Normalized Net Income

December 17, 2020

What is Normalized Net Income?

Normalizing net income refers to cleaning out the impact of non-recurring items to better understand a company’s ongoing net income. Normalized net income helps in seeing the underlying trends in a business more clearly and plays an important role in valuation. The identification of non-recurring items is subject to judgement, but the following are commonly considered:

- Restructuring/reorganization costs

- Unusual gains or losses

- Accounting policy changes which mean the items will not exist in future

- Fines and penalties

- M&A costs

- Impairments and write downs

- Severance costs

Key Learning Points

- Normalizing net income is the process of cleaning reported net income from the impact of non-recurring items

- All continuing income, including income from non-core activities is included in normalized net income. Only non-recurring items are

- Normalized net income helps in developing informed views about a business’ future performance

- In valuation, any distortions caused by non-recurring items might have a significant impact on the multiples used. Normalized net income helps remove such distortions

- Net income is a post-tax number so all non-recurring items must be removed on a post-tax basis

Normalized Net Income & Valuation

A thorough understanding of the underlying trends (growth rates, margins, returns) is critical for valuation. It enables an objective evaluation of the peer group for comparability and also provides context for the multiples. Any distortions in the underlying trends will undermine the ability of the valuer to make appropriate judgements on the output. For example, in cyclical industries, multiples are often averaged through the economic cycle. Any distortions caused by non-recurring items might have a significant impact on the average multiple used for the valuation.

Example: Normalized Net Income

Since net income is a post-tax number located at the bottom of the income statement, all non-recurring items must be removed on a post-tax basis. If the post-tax non-recurring items are not provided in the financial statements (which is common), then an estimated post-tax amount is calculated by assuming the tax impact at the marginal tax rate (MTR). The post-tax impact on net income is calculated as follows:

Non-recurring item * (1-MTR)

Calculation: Normalized Net Income

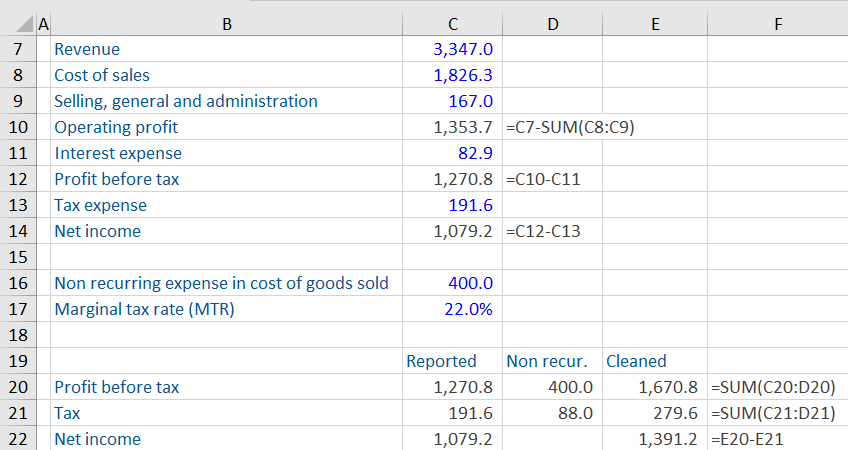

Based on the following information, we will demonstrate how normalized net income should be calculated. All figures are in ($) millions.

The company has a non-recurring expense of 400, which is included in its cost of goods sold, or cost of sales. The calculation of normalized net income starts with summarizing the profit before tax, tax, and the income as reported.

We will add the non-recurring expense to the profit before tax to get the normalized, or cleaned, profit before tax. Next, we will calculate the estimated tax impact arising from adjustment of removing the non-recurring expense from the profit before tax. Since the profit before tax is higher once this non-recurring expense is removed, there will be a higher tax expense, which is estimated by multiplying the non-recurring expense of 400 by applying the marginal tax rate of 22.0%. This means that if the expense of 400 was removed, profit before tax would be higher by 400 and therefore the tax expense would be higher by 88 [22% of the 400].

Based on this calculation, we get the cleaned or normalized net income of 1,391.2. Since the adjustment was for a non-recurring expense, the normalized net income is higher than the reported net income.

Normalized Net Income Vs. Adjusted EBIT/EBITDA

The process of normalizing net income is similar to the calculation of adjusted EBIT or EBITDA. However, when calculating adjusted EBIT or EBITDA, we also adjust for any non-core or non-controlled items. Non-core items reflect income or losses generated from activities outside of the core activities of a business. Non-controlled items refer to income or losses generated from businesses or subsidiaries in which the organization does not own a controlling stake.

When calculating adjusted EBIT, analysts look to understand the company’s core operating profits and therefore exclude any non-core income or income from controlling stake in another company.

However, in the calculation of normalized net income, we want to know the company’s continuing net income attributable to common shareholders from all of the activities the company undertakes to generate returns for its shareholders. This income includes the net income from non-core and non-controlled items. Therefore, we must include these in the calculation.