Commercial Bank

November 4, 2020

What is a Commercial Bank?

A commercial bank is an institution, which provides a range of retail banking products and services to both individuals and corporations. These services typically include checking and savings accounts, loans, credit, and other forms of borrowing.

Commercial banks accept deposits from their customers and use these deposits as their main source of capital to lend money out to borrowers. These loans are a form of debt to the borrower, which represents a present financial obligation where the borrowed amount must be repaid at a later date. The repaid amount usually includes interest payments, which is the main source of profit for the bank. From the bank’s perspective, these securities are recorded as an asset on their balance sheet, as they are resources controlled by the bank with the expectation of generating future economic benefits.

Commercial banks play an important role in society. They provide customers with a means to safely store their money whilst providing liquidity and capital to those in need. Commercial banks’ services are not limited to lending; many also offer brokerage services as well as financial planning and other consultancy work in return for a fee.

How Do Commercial Banks Work?

Let us explore the main business model for this type of institution.

Deposits

Commercial banks accept deposits from corporations, governments, or individuals, and provide interest on these deposits. These are recorded as liabilities on the bank’s balance sheet. Customers can opt for instant access deposits, such as savings and current accounts, or fixed-term deposits that offer a fixed return for a fixed term.

Loans

Commercial banks use the capital generated from deposits to offer loans and advances to individuals and businesses. These are recorded as assets on the bank’s balance sheet. They make money by lending to borrowers at a higher interest rate than they offer to depositors. These loans come in different forms such as consumer loans, mortgages, working capital loans such as credit line or bank overdrafts, equipment financing for purchasing fixed assets, etc.

Equity

Banks undertake credit analysis to ensure their money is lent out prudently with minimal However, unforeseen events can lead to defaults and bad loans. Banks need some headroom, known as equity, between the deposits and loans to deal with unforeseen challenges. Banks quantify credit risk using an expected credit loss (ECL) model that calculates the probability of default. They use ECL calculations to set aside additional capital to deal with the forecasted losses.

Other Expenses and Income

Banks require funds for administrative expenses & overheads. In addition to interest, banks generate income through fees, such as minimum balance fees, consulting fees, FX etc.

Reserve and Capital Requirements for Commercial Banks

Commercial banks must adhere to regulatory requirements to maintain enough funds to meet sudden withdrawal requests. The requirements vary by country. For example, in the US, all commercial banks are required to maintain a certain amount of cash as reserves in their vaults or at their nearest Federal Reserve bank. The reserve requirements depend on the amount of deposits held by the commercial bank.

Here is an example of the reserve requirements for banks in the US as of 2018.

| Deposits |

Reserve requirement (%) |

| Less than $16 million |

0 |

| Between $16 million and $122.3 million |

3% |

| Above $122.3 million |

10% |

Countries such as the United Kingdom, Canada, and Australia, among others, do not have reserve requirements. However, commercial banks in these countries are required to have an additional layer of capital to absorb potential losses. The respective country’s financial regulator governs the capital requirements.

Example: Building a Basic Bank Income Statement and Balance Sheet

Banks are required to report their financial data to investors and other stakeholders. A bank’s balance sheet does not include items like plant and machinery, accounts receivable/payable, and inventory. A bank’s income statement is similar to that of other businesses and reports the bank’s profit and expenses over a financial period. Here, we build a basic balance sheet and income statement for a bank based on the following assumptions.

Assumptions (in millions)

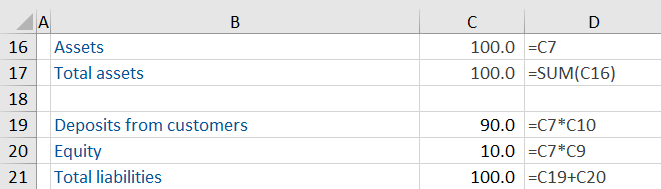

Balance sheet

The balance sheet reports the bank’s financial position at a point in time and is based on the accounting equation:

Assets = Liabilities + Equity

Key items can be substituted into the equation to reflect the main asset, liability and equity items bank’s report in the balance sheet.

Loans (Assets) = Deposits (Liabilities) + Equity (Ownership)

Banks charge interest on their loans which is accounted as interest income and pay depositors interest on the amount of their savings. This is reported as interest expense in the income statement. The balance sheet is shown below for the above data:

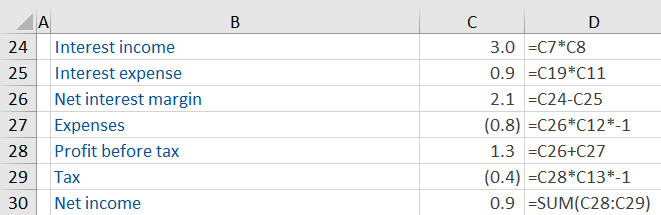

Income statement

The net interest margin is the difference between interest received and interest paid. After accounting for expenses and taxes, the bank is generating a net income of 0.9 million. The return on equity is a common metric when analyzing the performance of a bank. It expresses the profits generated for shareholders as a percentage of the equity investment. It is calculated as:

Return on Equity (ROE) = Net income / Shareholders’ equity

In the above example, this is calculated as:

ROE = 0.9 / 10.0

= 9.0%

It is typical for a bank in the US and Europe to have ROEs between 5.0%-10%. Ideally, this should be equal to or above the bank’s cost of capital.

The Difference Between Commercial Banks and Investment Banks

Commercial banks cater to individuals and businesses. They provide checking account services, offer various kinds of consumer and business credit services such as mortgages, credit cards, or overdraft facilities. They also offer services like foreign exchange or bill payment facilities.

Investment banks cater to large companies, institutional investors, and high net worth individuals. Their services include underwriting, raising capital, mergers & acquisitions, and performing advisory services. Goldman Sachs is an example of an investment bank.

The line between commercial and investment banks is often blurred and these institutions are referred to as universal banks. Most banks offer a mix of services depending on the needs of their customers. For example, Barclays and JP Morgan offer both commercial and investment banking services.