Due Diligence

May 6, 2021

What is “Due Diligence”?

Mergers and acquisitions (M&A) are transactions resulting in the purchasing and/or joining of one business with another. These transactions are complex and lengthy as the buyers want to be sure of what they are buying. Due diligence is an essential part of giving buyers certainty, and is the process of thoroughly examining the target company.

As a result, due diligence helps in deciding whether to proceed with the acquisition or not. It involves an assessment or investigation of all aspects of a target’s business, including financial information, tax issues, technology, intellectual property, legal documents, customers, management, employees, litigation, environmental and regulatory issues.

Without due diligence, companies might fail to share important information that could ultimately impact a buyer’s decision to go through with a deal.

Key Learning Points

- Due diligence covers both financial and non-financial aspects of the target company

- Financial due diligence covers factors that can affect valuation, working capital assumptions, non-operating cash flows, tax and accounting related matters

- Evaluating the quality of earnings is an important part of financial due diligence.

- Due diligence helps identify any potential upward/downward adjustments to be made to the company’s earnings projections. This can have an impact on the target company’s valuation

Financial Due Diligence Explained

Given below are some examples of the areas covered in financial due diligence.

Quality of Earnings

The quality of earnings impacts a company’s operating performance and its cash flows. An analysis of the quality of earnings helps in identifying any adjustments to EBITDA, which would eventually affect the target company’s value.

Even if a company reports large net income, it may not be as financially sound as it appears if its operating cash flows are negative, or fluctuate markedly over time.

Working Capital

Working capital is of critical importance in the operation of a company and a barometer of its health. Working capital looks at the cash tied up in operations. If this fluctuates wildly during the year, investors may need to source more cash during peak periods to ensure bills can be paid. Working capital thus contributes to the smooth running of operations, and impacts on funding requirements. Therefore, analysis of working capital is a part of due diligence.

Non-Operating Cash Flows

Due diligence also involves an analysis of non-operating cash flows (i.e. cash flows that are not related to a company’s day-to-day operations), which may not be included in the valuation models.

Examples of non-operating cash flows include pension payments, lease obligations, debt issuance/repayment, and dividends payable. This analysis helps in determining the actual cash flow requirements of the company after the deal.

Taxation and Accounting Related Factors

Due diligence can also help identify any potential issues related to accounting practices. For example, the selling company may not have been recognizing revenue as per international standards. This can lead to a re-statement of the previous year’s financials and unexpected tax liabilities.

Due diligence also helps in identifying whether adequate provisions have been made for potential long-term liabilities. These issues help in identifying any potential cash outflows, thus affecting the deal size.

Example: Due Diligence

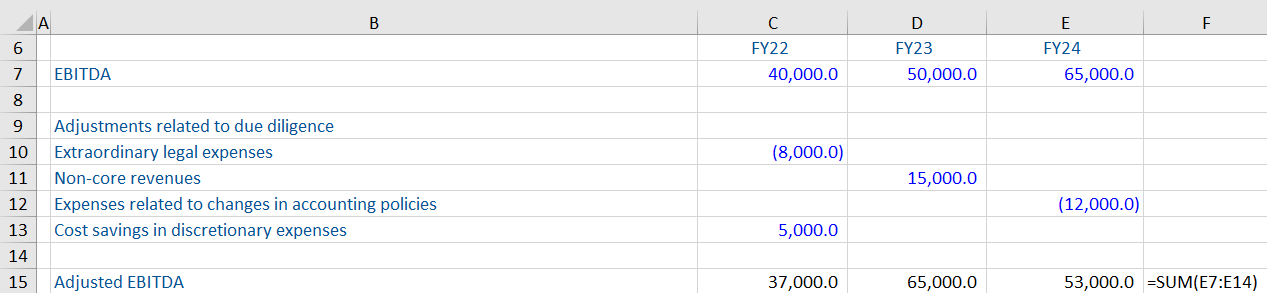

Given below are the EBITDA forecasts of a company for 3 years. Also shown are potential adjustments brought to light through the due diligence process.

Based on the above expenses, the adjusted EBITDA for each of the three years works out as follows:

In FY22, the extraordinary legal expenses reduce the EBITDA, while the cost savings in discretionary expenses get added to the EBITDA. In FY23, potential non-core revenues identified during the due diligence process increase the EBITDA and in FY24, potential expenses related to changes in accounting policies reduce the EBITDA.

Here, we can see the due diligence process has identified certain income and expenses, which were not projected earlier. These new items have an impact on the EBITDA, and thus on the company’s value.