How to Model Non-Controlling Interest

September 29, 2025

What is Non-Controlling Interest?

Non-Controlling Interest (NCI) represents the portion of a subsidiary not owned by the parent company. For example, if a parent owns 85% of a subsidiary, the remaining 15% is held by external shareholders and is classified as NCI. Although the parent consolidates 100% of the subsidiary’s financials, the NCI’s share is separately reported in the income statement, balance sheet, and cash flow statement. NCI is part of consolidated equity unless it is redeemable, e.g., due to a put option, in which case it may be classified as a liability.

Key Learning Points

- NCI represents the portion of a subsidiary not owned by the parent company

- It is separately reported in the income statement, balance sheet, and cash flow statement to ensure transparency and avoid overstating the parent company’s profits

Modeling NCI in Financial Statements

In a financial model, the income statement shows total profit, which is then split between the parent and the NCI. The balance sheet includes NCI as a separate line within equity. The cash flow statement shows dividends paid to NCI as financing outflows.

A complete model includes:

- Forecasting NCI income using growth assumptions

- Calculating dividends using payout ratios

- Updating base calculations for both NCI and parent equity

- Ensuring all entries are reflected in the three primary financial statements

Example of Non-Controlling Interest

Financial Statements and Non-Controlling Interest

Here are some examples of how non-controlling interest (NCI) appears in financial statements:

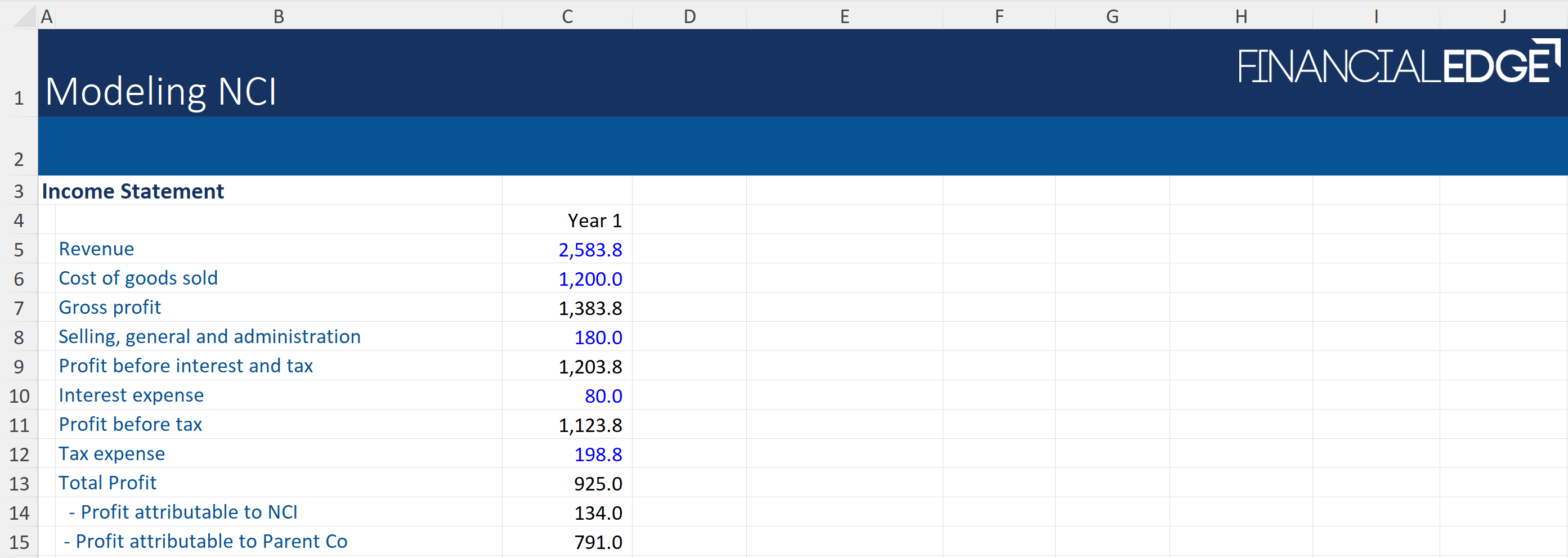

Income Statement Example

In the income statement, NCI is shown as a portion of the total profit that is attributable to shareholders other than the parent company.

For example, if the total profit for the year is 925, the income statement might show that 134 of that profit is attributable to non-controlling interests, while the remaining 791 is attributable to the parent group. This distinction ensures that the parent company does not overstate its share of the profits.

Balance Sheet Example

On the balance sheet, NCI is included within total equity but is reported separately from the equity attributable to the parent company’s shareholders.

For instance, if total equity is 35,739, the NCI might account for 652 of that amount, with the remaining 35,087 belonging to the parent. This separation helps clarify ownership and financial responsibility within the group structure.

Cash Flow Statement Example

In the cash flow statement, dividends paid to non-controlling interests are recorded as financing outflows. These are shown separately from dividends paid to the parent company’s shareholders. This treatment reflects the cash that flows out of the group to external shareholders and ensures that the cash flow statement aligns with the ownership structure presented in the other financial statements.

Key Considerations When Modeling NCI

There are several important considerations when working with NCI.

Consistency

First, consistency across the financial statements is crucial. All three primary statements—the income statement, balance sheet, and cash flow statement—must reflect 100% of the subsidiary’s figures, with the NCI’s share shown separately.

Avoid Double-Counting

Second, it is vital to avoid double-counting. This means that the equity base calculation must be split into two components: one for the parent company’s shareholders and one for the NCI. The same separation must be applied to net income and dividends.

Look at the Maturity of the Subsidiary

Third, the maturity of the subsidiary can influence assumptions such as the dividend payout ratio.

Check for Put Options

Finally, if the NCI is redeemable, such as when a put option is granted, it may need to be reported as a liability rather than equity. This distinction affects how the NCI is presented in the financial statements and must be handled carefully to ensure accurate reporting.

How to Model NCI Checklist

These are the steps to follow to effectively forecast NCI in a three-statement model.

- Calculate the income attributable to non-controlling interests using the growth rate assumption and generated forecasts for subsequent years

- Build base calculations for non-controlling interests, starting with the ending balance from the balance sheet and adjusting for NCI net income and dividends

Base Analysis involves starting with the prior year’s ending balance, adding net income (from the income statement), subtracting dividends (calculated using a dividend payout ratio), and including equity issuance or repurchase (for parent equity only)

- Complete the balance sheet by incorporating the ending balances for equity attributable to parent company shareholders and non-controlling interests

- Finalize the cash flow statement by including dividends from the base calculations and ensuring the model balances

- After all entries are completed, verify the model to ensure it balances, confirming its integrity

Steps to Model NCI

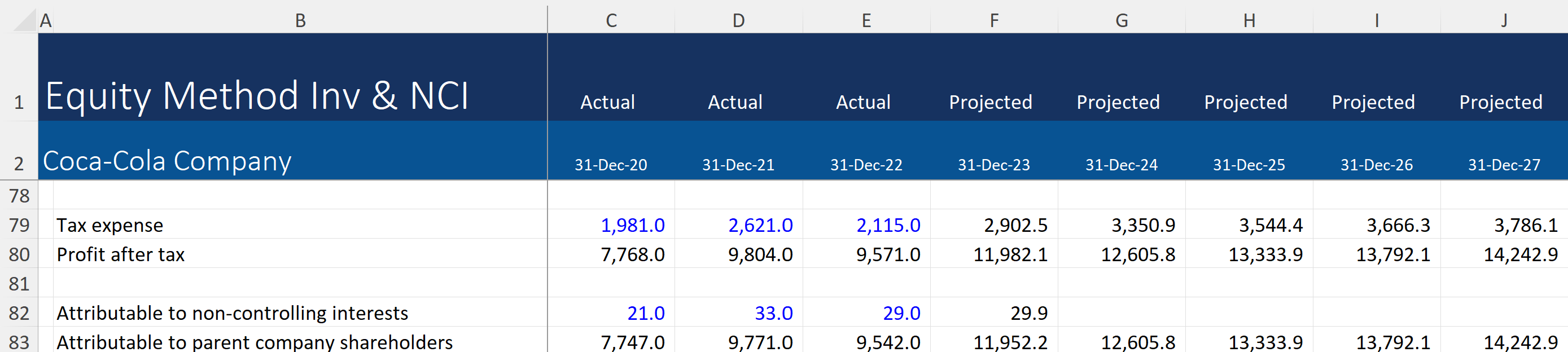

Let’s walk through the steps to complete a financial model for Coca-Cola, looking at year one. The full model in the Building a Model with Complex Balance Sheet Items playlist can be accessed in Felix. Download the free Financial Edge template to follow the calculations in Excel.

This example will focus on the income statement, balance sheet, and cash flow statement entries for non-controlling interests (NCI).

1) Income Statement Calculations

Calculate the income attributable to non-controlling interests using the growth rate assumption and generate forecasts for subsequent years.

Here it is shown for year one; this forecasted NCI income is then extended across future years.

2) Base Calculations for NCI

Build base calculations for non-controlling interests, starting with the ending balance from the balance sheet and adjusting for NCI net income and dividends.

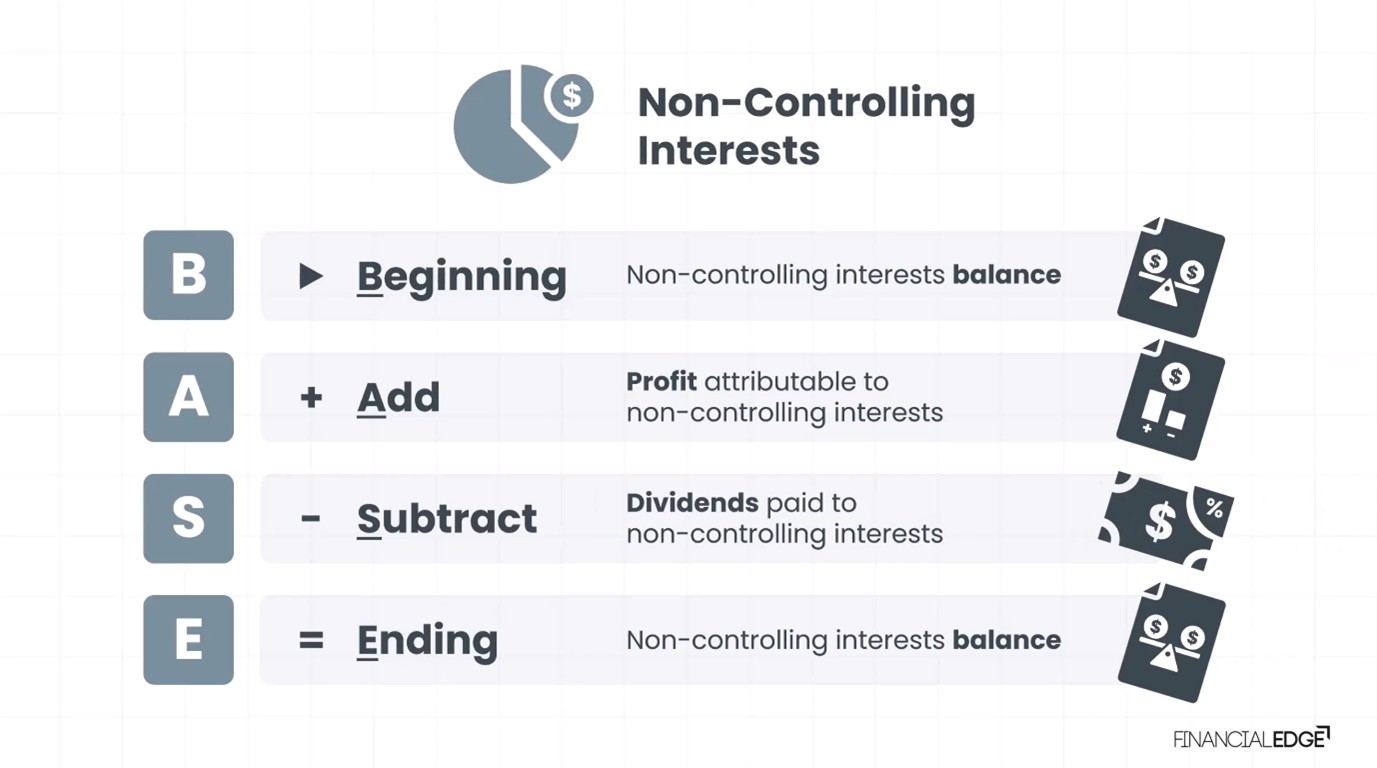

BASE Analysis

The calculation of NCI is typically done using a base analysis approach. Base analysis is helpful when forecasting items where there is a relationship throughout the financial statements.

In this context, we are looking at the forecasting relationship between the NCI on the balance sheet, and the profit and dividends that are earned and paid out over the forecast period.

The process involves:

Beginning + Add – Subtract = Ending

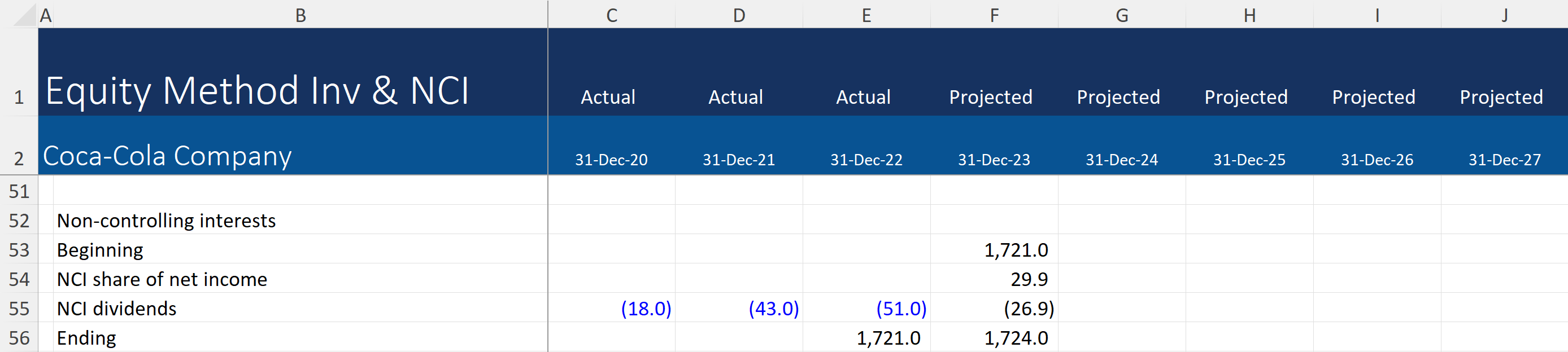

The base analysis rows have all been inserted into the Financial Edge Excel template, so follow these steps to link the data

- Starting with the prior year’s ending NCI balance (taken from the balance sheet and 1,721 in this Coca-Cola example)

- Adding net income attributable to NCI (29.9 taken from the income statement)

- Subtracting dividends payable to NCI (26.9 calculated using a dividend payout ratio or growth rate in line with company guidance or analyst estimates)

- Including equity issuance or repurchase if taken place (this is for parent equity only)

The resulting ending balances are then inserted into the balance sheet, here it is shown for year 1.

In this model the NCI net income has been forecast at 3% YoY growth, and the dividend payout ratio has been forecast at 90%.

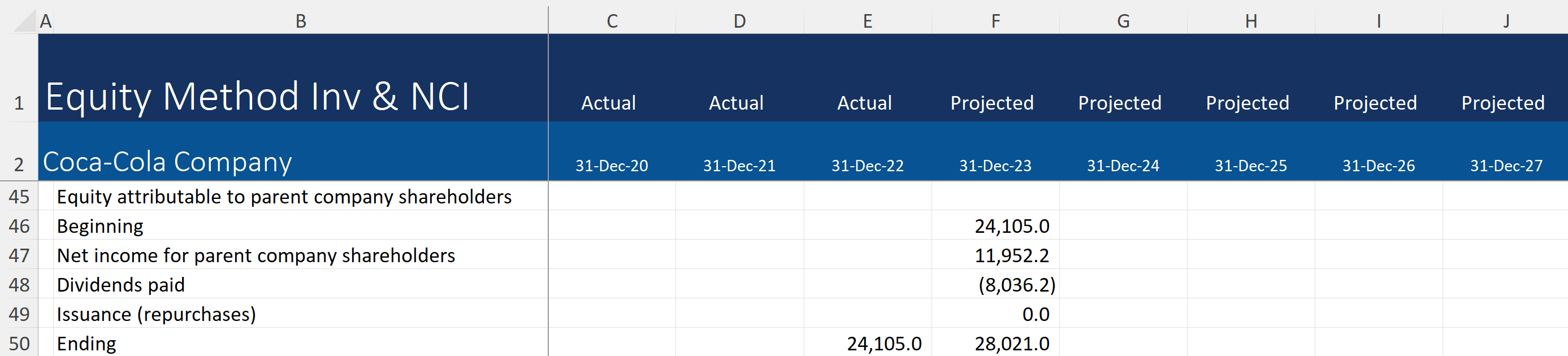

Base Calculations for Parent Company Shareholders

Perform similar base calculations for equity attributable to parent company shareholders, including net income, dividends, and equity issuance or repurchase.

Here, the parent company net income has been taken from the income statement after deducting the NCI portion. The company dividends have been forecast to grow at 5.5% p.a.

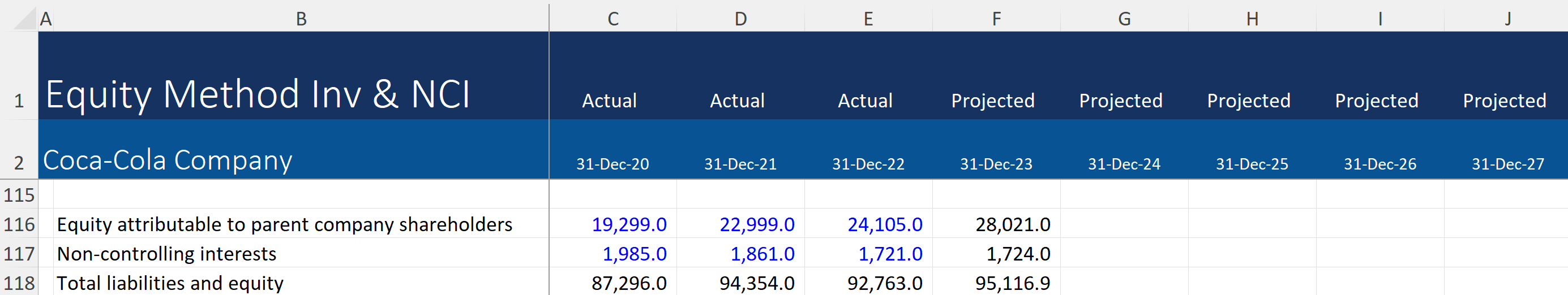

3) Balance Sheet Completion

Complete the balance sheet by incorporating the ending balances for equity attributable to parent company shareholders and non-controlling interests.

Again, the rows and headings have been added to the bespoke template, so just ensure the data is entered correctly and cells are linking to the appropriate year.

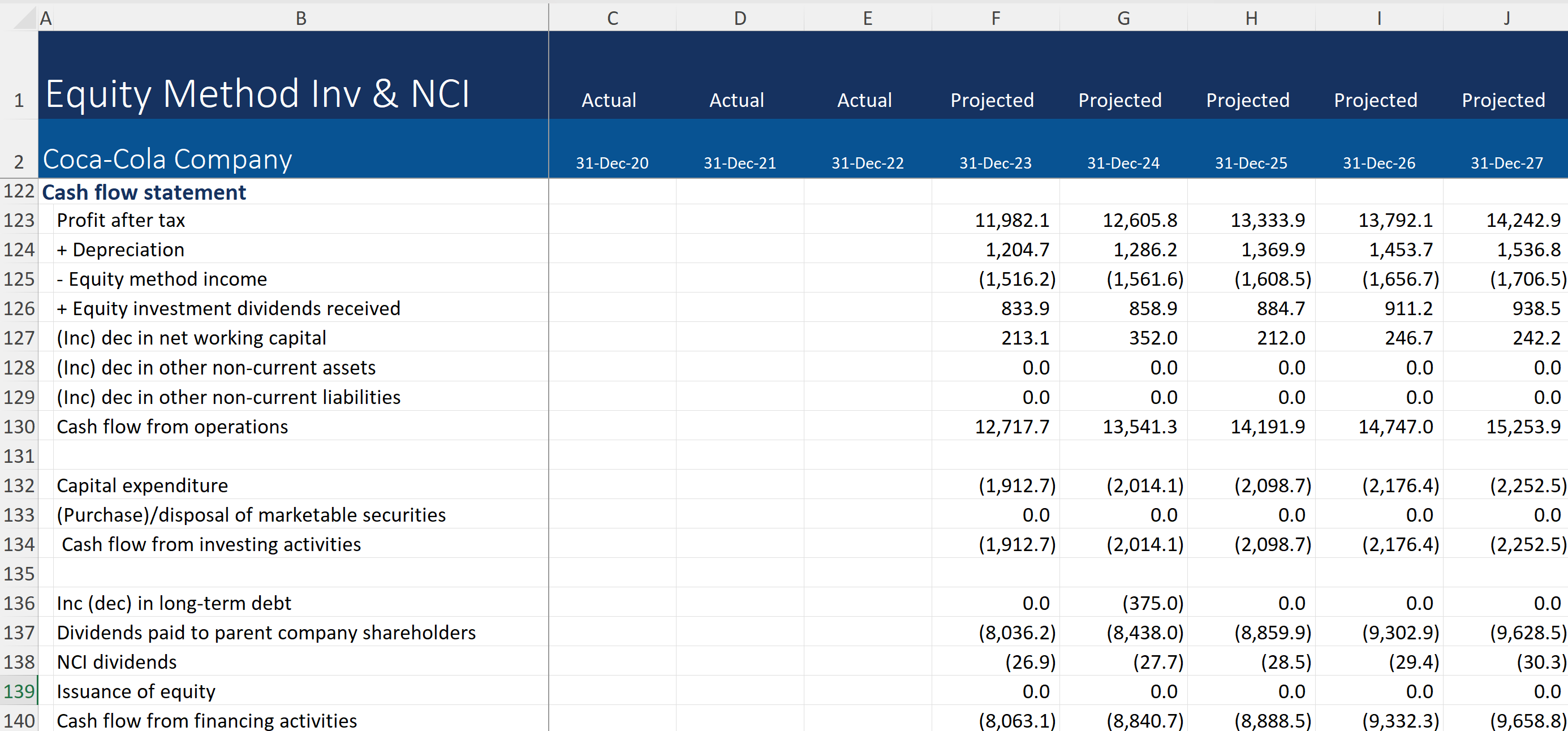

4) Cash Flow Statement Completion

Finalize the cash flow statement by including dividends from the base calculations and ensuring the model balanced. These lines have been left blank in the excel model so should be straightforward to add.

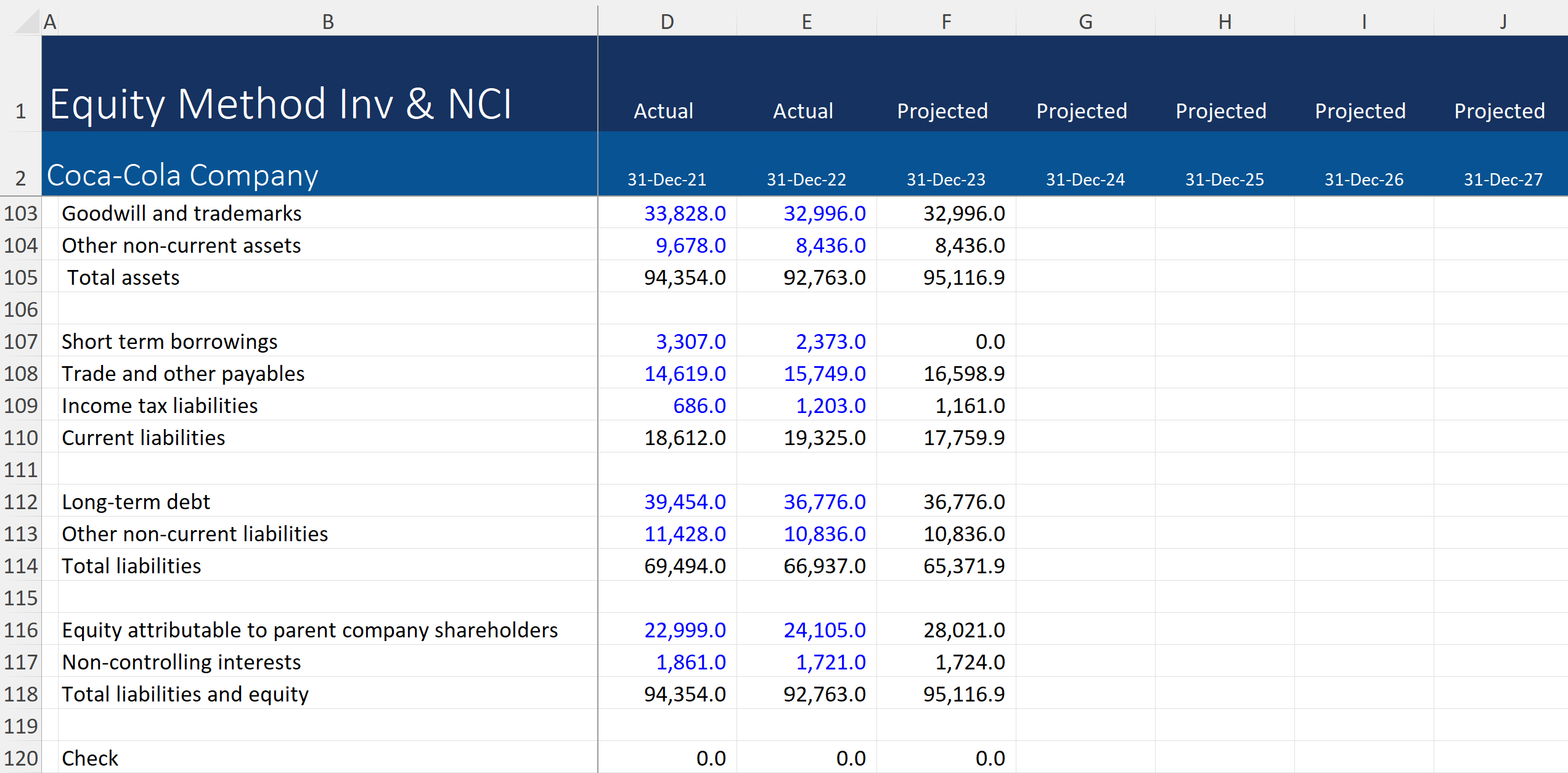

5) Final Check

After all entries are completed, the model is verified to ensure it balances, confirming its integrity. Use the excel model provided to make sure calculations are correct.

If the balance sheet doesn’t balance, then carefully start to check if any mistakes have been made in the model. If it is the same figure (e.g. 65.2) that each year is unbalanced by, then it will likely be an error in the first year it appears. Check all calculations and make sure formulas have been pulled across correctly. If it’s a different figure each year, then it may well be a calculation.

Also check to ensure that additions and subtractions are correctly inputted – it’s very easy to accidentally link a negative figure and forget that in the next calculation it is a positive!

Conclusion

Understanding and accurately modeling Non-Controlling Interest (NCI) is crucial for presenting a clear and precise picture of a company’s financial health. By ensuring that NCI is consistently reflected across the income statement, balance sheet, and cash flow statement, businesses can provide transparency and avoid overstatement of profits.

The key steps involve forecasting NCI income, calculating dividends, and updating base calculations for both NCI and parent equity. Additionally, it is important to consider the maturity of the subsidiary and the potential need to classify redeemable NCI as a liability. By following these guidelines, companies can ensure accurate financial reporting and maintain the integrity of their financial models.