Research and Development (R&D)

What is Research and Development?

Research and development (R&D) is a process an organization undertakes to obtain knowledge that will potentially lead to innovation and the introduction of new technology, products, or services. In most cases, companies engage in research and development to introduce new products or services to add to the bottom line.

Companies conduct research and development is to stay ahead of their competition. Companies regard R&D as a potential future asset, rather than a source of immediate income. The return on investment for R&D is uncertain, so companies have to estimate the risk-adjusted return on their R&D expenses.

Technology and pharmaceutical companies usually spend the highest percentage of their sales on R&D. Due to the uncertainty of an investment return in research and development, general accounting standards and practices state that most R&D costs should be expensed to the income statement, however, more detail will be provided on this below.

Key Learning Points

- Research and development (R&D) is a process an organization undertakes to obtain knowledge that will potentially lead to innovation and the introduction of new technology, products, or services

- Software, technology, and pharmaceutical companies usually spend the highest percentage of their sales on R&D

- Under US rules, research and development costs are expensed. The only exception is software-related R&D costs, which can be capitalized

- Under IFRS, research costs are expensed, but development costs could be capitalized if they meet certain criteria

Accounting Treatment of Research and Development Costs

Under US rules, research and development costs are expensed. The only exception is software-related R&D costs, which can be capitalized. However, under IFRS, research costs are expensed, but development costs could be capitalized if they meet certain criteria. Here is the distinction between the two for accounting purposes.

Research Costs

These are costs aimed at the discovery of new knowledge. These costs are expensed as incurred, i.e., the full costs incurred are reported in the income statement. The profits for that year are reduced as a result of the expense.

Development Costs

Development translates research into a plan or design of a new product or a process. These costs can be capitalized, and the developed product can be recognized as an intangible asset if it meets the following criteria:

- The company should be able to demonstrate, among other things, the technical feasibility of the intangible asset being developed and that it can be sold

- The management intends to complete the intangible asset and should demonstrate how the asset will generate future economic benefits

- The management should have the resources to complete and sell the intangible asset

- The development costs can be reliably measured

Here are some examples of the distinction between research and development costs.

| Application |

Research |

Development |

| Self-driving car |

Expenses incurred on acquiring new knowledge of technology |

Expenses incurred on developing a new prototype |

| Mobile operating system |

Expenses incurred on researching new features of an operating system to replace an existing one |

Expenses incurred on testing the pilot version of a new operating system |

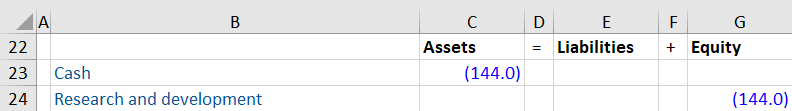

Research and Development Example

Below is an extract from Kellogg Company Income Statement Year Ended December 28, 2019.

Since Kellogg is a US company, the costs of research and development (R&D) are expensed as incurred. These are classified in selling, general and administrative expense. R&D includes expenditures for new product and process innovation, as well as significant technological improvements to existing products and processes. Company’s’ R&D expenditures could consist of internal salaries, wages, consulting, and supplies attributable to time spent on R&D activities.

Kellogg Company reported its R&D costs as follows:

*All figures are in millions