Accruals

October 1, 2020

What are Accruals?

The accrual method of accounting involves allocating expenses and revenues in the periods to which they relate, rather than when the associated cash flows happen. An accrued liability arises when a company recognizes a cost but is yet to receive the invoice. It cannot treat the expense as an accounts payable as the obligation it owes is based on an estimate.

When a company records its accrued expenses, the amounts accrued might be incorrect since they are estimates. This poses potential issues for due diligence and cash flow forecasts. In the case of operational expenses, companies will often base estimates on prior expenses incurred.

In addition, accruals can cover one-off expenses e.g. the accrual for legal costs in the Deepwater Horizon disaster for BP.

Accruals also include the cash a company has received in advance for services or goods that it will provide in the future, so-called deferred revenues.

Key Learning Points

- The accruals method of accounting involves allocating revenues and costs when they occur regardless of when the associated cash flows happen

- An accrued expense is recorded as a current liability (expectation of settlement within 12 months) and reduces retained earnings by the same amount

- Both IFRS and US GAAP have guidelines to help companies prepare their financial statements; one of the main principles is accruals where companies recognize revenues and expenses as incurred

- As a result of accruals, reported profits rarely equal the cash flows received by a company. Instead, the income statement shows a company’s sales (or revenue) less expenses for the period in question

The Impact of Accruals in Financial Statements

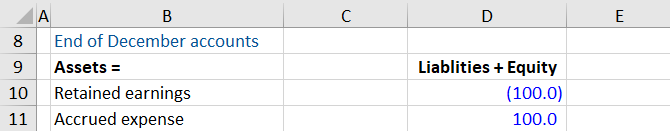

A company estimates its electricity expense of 100 in November 20X9. However, the company will not receive the invoice until December 20X0. What is the effect on the company’s balance sheet?

Example

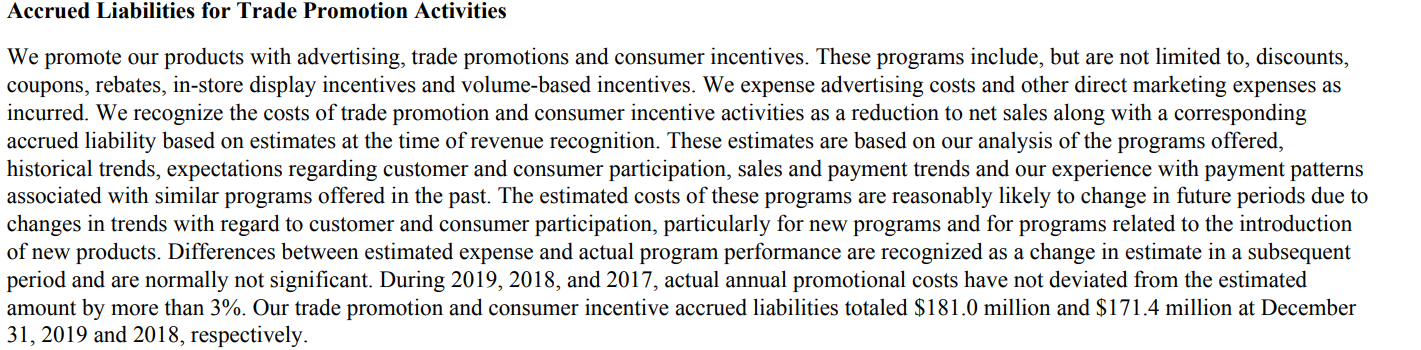

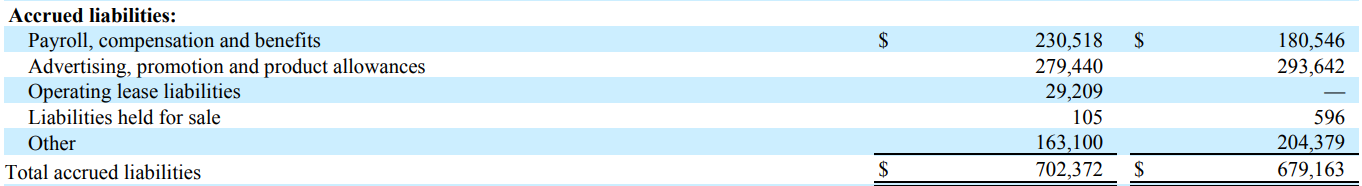

Below are notes from Year-End 2019 Financial Statements of The Hershey Company:

The Hershey Company – Extract from management discussion and analysis

The Hershey Company – Extract from Notes to Consolidated Financial Statements

Why Use the Accrual Method of Accounting?

Although the cash method is a simpler way to keep track of the books, it does not provide an accurate picture of a business’s profitability during a specific period. The accrual method records income and expenses for the period they occur, regardless of when the company receives the cash.

The accrual method ensures that a company reports all the revenue earned and associated expenses incurred during a specific period. This means that profits rarely equal cash flows received, but this does provide a better representation of the income and expenses incurred during the period.