Common Stock

March 31, 2021

What is “Common Stock”?

Common stock is a type of security and represents ownership in a public or a private company. All companies have common equity or ordinary share investors who hold common stock. The holders of common stock have the power to vote on important company decisions and its future strategy.

Common stockholders or shareholders can be individuals, companies, or institutions that own at least one share of a company’s stock. Their name is found on the issued share certificate. Being the owners of the company, common stockholders reap financial rewards and bear risks associated with the company.

Key Learning Points

- Common stock is a security that represents ownership of equity in a company. Common stockholders are those who own the company’s stocks and have a legal share certificate in their name

- Unlike fixed income securities, common stockholders do not promise any fixed repayments to investors. The financial rewards are dependent on the financial performance of the investee company

- Common stockholders receive rewards via an increase in the value of their shares and/or profits distributed as dividends. On the downside, common stockholders risk losing their initial investment if the company’s share price decreases or the company is unprofitable

- If the company is liquidated, common stockholders are paid out last as debt holders have a priority claim on the company’s assets. In some cases, they risk losing their entire investment

- Common stockholders have the right to vote on key decisions of the company. They also enjoy pre-emptive rights to buy additional shares at a discounted price if the company raises capital through a rights issue

- There can be multiple classes of common stock with each class having different rights and entitlements

Common Stock Explained

We have listed some features of common stock.

Returns to Investors

Unlike fixed income securities such as bonds, these securities do not have repayment terms. The rewards from common stock stem from the increase in share price and profits distributed in the form of dividends. However, dividend payments are not mandatory. Many businesses do not pay dividends, especially while in the growth phase of the company lifecycle.

However, once they start, they tend to declare and pay dividends regularly, either quarterly, twice a year, or annually (normally depending on the convention in the country). Investors also get return via stock price appreciation and hope to make capital gains when they sell the shares. This is done privately or via a stock exchange if the shares have been listed for sale publicly.

Risks for Investors

Common stock is deemed riskier than preferred stock or debt securities due to holders holding a lower priority claim against the company’s assets. The risk for common stockholders is a drop in share price and the company incurring a loss, resulting in no dividend payments. If a company goes bankrupt, common shareholders will be paid out last. In case of liquidation, companies will first pay creditors, then preferred shareholders before common shareholders. In some cases, common stockholders can lose their entire investment.

Issue Price and APIC

Common stock is initially recorded at issue price. The par or nominal amount is recorded separately from the additional above par. For example, if a share with a par value of 1 is issued at 1.75, it will be recorded as 1 in share capital and 0.75 in additional paid-in capital (APIC) or share premium.

Rights of Common Stockholders

Common shareholders have the right to vote on certain company decisions, such as the appointment of the board of directors. They also often enjoy pre-emptive rights (dependent on the relevant country’s legal system), allowing them to buy a specific number of new shares that the company has offered before they become available to new investors. Pre-emptive rights are attractive to common shareholders since a company usually offers it at a subscribed price on a per-share basis.

Multiple Classes

There can be multiple classes of common or ordinary shares. Each one of the classes can have different voting rights, restrictions on sale, and dividend entitlements. An example of multiple share classes is a Class A and Class B structure. Each Class B share may have 10 voting rights, while each Class B share may have only 1 voting right. In some cases, the company may place restrictions on the trading of common stock of a particular share class.

Finding Common Stock in Financial Statements

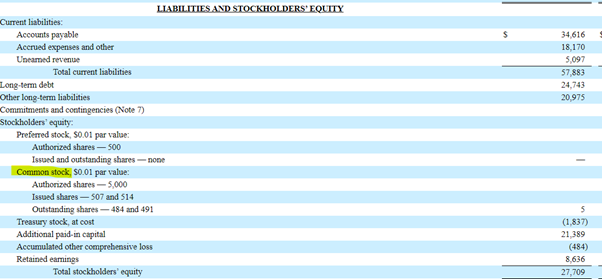

Here are some excerpts from the 2018 annual report of Amazon, Inc. Common stock can be found at multiple places.

![]()

On the first page of their annual report, they have included the number of common stock outstanding.

In the section above on risk factors, the company has outlined various risks that can cause the trading price of their common stock to fluctuate.

In the company’s balance sheet, the company has included the number of common stock in the liabilities and stockholder’s equity section. Authorized shares represent the number of common stock the company is permitted to issue legally. Issued shares are the common stock issued by a company or the total number of shares in existence physically.

Treasury shares are common stock issued but bought back by the company as part of share repurchases. Share repurchases or share buybacks are transactions where a company buys back its own stock either from the open market or directly from shareholders.

Outstanding shares is calculated as issued shares less treasury stock.

In the company’s consolidated statements of stockholders’ equity, the company has included details of changes related to common stockholders. Companies give employee stock options to their employees and executives as a form of equity compensation. Unlike regular shares, options are like derivative instruments. When these options are exercised, they get converted to common stock and the changes are reflected in the statements of stockholders’ equity.

Amazon Inc has included a note on stockholders’ equity. In this note, they have included details of all their common shares outstanding. They have also included an update on the repurchase of common stock.