Share Buybacks

November 30, 2020

What are Share Buybacks?

Share buybacks or share repurchases are transactions where a company buys its own shares. The shares are normally bought in cash and are purchased from either the open market or directly from shareholders. The transaction results in a decrease to the number of shares outstanding and a corresponding increase in treasury stock.

Share buybacks are an alternative to paying dividends and another way of returning capital to shareholders.

Key Learning Points

- Share buybacks are transactions where a company buys back its own stock either from the open market or directly from shareholders

- A share buyback decreases the shares outstanding account and causes a corresponding increase in treasury stock

- Treasury stock is reported as a negative number in the statement of shareholders’ equity

- Profits are unaffected and earnings per share (EPS) increases because of the lower number of shares outstanding

- Return on Equity (ROE) and EPS are both affected post transaction

Accounting for Share Buybacks

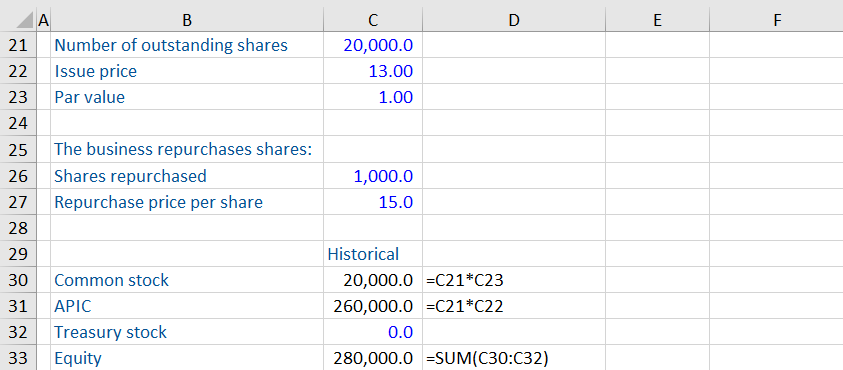

Here is a simple illustration of a share buyback. Suppose a company has a beginning balance of 20,000.0 common shares outstanding. The par value of each share is 1.00, and the issue price is 13.00. During its accounting period the board of directors decide to buy back 1,000.0 shares at 15.00 per share. Here is how the buyback will affect the shares outstanding.

Treasury stock is an account used for representing the number of shares repurchased from the open market. As a result of this buyback, the number of shares outstanding has reduced to 19,000.0.

Impact of Share Buybacks on Capital Structure:

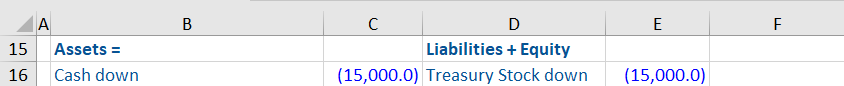

Continuing with the above example, let us look at the impact of share repurchases on the balance sheet and the equity of this company.

The company must pay cash to buy its own shares, so cash goes down by 15,000.0. The right side of the balance sheet equation is balanced by a reduction in the treasury stock account. Even though the treasury stock account is going up by the repurchase of shares, overall, it has a negative effect on the balance sheet as it reduces the equity.

The Effect of Share Buybacks on Equity:

Here is the historical scenario before the share buyback.

In the example above, the equity of the company is 280,000.0 prior to the share buyback. APIC stands for additional paid-in capital.

After adjusting for the share buyback, the equity comes down to 265,000. Note that equity should not be confused with equity value. Here, equity represents the value of basic common shares outstanding. Equity value calculations use the diluted number of shares outstanding. Several other things, such as stock options, restricted stock units, and conversion of bonds, go in calculating the diluted number of shares outstanding.

The Role of Share Buybacks in Valuation:

Analysts calculate a company’s equity value by multiplying the share price by the diluted number of shares outstanding. Basic common shares outstanding are the largest portion of the total diluted shares outstanding.

The number of shares outstanding is available in the company’s latest filing. If you look at the latest balance sheet or in the footnotes section of a company, you can get the number of shares outstanding as of the balance sheet date. If you are in the US, you can find updated information on shares outstanding in the latest 10-K (annual report) or 10-Q (quarterly report.)

However, there is a possibility of events like share issues or buybacks between the publishing date of common shares outstanding and the valuation date. Share buybacks reduce the number of outstanding shares. Analysts need to adjust the common shares outstanding to reflect these events.

Share Buybacks Key Metrics

Share buybacks reduce the equity balance and affect certain financial metrics:

Return of Equity (ROE):

Share buybacks reduce both cash and the equity account. A reduction in equity boosts the Return on Equity (ROE) ratio. Net income remains unchanged so only the denominator is decreasing.

EPS

A reduction in the number of shares outstanding also increases earnings per share (earnings now divide by a lesser number of shares). This change improves the Price-to-Earnings (P/E) ratio of a company. When valuing companies with a history of share buybacks, analysts should be alert to the buyback’s impact on key ratios.

Return on Invested Capital (ROIC):

Cash is used to purchase shares which decreases the cash balance. Less cash results in an increase in net debt. However, the net assets remain unchanged post transaction. This means the return on invested capital remains unchanged.