Equity Method Investments

October 1, 2020

What are “Equity Method Investments”?

Companies use the equity method to report their profits earned through investments in other companies. The investor company will report the revenue earned by the investee company in its income statement, with the percentage of the equity investment in the investee company.

Investor companies will use the equity method to report their investments in the investee company when they have:

- Significant influence but not control.

- Usually, but not always, a stake between 20% and 50%.

- Exception – if the investor company owns 55% but anti-trust issues prevent it from having control.

- Exception – if you have a board veto and own 45%, then you would probably fully consolidate.

The investor company would report the investment as a one-line consolidation – one line on the income statement, balance sheet and cash flow statement. The investment on the balance sheet would reflect at the original cost, then retained earnings would be added over time. In most cases, the balance sheet does not reflect the fair value of the investment.

Key Learning Points

- Equity method investments are strategic purchases of equity in another business where the investor has significant influence but not control in the investee company (usually 20%-50%)

- The investor must use the equity method to report these types of investments in their financial statements

- Equity method investments are reported as a one-line consolidation item in the investor’s income statement, balance sheet and cash flow statement

- When the investment is made it is recognized as a non-current asset; the subsequent financing accounts (cash for example) must go down by the purchase amount

- Income generated by the investment is included in the investor’s income statement (at their % share) as well as the retained earnings account and the investment asset

- A dividend payment by the investment will result in the investor’s cash balance increasing by their share of dividend received and a corresponding decrease in the asset

Equity Method Accounting Example

Nestle owns a 23.2% stake in L’Oreal, which is treated as an equity method investment:

On the income statement is a one-line called “Income from Associates and Joint Ventures”. The line is below tax and shown net of taxes. So Nestle’s share of income from equity method investments (which is largely L’Oreal) is 916MM.

On the balance sheet, a long-term asset shows the original purchase price plus any reinvested earnings to date:

The notes to the accounts provide more detail:

For L’Oreal, the 2018 year started with 8,184MM and Nestle then added its share of L’Oreal’s net income of 1,044MM (this number is different than the 919MM on the income statement as there were other associates and JVs, some of which were lossmaking so Nestle took their share of the other company’s losses). When Nestle receives dividends from L’Oreal these are deducted from the investment and added to the cash balance.

On the cash flow statement, the equity income of 1,044MM is subtracted in the cash flow from operations, and usually, the dividends received are added to the cash flow from operations (there is scope under IFRS to add the dividends received to the cash flow from investing activities).

Accounting Entries

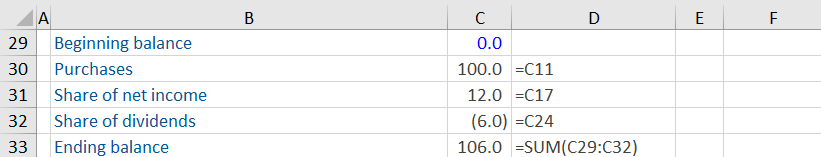

Company A buys 20.0% of the equity of Company B from the shareholders of Company B for 100.0 in an all cash deal. What are the impacts on Company A’s financial statements as a result of this deal?

Company B records net income of 60.0 after tax:

Company B pays dividends of 30.0:

Points to Note

- Company A reduces its cash with $100 million and shows its investment in Company B.

- Although Company B earned $60 million net income, Company A only reports 20% of that in their books since that is their investment in Company B.

- When Company B declared a dividend of $30 million, Company A reported only $6 million since they are entitled to 20% of that.

- Company A increased their cash with the dividend amount ($6 million) but decreased their equity investment since they received the dividend from Company B. If they had increased their investment, they would be double-counting.

The dividend accounting is confusing as many people want to put the 6.0MM in dividends into the income statement. However, Company A has already taken 12.0MM to the income statement – its share of net income, taking the dividends as well, would be double counting.

Remember, when a public company pays a dividend its stock price drops. So, we reflect the decrease in equity value by deducting the dividend from the equity method investment.