How to Become an Investment Banker

September 10, 2024

What is an Investment Banker?

An investment banker is a finance professional who works closely with corporations, institutions, and governments to help them raise capital, conduct a merger or acquisition, or restructure. For example, a client may require debt financing in order to acquire a target or need strategic advice on the acquisition. Investment bankers are split into coverage groups (such as Consumer, Retail & Healthcare) and product groups (such as Mergers & Acquisitions) to cater to specific client needs.

Key Learning Points

- Investment bankers help companies raise capital and advise clients on deals

- A degree and relevant work experience are important prerequisites for the job

- Certifications and courses are not required for investment banking applications

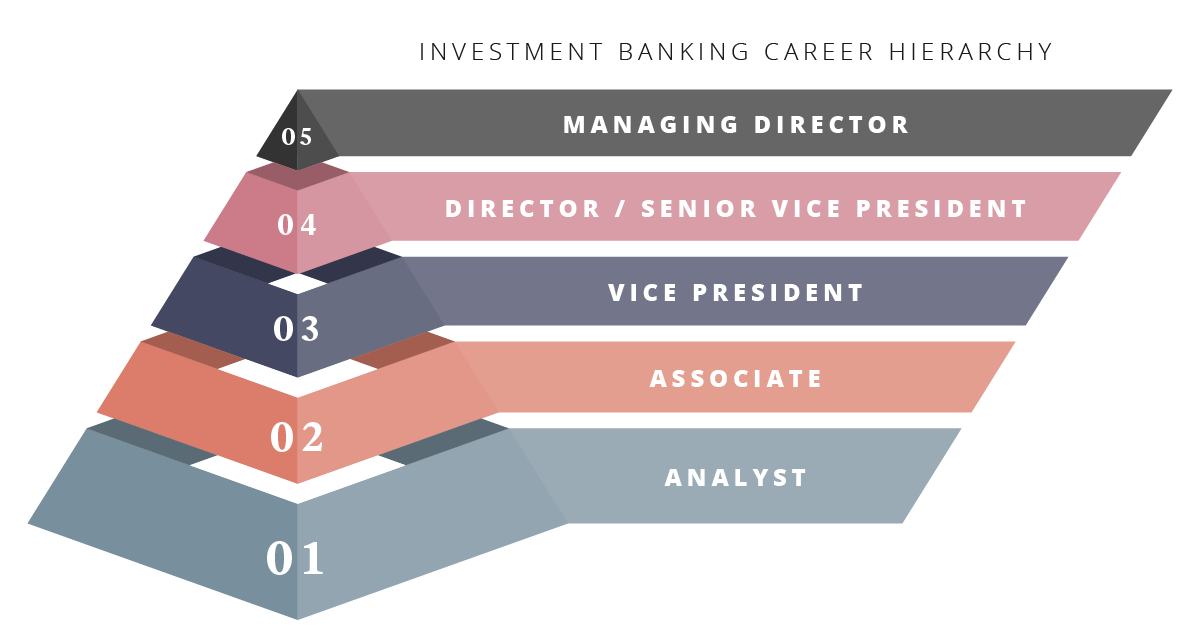

- There is a clearly defined team structure and hierarchy within banks

- A wide range of skills is required to succeed in investment banking

Education Requirements for Investment Banking

To become an investment banker, it typically requires a minimum of a bachelor’s degree with a passing grade of a 2:1 in the UK. Some banks in the US are highly selective and favor applicants who have graduated from an Ivy League college. Although STEM (science, technology, engineering, and mathematics) students tend to gravitate toward investment banking, this type of degree is not a requirement. Relevant work experience, such as internships in the financial services sector, are vital when applying for a full-time role in investment banking.

How to Break into Investment Banking with No Experience

The key to getting your foot in the door is an internship. This is usually the first point of contact in investment banking and often takes place during a 10-week period over the summer. An off-cycle internship, which takes place outside the regular internship cycle, is another option. Typically, there is a rigorous application process for either option and includes submission of a CV/resume and cover letter, online psychometric tests, a variety of interviews, and a visit to an assessment center. These internships not only provide first-hand industry experience, but also help build your network and potentially secure a full-time offer. Voluntary work placements in the financial sector and relevant qualifications can also help position your application when applying for internships.

Access the free download to see two examples of resumes – a good version and a bad version. The good version is crisp and succinct, and it leads the eye of the reader from well-chosen highlight to another. The bad version of a resume is bland, wordy and uninteresting. Before submitting your resume to your top choices, it’s a good idea to circulate your resume to professionals and ask them for their constructive feedback.

Investment Banking Certifications

Professional qualifications can help you stand out in your investment banking career. Online courses from reputable financial training providers can put you in good stead to refine your technical skills such as accounting, financial modeling and valuation. Our online investment banking course gives you access to the same training as new hires to the top 4 investment banks. Enroll on the Investment Banker to start mastering accounting, financial modeling and valuation, and receive a recognized Wall Street Certification.

Other qualifications include the Chartered Financial Analyst (CFA) and the Associate Chartered Accountant (ACA) in UK or CPA in USA, which require years of study and a number of exams to pass. Typically these qualifications are undertaken by those with a finance, accounting, economics, or business background, and have certain work experience requirements.

Investment Bank Team Hierarchy

The investment banking career hierarchy follows a clear progression, starting with Analyst, moving up to Associate, Vice President (VP), Director/Senior Vice President (SVP), and reaching the top position of Managing Director (MD).

Investment Banking Analyst

- Description: Analyst is the most junior position in the bank. Analysts work closely with associates to compile marketing materials for client pitches, build financial models for company valuation purposes, and support their team with industry and product research.

- Estimated Salary: £65,000 in UK; $80,000 in US

- Estimated Bonus: £30,000 to £45,000 in UK, $56,000 to $64,000 in US

- Promotions: Promoted to Associate within 2-3 years

- Exit Opportunities: Corporate Finance, Private Equity, Management Consulting, Hedge Funds, Venture Capital, FinTech, Entrepreneurship

Investment Banking Associate

- Description: An Associate manages Analysts in delivering marketing materials and other content to the vice presidents (VPs) above them. The Associate’s role is similar to that of an Analyst with additional responsibilities, such as taking ownership of financial models.

- Estimated Salary: £90,000 in UK, $150,000 in US

- Estimated Bonus: £60,000 to £75,000 in UK, $90,000 to $120,000 in US

- Promotions: Promoted to VP within 2-3 years

- Exit Opportunities: Corporate Finance, Private Equity, Management Consulting, Hedge Funds, Venture Capital, FinTech, Entrepreneurship

Investment Banking Vice President (VP)

- Estimated Salary: £140,000 in UK, $250,000 in US

- Estimated Bonus: £100,000 to £170,000 in UK, $200,000 to $400,000 in US

- Promotions: Promoted to Senior Vice President within 3-4 years

- Exit Opportunities: Corporate Finance, Private Equity, Management Consulting, Hedge Funds, Venture Capital, FinTech, Entrepreneurship

Investment Banking Managing Director

- Estimated Salary: £210,000+ in UK, $350,000+ in US

- Estimated Bonus: 100% to 200% of base salary

- Promotions: Can be promoted to head a product/sector group or to the company C-suite

- Exit Opportunities: Corporate Finance, Private Equity, Management Consulting, Hedge Funds, Venture Capital, FinTech, Entrepreneurship

Note: Estimated salaries are subject to changing markets, and other factors e.g. bulge brackets tend to pay more than smaller boutiques.

Key Skills Required for Investment Bankers

Commercial awareness is crucial, coupled with a broad understanding of how macroeconomics and financial markets work. In terms of technical skills, investment bankers must have acute attention to detail above all else, while a strong numerical ability and fluency with PowerPoint and Excel are also prerequisites. In terms of soft skills, bankers must be articulate, able to work in a team environment, and must be willing to put in long hours and function well in a high-pressure environment.

Investment Banking Working Hours

It’s no secret that investment banking entails very long hours. Investment banking analysts can expect to work anywhere between 80 to 100 hours per week on average. This is largely due to the nature of the job, as quick turnarounds are required to deliver work for clients and for the bank to position itself for potential opportunities. A typical day as an investment banking analyst may start at as early as 7:30 am and end at midnight or later. It’s not uncommon for bankers to work over the weekend and even during holidays.

Investment Banking Pros and Cons

Pros: Technical skills learned, networking opportunities, exciting career prospects, various exit opportunities, high salary and compensation, transparent promotion system, practical learning, deal-driven experience.

Cons: Long hours, high degree of pressure, steep learning curve, working during weekends and holidays, limited work-life balance.

How to Get a Job in Investment Banking

Why Investment Banking May be Right for You?

If you gravitate towards the financial industry and you are naturally career-focused, investment banking can offer a rewarding career both in terms of experience and compensation. The deal-driven nature of the job means that no one project is ever the same and you will find yourself constantly learning. Investment banking also offers a strong platform for both technical and soft skills, equipping you with a toolkit for success in any future career. The various exit opportunities available means that you have the flexibility to switch to an alternative career path after a few years’ of experience in investment banking. If you are looking to build a long-term career in the industry, there is a clear progression path and you will find yourself taking on more responsibilities over time, which can be extremely rewarding.

Additional Resources

Everything You Need to Know about Investment Banking Spring Weeks