Accounts Payable

September 15, 2025

What is Accounts Payable?

Accounts payable represents a company’s obligation to pay the short-term debt it owes to suppliers for goods or services purchased to run its operations, where they have received an invoice. It is a line item that companies report in the balance sheet under current liabilities. A company will likely have several suppliers, so it will report the total amount outstanding in accounts payable.

The movement of accounts payable from the previous period to the reported one will appear in the cash flow statement. An increase in the accounts payable account from the previous period means that a company has bought more goods or services on credit, instead of paying cash. A decrease in accounts payable depicts that a company has paid its outstanding supplier invoices at a faster rate than it has accumulated new ones.

Managing the accounts payable account is important to a business to ensure healthy cash flow. Accounts payable differ from notes payable, which are debts created by formal legal documents. IFRS companies often call accounts payable as trade payables.

Key Learning Points

- Accounts Payable is the total amount that a company owes its suppliers for goods and services

- It is a line item on the balance sheet under current liabilities

- The change in accounts payable over the financial period is also recorded in the cash flow statement

- Accounts payable is part of a company’s working capital, investors will monitor this to ensure efficient use of cash (and sufficient liquidity) in a company’s day-to-day activities

Accounts Payable Journal Entry

When a business receives an invoice from its supplier for goods or services purchased, the accountant will credit it to accounts payable so that the short-term liability reflects and will debit an expense to offset the entry.

If a business received an invoice from its cleaning materials supplier for $100, the entry would look as follows:

| Purchase of cleaning materials on credit | Assets | L&E | ||

| Cleaning Materials | 100.0 | Accounts Payables | 100.0 | |

Once the business has paid the creditor, the entry would be:

| Payment of invoice | Assets | L&E | ||

| Cash | (100.0) | Accounts Payable | (100.0) | |

Cleaning materials is an expense reported through the income statement so retained earnings falls, and accounts payable increases balancing the balance sheet. Cash decreases when the company pays the creditor.

Accounts Payable vs. Accruals

The key difference between accounts payable and accruals is that with accounts payable, the company has received an invoice and is certain of the liability. In contrast, accruals are estimates of liabilities that have been incurred but not yet invoiced. This means that accruals are based on estimates rather than confirmed amounts

Accounts Payable vs Accruals vs Notes Payable

Here is a guide to help distinguish been accounts payable, accruals and notes payable. All can be considered types of liabilities but have distinguishing characteristics.

| Feature | Accounts Payable (AP) | Accruals | Notes Payable (NP) |

| Definition | Amounts a company owes to suppliers for goods/services received but not yet paid for | Expenses or revenues recognized before cash is exchanged | Written promises to pay a specific amount of money at a future date |

| Nature | Short-term liability | Can be asset or liability (usually liability in this context) | Can be short-term or long-term liability |

| Documentation | Based on supplier invoices | No formal documentation; based on estimates or adjusting entries | Formal written agreement (promissory note) |

| Examples | Unpaid supplier invoices, utility bills | Accrued salaries, interest payable, taxes owed | Bank loans, promissory notes, financing agreements |

| Interest Involved | Typically no interest | No interest | Usually includes interest |

| Recorded When | Goods/services are received and invoice is received | Expense is incurred but not yet paid or invoiced | When the note is signed or funds are received |

| Payment Terms | Usually short-term (30–90 days) | Short-term, often settled in the next accounting period | Can be short-term or long-term, depending on the agreement |

| Balance Sheet Classification | Current liabilities | Current liabilities (mostly) | Current or non-current liabilities depending on due date |

| Accounting Treatment | Credited when invoice is received, debited when paid | Adjusting journal entries at period end | Liability recorded with interest expense over time |

| Audit Trail | Clear audit trail via invoices and purchase orders | Requires estimation and justification | Strong audit trail due to formal agreements |

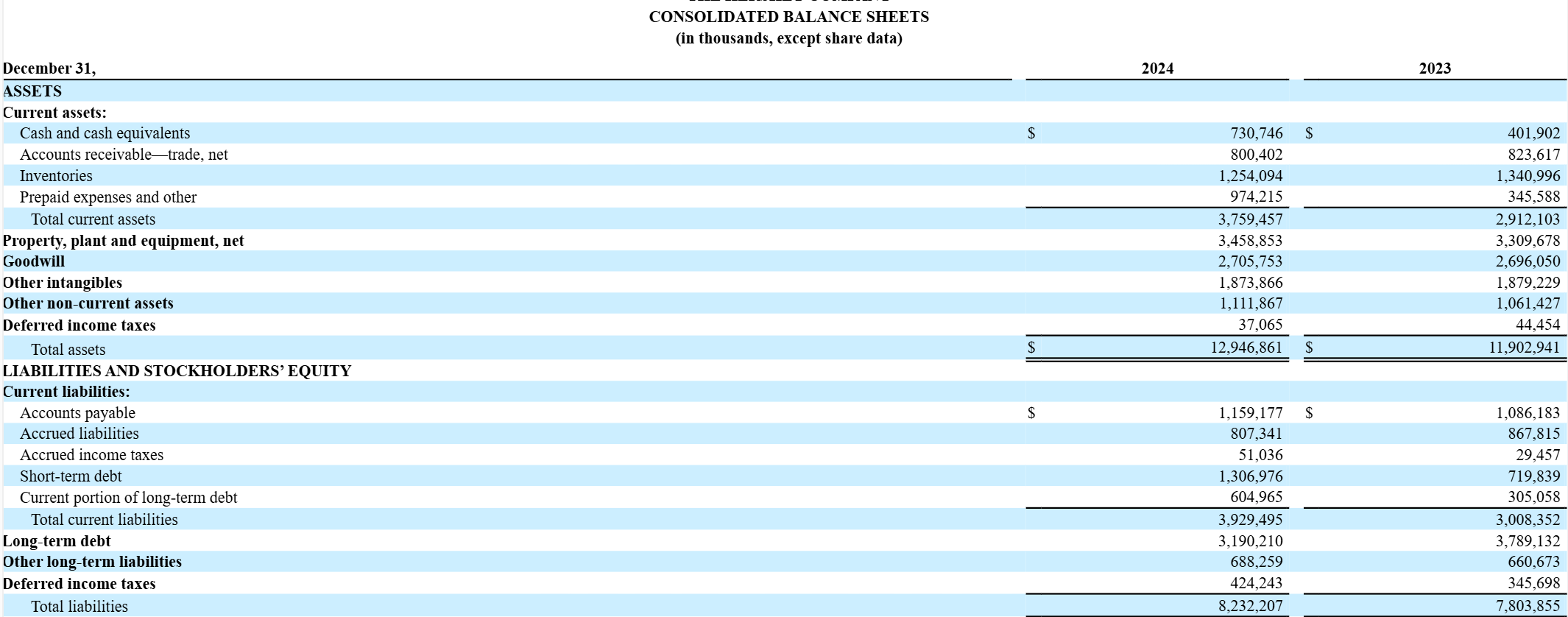

Accounts Payable Example – Hershey Company

Below is an extract from The Hershey Company Balance Sheet at 12/31/24 taken from Felix.

Accounts Payable (AP) represents Hershey’s short-term obligations to suppliers for goods and services received but not yet paid for.

It is listed under current liabilities on the balance sheet and is a key indicator of the company’s operational efficiency and cash flow management. Efficient AP management helps Hershey maintain good supplier relationships and optimize working capital.

Total Accounts Payable Turnover (TAPT) Formula

The Total Accounts Payable Turnover (TAPT) formula is used to measure how efficiently a company pays off its suppliers. It shows how many times, on average, a company pays its accounts payable during a period (usually a year).

Total Accounts Payable Turnover (TAPT) is equal to the total purchases divided by the average accounts payable. This is calculated by summing the AP at the start and end of the period and then dividing by 2.

Total Accounts Payable Turnover =Total Purchases / ((Beginning AP+ Ending AP) / 2)

- Total Purchases: The total amount of goods/services bought on credit during the period

- Beginning Accounts Payable: AP balance at the start of the period

- Ending Accounts Payable: AP balance at the end of the period

- The denominator is the average accounts payable for the period

Example of TAPT Formula

Company A reported the following items:

| Day 1 | Accounts Payable | 300.0 |

| Day 30 | Accounts Payable | 350.0 |

| Reporting Year 2019 | Purchases | 4,000.0 |

All figures are in ($) thousands

We can take this information and form the following equation:

$4,000,000 / (($300,000 + $350,000) / 2) = 12.3

This indicates that the company has paid its suppliers just over 12 times during the financial period.

Payable Days Ratio

A metric associated with accounts payable is the Payable Days ratio. This measures the average number of days it takes a company to pay its creditors. It’s useful to see if a company is taking its suppliers in a timely manner whilst retaining enough liquidity in the company to keep the business running smoothly

Payable Days Ratio

This is calculated by taking the average accounts payable and dividing it by the cost of sales. This is then multiplied by 365 to show the payable days for a year.

Payable Days = (Average Accounts Payable) / (Cost of Goods Sold) x 365

If investors were looking at quarterly performance, they would use 90 days to reflect 3 months of operations.

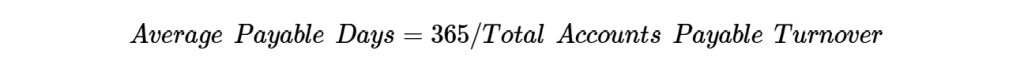

Average Payables Days Formula

We can also take the information from the TAPT calculation and use it to derive the average payable days.

Average Payable Days =365 / Total Accounts Payable Turnover

365 / 12.3 = 30 days

By taking 365 and dividing it by the 12.3 turnover, we can determine that the average payables days for this company is 30 days.

Download the free Financial Edge template to follow these steps in Excel.

Managing Accounts Payable Effectively

Companies need to use the total purchases for the year when calculating TAPT, not only the cost of goods sold. The above example shows that Company A pays creditors on average within 30 days of invoice.

Companies who take too long to pay creditors risk jeopardizing their relationship and may forfeit credit terms. Companies who pay creditors too soon might have cash flow issues.

Conclusion

Understanding and managing accounts payable is crucial for maintaining a healthy cash flow and ensuring the financial stability of a business. By effectively tracking and managing short-term liabilities, companies can optimize their working capital, maintain good relationships with suppliers, and avoid potential cash flow issues.