Types of Risks in Investing

July 9, 2021

What are the “Types of Risks in Investing”?

The fundamental concept in investing is based on the positive relationship between risk and potential return, but there are various types of risks that have to be considered. Assessing the individual’s risk appetite and selecting the right mix of asset types is a process during which “systematic” and “specific” risks are rigorously analyzed. This may include issues around inflation, currency, political and regulatory climate, economic or company specific events.

Key Learning Points

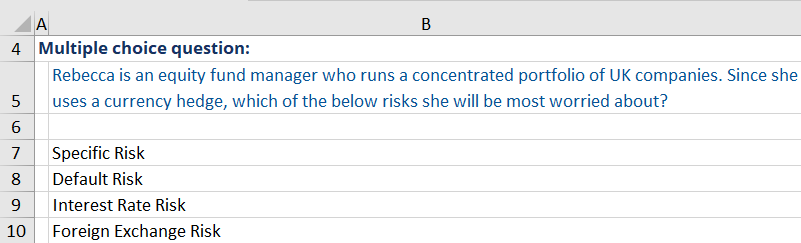

- The relationship between risk and return is fundamental in investing – the higher the risk, the greater the expected potential return

- Systematic risk (also known as market risk) relates to the entire economic system and will have an impact on all (or the vast majority of) market participants – this cannot be diversified

- Specific (also known as idiosyncratic or unsystematic) risk affects only a specific company or an industry and can be managed through diversification

- Some of the major types of risk in investing include foreign exchange risk, interest rate risk, default risk, political and liquidity risks

Different types of investment risk

Company Specific Risk

This type of risk relates to a particular business and its financial health. Companies are normally expected to demonstrate sound earnings, which sends a positive signal to investors and can contribute to sustainable stock price appreciation. Company specific risk includes the management of all internal aspects of the business, for example costs of production or administrative expenses. Specific risk could be dependent on factors such as demand and cost of goods, sector and direct competition, and profit margins. The announcement of company results is therefore closely watched by both existing shareholders and potential investors as a measure of the health of the company and underlying businesses.

Foreign Exchange Risk

Also known as currency risk, this is a major risk that needs to be considered as change in exchange rates can change the price of an asset too. This type of risk is applicable to all financial instruments that are priced in a different currency to the domestic currency. For example, a British investor buys Australian stock in domestic Australian dollars, and although its share price appreciates in one year time, GBP strengthens against the AUD and the investor might be making a loss due to the exchange rate risk.

Interest Rate Risk

This type of risk relates to the potential change in the value of an asset due to a change in interest rates. It directly affects bond prices and is a significant risk for fixed income investors. It is typically measured as by the “duration” of a security, which represents its sensitivity to changes in interest rates.

Default Risk

Also known as “credit” risk, this type of risk is most concerning to bond investors. It generally relates to the creditworthiness of the borrower and is assessed on a number of factors such as previous history of meeting debt obligations and forward-looking economic prospects. Government bonds are considered less risky than their corporate peers, but as a result of that provide lower yields. Lower risk bonds are categorized as “investment grade”, where those with high default probability as labelled by major credit rating agencies such as Standard & Poor’s, Moody’s and Fitch as “junk”.