrying amount of assets and liabilities. These liabilities are typically presented as non-current liabilities on the balance sheet and are caused by discrepancies in the timing of expense recognition between tax authorities and accounting standards.

Understanding and accurately accounting for a DTL is crucial for financial reporting, as it ensures that the tax expense in the financial statements aligns with the tax payable calculated by the tax authorities. Proper management of deferred tax liabilities can help companies better anticipate future tax payments and maintain a clear and accurate financial position.