90-Minute LBO Modeling Test

February 11, 2026

The LBO modeling test is the most important technical assessment in a private equity interview. By the time candidates reach this stage, firms are no longer evaluating whether they understand leverage or valuation in theory. Instead, they are testing whether a candidate can execute a real buyout model under time pressure, follow instructions precisely, and produce correct, auditable returns.

This article explains how the 90-minute LBO modeling test fits into the private equity recruiting process, the types of LBO tests candidates encounter, how these tests are graded in practice, and the key differences between basic and standard-level cases. The second half of the article walks through a standard 90-minute LBO modeling test, using an interview-style prompt and embedded build guidance.

Structure of the Private Equity Interview

Private equity interviews typically progress through several stages. Early rounds focus on background, deal experience, and technical fundamentals. As the process advances, interviews become increasingly applied, typically culminating in a timed LBO modeling test.

During the 90-minute LBO modeling test, firms assume candidates already understand LBO mechanics conceptually. The modeling test exists to evaluate execution: structuring a clean model, handling debt and cash flow correctly, and translating operating performance into sponsor returns.

Types of LBO Modeling Tests

LBO modeling tests generally fall into three categories:

- Paper LBOs, used early in the process to test intuition

- Basic Excel LBO tests (45–60 minutes), with simplified assumptions and limited debt

- Standard Excel LBO tests (90 minutes), which replicate real deal complexity

The case used in this article reflects a standard 90-minute LBO modeling test, consistent with associate-level interviews at middle-market and upper-middle-market private equity firms.

Where the Modeling Test Fits in the PE Recruiting Process

The LBO modeling test is usually administered in the final or penultimate interview round. At this stage, most candidates have similar resumes, often with investment banking or prior buy-side experience.

Because differentiation in candidates’ backgrounds is limited, the modeling test acts as a filter. Firms use it to assess whether a candidate can be trusted to build, audit, and explain models that inform real investment decisions.

How a 90-Minute LBO Modeling Test Is Graded

Despite the apparent complexity of these tests, grading is typically pragmatic and consistent across firms. Interviewers focus on four core areas:

- Structural correctness

Examples of structural correctness include ensuring that the sources and uses are balanced, debt rolls forward appropriately, and exit equity reconciles to enterprise value minus net debt.

- Instruction discipline

Candidates are expected to follow the prompt exactly. Prepaying debt without optionality, ignoring PIK accretion, or misapplying fees are common reasons models are downgraded.

- Return accuracy

IRR and MOIC must be calculated correctly based on sponsor cash flows, not total equity or enterprise value.

- Auditability and clarity

Inputs should be clearly separated from calculations, with consistent sign conventions and a logical build order.

A simple, correct, and explainable model consistently scores higher than an overbuilt complex model with errors.

Basic vs. Standard LBO Modeling Tests: Key Differences

A basic LBO modeling test typically includes:

- A simplified operating forecast

- One or two debt tranches

- No purchase accounting

- Limited or no sensitivity analysis

A standard 90-minute LBO modeling test typically requires

- A full five-year operating forecast

- Multiple debt tranches with distinct terms

- Financing fees and amortization

- PIK interest

- Cash flow–driven debt repayment

- IRR and MOIC calculations

- Sensitivity or goal-seek analysis

The walkthrough below reflects these standard expectations.

Common Features Tested in Standard LBO Modeling Cases

Candidates should expect standard-level LBO tests to potentially include:

- Multiple senior and junior debt tranches

- PIK interest and principal accretion

- Financing and advisory fees

- Cash sweep mechanics

- Sponsor monitoring or management fees

- Purchase price allocation and incremental D&A

- Management rollover equity

- Returns sensitivity or goal-seek analysis

Not every test includes all of these, but candidates should be prepared to handle any combination within a 90-minute time constraint.

90-Minute LBO Modeling Test Prompt

Time Allowed: 90 minutes

Deliverable: Excel model driven entirely by inputs

Case Overview

A private equity sponsor is evaluating the acquisition of TUMI. The company generated $123.0mm of LTM EBITDA prior to acquisition.

The sponsor acquires the business at a 20% premium to the share price and plans to exit after a five-year holding period at the same EBITDA multiple.

Transaction Assumptions

- Net cash acquired at close: $92.3mm

- Advisory fees: 1.0% of enterprise value

- Debt financing fees: 1.0% of total funded debt, amortized over 5 years

Sources and Uses

Sources

- Cash from balance sheet: $92.3mm

- Term Loan A: $425.0mm

- Term Loan B: $165.0mm

- Mezzanine loan (PIK): $75.0mm

- Senior unsecured notes: $75.0mm

- Sponsor equity: $1,389.1mm

- Uses

- Equity value purchase: $2,193.0mm

- Debt financing fees: $7.4mm

- Advisory fees: $21.0mm

LBO Modeling Walkthrough (Embedded Build Order)

Step 1: Inputs and Assumptions

Begin by isolating all assumptions in a single inputs section. Entry and exit multiples, transaction fees, debt balances, and operating assumptions should all be controlled from this area. No assumptions should be hardcoded inside formulas.

Step 2: Sources & Uses

Build the Sources & Uses schedule first. This table anchors the model and establishes:

- Entry equity value

- Fees

- Initial leverage

- Sponsor equity contribution

If Sources & Uses does not balance, the model is incomplete.

Step 3: Operating Forecast

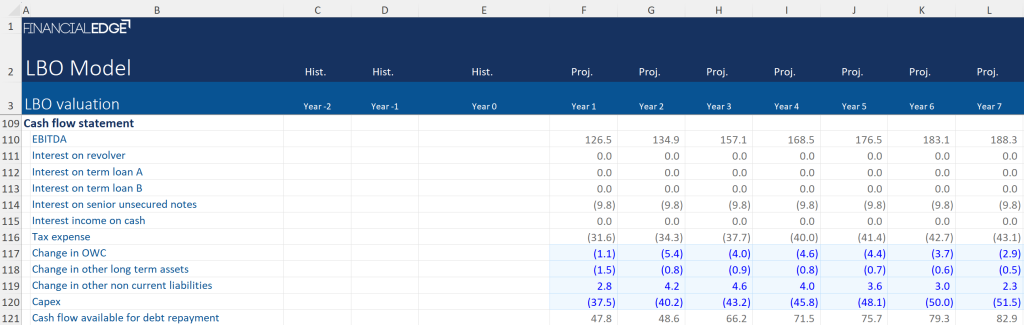

Project the business over five years. Revenue growth and margin expansion drive adjusted EBITDA growth from $126.5mm in Year 1 to $176.5mm in Year 5.

From EBITDA, derive operating cash flow after:

- Cash interest

- Cash taxes

- Capital expenditures

- Changes in operating cash requirements

This produces cash flow available for debt repayment, increasing from $47.8mm to $75.7mm over the projection period.

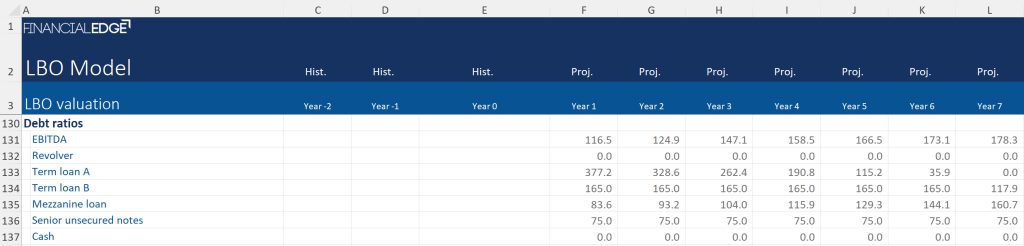

Step 4: Debt Schedules

Model each debt tranche separately:

- Revolver covers a deficit and receives excess cash flow

- Term Loan A amortizes and receives excess cash flow

- Term Loan B is treated as bullet debt

- Mezzanine debt accrues PIK interest

- Senior notes remain outstanding and are not prepayable

Interest expense flows through the income statement, while ending balances link to the balance sheet. Cash interest flows through the cash flow statement.

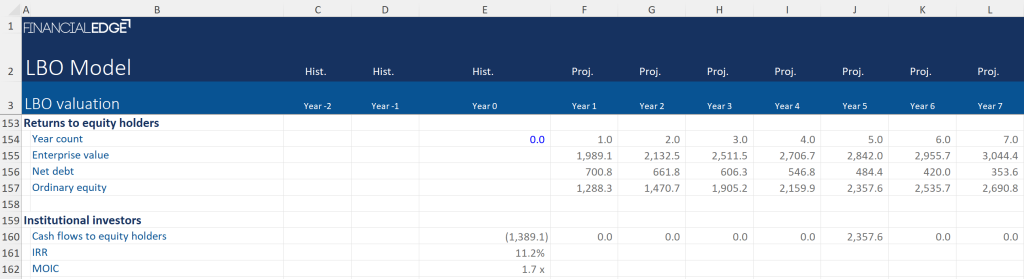

Step 5: Exit and Returns Analysis

At exit (end of Year 5):

- Calculate exit enterprise value using the exit multiple

- Subtract net debt by tranche to arrive at equity value

- Compare exit equity proceeds to initial sponsor equity invested

Calculate MOIC and IRR using sponsor cash flows only.

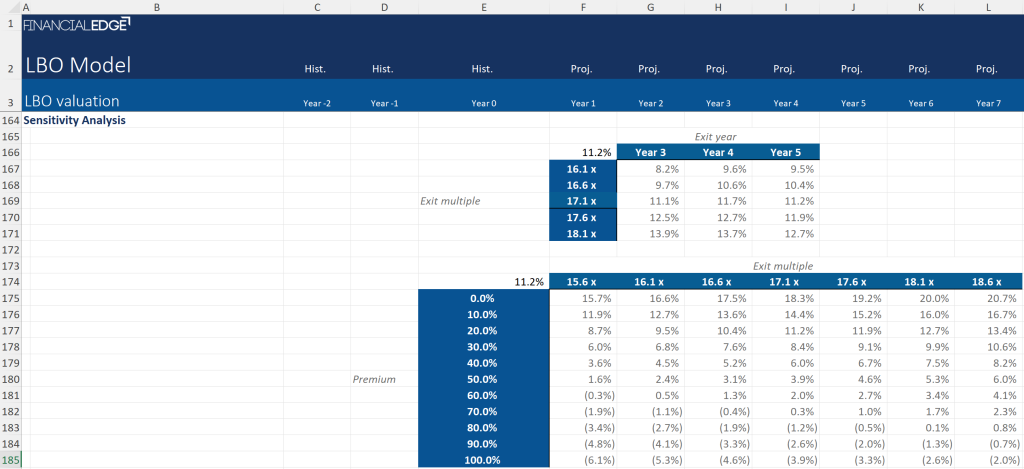

Step 6: Sensitivity Analysis

A standard 90-minute test typically requires at least one sensitivity. In this case, IRR is sensitized to exit EBITDA multiples to assess how returns respond to valuation changes.

How to Practice for a 90-Minute LBO Modeling Test

Effective preparation focuses on repetition and structure:

- Practice building models from a blank Excel file under timed conditions

- Use a consistent build order every time

- Prioritize Sources & Uses, cash flow, debt mechanics, and returns

- Add sensitivities only after core outputs are correct

Candidates who practice standard-level cases consistently are far more likely to perform well under interview conditions.

In early Private Equity interviews, candidates are typically asked about technical skills, deal experience, firm and industry knowledge, and personal fit. Here are 3 common private equity interview questions and answers.

Frequently Asked Questions About LBOs in Private Equity Interviews

What is a Leveraged Buyout (LBO)?

A leveraged buyout is the acquisition of a company using a significant amount of debt financing, where the target’s cash flows are used to service and repay that debt over time. In private equity, LBOs are the primary transaction structure because they allow sponsors to control large assets with a relatively small equity investment. Interviewers expect candidates to understand not only the definition, but also how leverage, cash flow, and exit valuation interact to generate equity returns.

Why do Private Equity Firms Use Leverage?

Private equity firms use leverage to amplify equity returns by reducing the amount of equity capital required at acquisition. As debt is repaid through the company’s free cash flow, equity value increases disproportionately, assuming operating performance remains stable or improves. However, leverage also increases financial risk, which is why private equity firms focus heavily on cash flow durability and downside protection.

What are the Main Drivers of Returns in an LBO?

Returns in an LBO are driven by four primary factors: entry valuation, exit valuation, EBITDA growth and margin expansion, and debt paydown. Among these, entry price and exit multiple typically have the largest impact on returns. Operational improvements and deleveraging can materially enhance returns, but they rarely compensate for overpaying at entry.

If you would like to practice more interview questions, this blog breaks down the 20 most common questions asked, as well as how to prepare for a private equity interview.

Final Thoughts

A 90-minute LBO modeling test is not about building the most complex model possible. It is about building the right model, efficiently, under pressure. Firms look for candidates who can prioritize, follow instructions, and produce reliable outputs. Practicing with realistic, standard-level cases like this one is the most effective way to prepare for private equity interviews.