Debt Equivalents

September 30, 2020

What are Debt Equivalents?

A debt equivalent is a debt-like financial obligation or claim resulting from the signing of a short or long-term contract. Two of the most common examples of debt equivalents are finance leases and PPAs. A PPA is a power purchase agreement, i.e. a contract between an entity that generates and sells electricity and one that is buying electricity. Credit-rating agencies also use debt equivalents in their credit analysis.

A finance lease is considered a debt like claim because if the lessee company goes bust, the lessor could repossess the leased asset or demand payment.

Key Learning Points

- Debt equivalents include any debt like financial obligations and are always reported as liabilities

- A finance lease is considered a debt equivalent and is a contract for the use of an asset over a specified term which are similar to asset purchases in terms of the rights and obligations

- Debt equivalents are considered a source of finance and companies report these in their balance sheets

- In the EV to equity bridge, debt equivalents are a source of finance and must be included when calculated the company’s value

Where are Debt Equivalents Used?

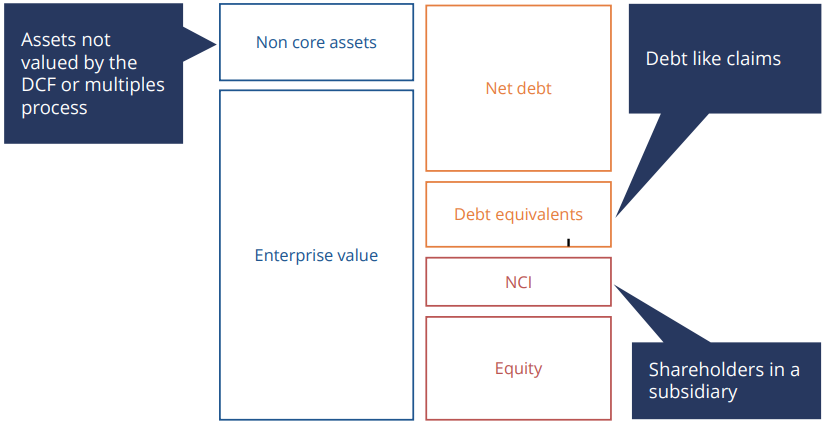

As they are a source of finance, they are used in the Enterprise to Equity Value bridge:

Credit analysts and credit-rating agencies use debt equivalents (or debt equivalency) to describe the financial risk that is inherent in a fixed financial obligation that is not typically shown on the balance sheet. This is why debt equivalents are considered a separate category to net debt in the bridge above. Credit-rating agencies consider these obligations to have a similar risk to debt, as they could, through an event like bankruptcy, be converted into debt.

Other items include operating leases, which used to be off-balance sheet but after accounting rule changes are now likely to be seen on the balance sheet, and pension deficits (the amount that a company’s defined benefit pensions scheme is underfunded by).

If you’re looking to get into investment banking check out our top micro-degree today.