Capital Structure

October 15, 2020

What is Capital Structure?

A company’s capital structure represents the proportion of debt and equity used by the business to fund its operations and growth. Debt refers to an amount of money borrowed from one party by another on the condition that it is repaid at a later date. Equity is the ownership interest in the business and includes common stock, preferred stock and retained earnings. All these items can be found on a company’s balance sheet and can be used to calculate the capital structure.

Key Learning Points

- Capital structure is the proportion of debt and equity a business uses to finance its operations and growth

- Equity is the ownership interest in the business

- Debt is a type of liability and refers to an amount of money owed from one party to another on the condition that it is repaid at a later date (usually with interest)

- Leverage ratios help assess how levered a company is in proportion to its total capital

- The proportion of equity or debt that makes up a company’s capital structure is heavily influenced by its stage in its lifecycle

- Enterprise value is the value of the operational business and is unaffected by capital structure changes

Capital Structure Explained

A company purchases assets using capital. This capital is usually in the form of debt or equity. There are different types of debt and equity capital available to a company in order to raise cash and finance its operations. Below outlines common items found in debt and equity:

Debt

- Current portion of long-term debt

- Commercial paper

- Notes payable (often used in the United States to denote commercial paper)

- Leases

- Long term debt

All of these items are liabilities and are the present legal obligations of a company as a result of its borrowing activities or other fiscal obligations.

Equity

- Common stock

- Share premium

- Retained earnings

- Other comprehensive income (sometimes called ‘reserves under IFRS’)

These items represent the shareholders’ investment in the company. Note these amounts are recorded at the amount invested at the time and not the current market value.

Leverage Ratios

Organizations differ in how they measure leverage (sometimes called gearing outside the US). The basic approach is to see what proportion of the capital of the company is debt vs equity. There are a number of ways you can achieve this. Below are two equations that measure leverage, just in slightly different ways:

Leverage = Debt / Equity

Leverage = Debt / (Debt + Equity)

You may also see Net Debt being used instead of debt if the assumption is that cash will be used to pay down debt.

Capital Structure and Stage of Growth:

The choice of capital structure, i.e. the mix between debt and equity often depends on where the business is in its company life cycle.

Startup/High growth companies:

Although startup companies may have cash, it’s often from interested investors who believe in the idea. Think of a company like Pinterest. Although it’s been operating in much the same way since 2010 it didn’t make any revenue until 2014, and has yet to reliably create profits. Most of its cash has been fairly unpredictable. If you were a bank, and thinking about the regular interest payments that debt would demand, you’d think twice before lending to Pinterest. So where does Pinterest’s cash come from? Equity. At the time of writing Pinterest’s gearing is 0, it has no debt.

Mature Businesses:

Mature businesses are well established in their industries. They are profitable and cash-flow positive and can meet regular debt interest and repayments. Mature businesses’ cash flows are predictable, reducing the risk to investors. As the company is profitable, it can take advantage of the tax deductibility on interest which will lower the cost of its overall financing. These companies often have a higher proportion of debt in their capital structure.

Airbnb, a tech company just like Pinterest is older, has more stable income, and is profitable. If you look at its financial statements you’ll see debt, and gearing. It can, and has borrowed. It’s in a more mature stage of its life-cycle than pinterest.

It’s important to note that debt is generally cheaper than equity to raise and maintain. Interest is lower than the dividends on an equivalent amount of funding. Interest is also tax deductible making it even cheaper. This is why mature companies gravitate towards debt if they can.

The Impact of Capital Structure on Equity Value

We calculate equity value by taking Enterprise Value, adding cash and subtracting debt. We can either value the company using a PE (price/earnings) multiple or an Enterprise Multiple. However, the PE multiple is distorted by the capital structure – by both large cash balances and large debt balances.

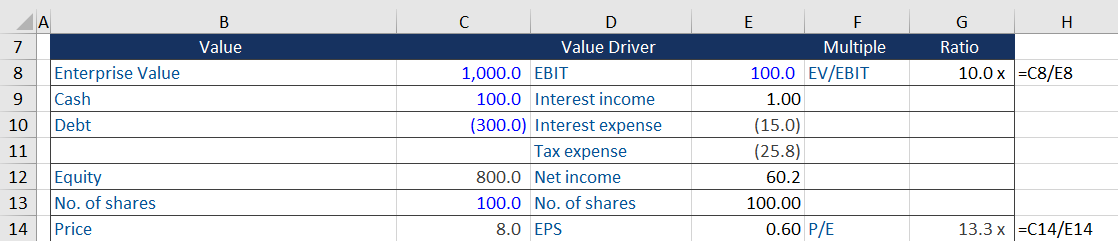

Here’s the data for a company before any capital structure changes:

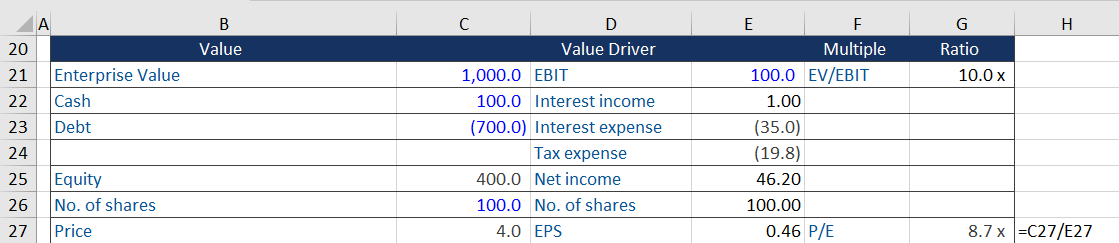

Changes to Capital Structure: higher leverage

Now let’s look at the numbers if debt is increased to 700.

Notice the enterprise value has remained unchanged by the addition of debt. However, the equity value has dropped to 400 the price to earnings ratio has fallen to 8.7.

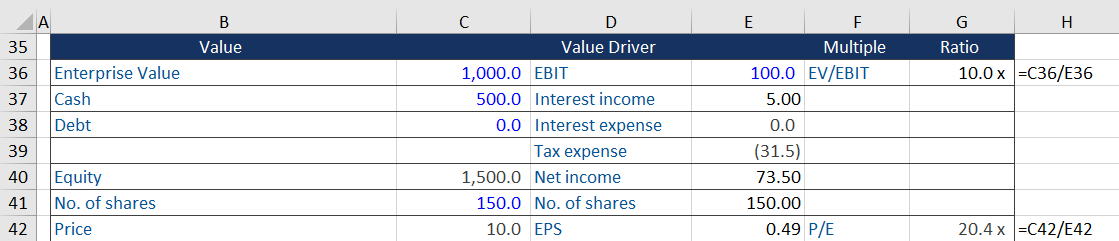

Changes to Capital Structure: higher cash

Next, let us assume the company has cash of 500 and no debt.

Now the P/E ratio is 20.4. As the PE ratio is now a blend of the Enterprise / EBIT multiple and the cash value to interest income multiple. Practice these calculations by accessing the free download.

Practical capital structure

Usually companies within a peer group will have a similar business risk, so they gravitate to having a similar financial risk. Normally we expect companies within a peer group will have a similar capital structure, certainly over the long-term. You do get outliers, for example if one of the companies has recently made a debt-financed acquisition.