Defined Benefit Pension – Plan Obligations

January 5, 2021

What are Defined Benefit Plan Obligations?

A defined benefit plan is a type of post-employment-benefit that guarantees a pension to employees in retirement. The plan rules state the post-retirement compensation, which is often a percentage of the retiring employee’s final salary.

It is up to the sponsoring employers to meet this future guarantee. They bear the risk of fulfilling the plan obligations even if there are not enough assets in the pension fund. The first step in understanding a defined benefit plan is figuring out, given the plan rules, the employer’s projected benefit obligations. This involves a series of assumptions, which must be made (and updated regularly) such as:

- Expected final salary

- Number of years of service

- Number of years of retirement (mortality)

- Discount rate

These assumptions (and many more) are usually made by the actuary based on statistical evidence.

Key Learning Points

- A defined benefit plan is a category of post-employment benefits that guarantees a pension to employees in retirement

- The plan rules state the post-retirement compensation, which is often a portion of the retiring employee’s final salary at retirement

- The first step in understanding a defined benefit plan is figuring out, given the plan rules, the employer’s projected benefit obligations. This also involves a series of assumptions such as the employee’s expected final salary, the number of years of service, the number of years of retirement, the discount rate, etc.

- The calculation also involves determining the service cost or the employer’s yearly contribution to be able to meet this defined obligation. The service cost is recorded on the income statement of the employer

- There are other items which affect the pension liability, such as pension payments to the retirees (reducing the obligation), interest being charged to unwind the discount, and an adjustment for assumption changes

Calculating the Defined Benefit Plan Obligations

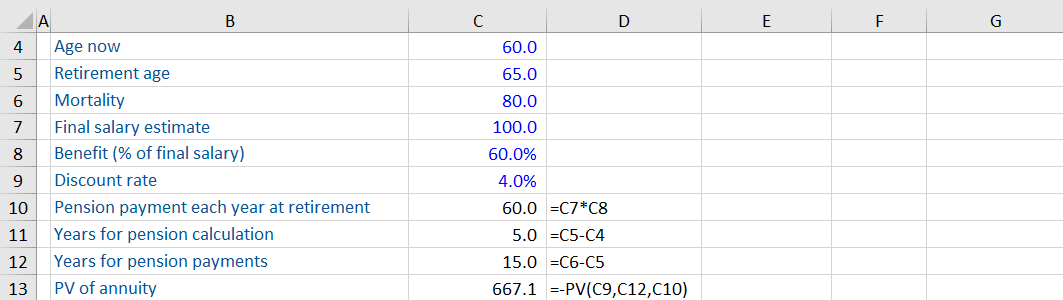

Here is some information about an employee retiring in 5 years. Based on this, we are asked to calculate the plan obligations of the employer.

The current age of the employee is 60. The retirement age of the employee is 65. Based on assumptions made by the actuary, the expected mortality of this employee is 80 years. The final salary of this employee at the time of retirement is expected to 100. The defined benefit plan obligation is expected to be 60% of the final salary for 15 years (from age 65 to 80). The number of years left for pension calculation are 5 (the difference between the current age and the retirement age).

The first step is to calculate the present value of the annuity. This can be done using the PV function in excel. Note we are assuming the pension does not increase over time for simplicity.

Excel function = -PV(rate, nper, pmt [FV])

Where:

PV is the present value i.e. today’s value of the annuity

Rate is the discount rate per period (4%)

Nper is number of periods i.e. the number of years for pension payments (15 years)

PMT is the benefit going out to the employee each year (60.0)

The result (667.1) is the pension pot that needs to be built up by the employer to be able to meet this defined benefit plan obligation.

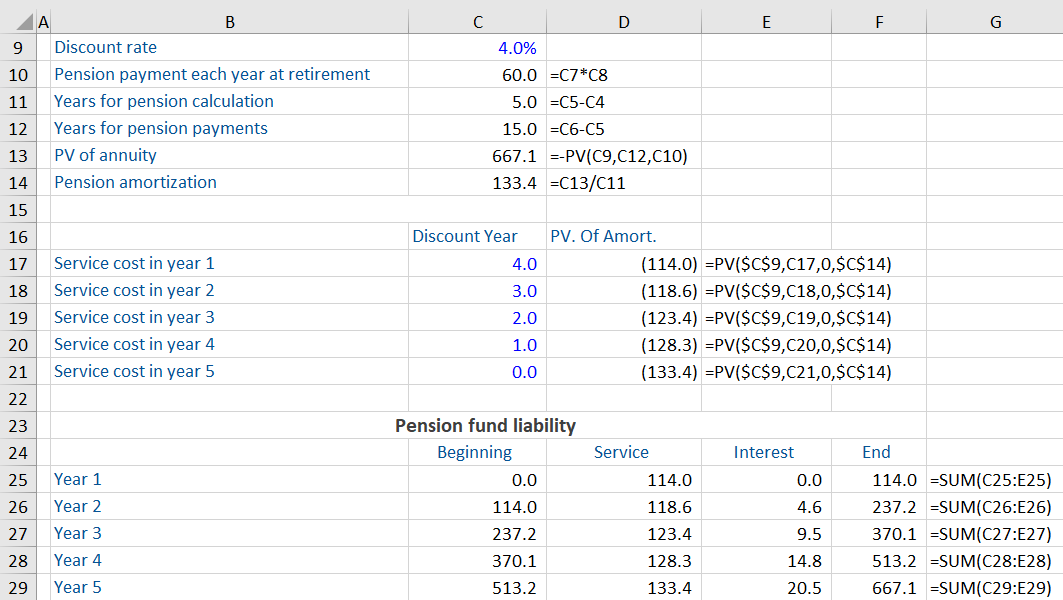

The next step is to determine the employer’s yearly contribution. This is known as the service cost, which shows on the income statement of the employer.

To calculate the service cost, the pension pot is amortized using the straight-line method across the number of working years (5). This works out to 133.4 (667.1/5) each year. Remember this the future value of the contribution to be made each year. For accounting purposes, we need to use the present value of this number. Using the PV function in excel, we can calculate the service cost for each of the 5 years.

Where:

R or rate is the discount rate (4%)

Nper or period is the number of discount years. For example, in year 1 the number of discount year is 4, because there are 4 years left before the obligation is due.

FV or the future value is the pension amortization (133.4)

Based on the above, the breakdown of the year on year increase in the employer’s pension liability is shown below:

Interest has been calculated on the beginning liability using the discount rate (5%). Notice that the employer’s liability in year 5 (667.1) matches the size of the pension pot.

In application, there are several other changes to the pension liability, with pension payments to the retirees being the most common. Pension payments reduce the obligation.

Example: Defined Benefit Plan Obligations

Here is an extract from the 2019 annual report of Johnson & Johnson, Inc.

Johnson & Johnson – Extract from Footnote 10 (Pensions and other benefit plans), Annual report 2019

At the beginning of 2019, the company had a projected benefit obligation of $31,670 million. During the year, there were changes to the pension liabilities, including service costs and interest. The company also paid benefits, which resulted in a reduction of pension liabilities. At the end of 2019, their projected benefit obligation had increased to $37,188 million.

Other items in the above table:

- Plan participant obligations which are contributions from the employees which should be matched by a cash inflow to the fund

- Amendments are probably changes to the pension benefits employees are entitled to

- Actuarial gains and losses are caused by changes to the key actuarial assumptions

- Divestitures and acquisitions are caused by changes to the liability from M&A activity

- Curtailments, settlements and restructuring is probably from cost reductions and other negotiated reductions in pension benefits

- The effect of exchange rates is probably due to the pension liabilities in foreign subsidiaries being recorded in a separate currency and being converted to the home currency at each balance sheet date