Private Equity Associate: The Recruitment Timeline

October 29, 2022

How Does Private Equity Recruitment Work?

Private equity is an incredibly competitive field with limited opportunities for entry. Since private equity is such a highly paid, prestigious, and competitive field, banks need to make little effort to attract candidates.

Private equity recruitment is the process that PE firms use to source, interview, and hire new employees. There are relatively very few private equity roles, and PE firms tend to apply very narrow hiring criteria.

Unlike college recruiting, during which it’s possible to apply online or through on-campus recruiting efforts, most PE firms don’t have an online portal. Instead, headhunters recruit for these roles, and each firm typically hires an executive recruiter to run its associate recruiting process.

Key Learning Points

- Private equity recruitment is the process that PE firms use to source, interview, and hire candidates.

- The PE process usually includes multiple rounds of interviews. Normally, analysts and associates will have 2-3 interviews; some firms even require 4-5.

- Internship recruitment is less intensive, requiring only 1-2 interviews.

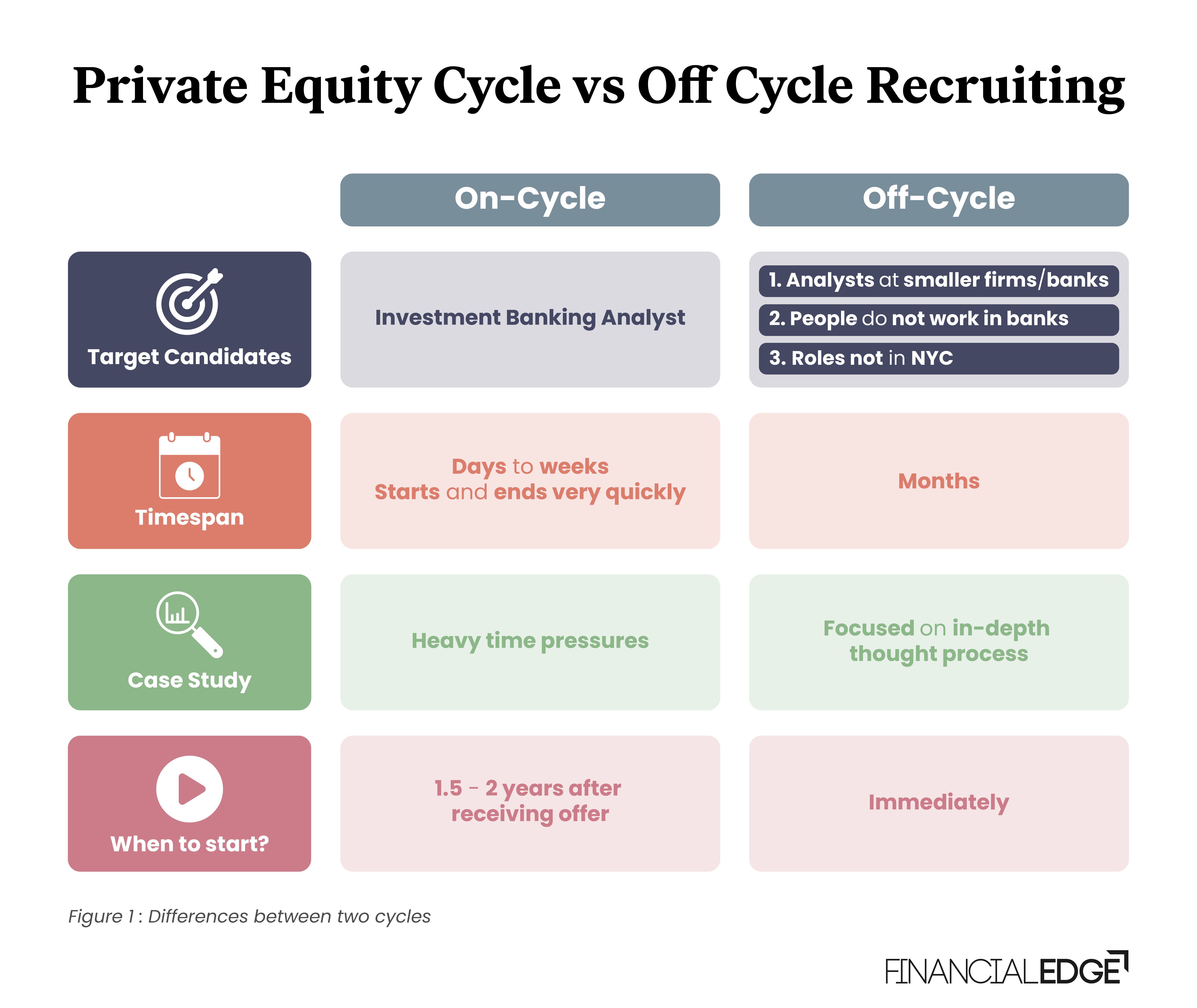

- There are two types of recruiting processes, on-cycle and off-cycle.

- The main differences between on-cycle and off-cycle are the timing, the hiring criteria, the number of steps, and the interview.

- If you’re interviewing for a job in a private equity firm, you need to think carefully about what will make your resume deal-oriented and prepare for questions that are likely to be asked frequently, including those assessing technical knowledge, deal experience, firm and industry knowledge, fit, and personality.

Private Equity Recruiting Process

There are two types of recruiting processes, on-cycle and off-cycle. They both aim to recruit for the associate role, but they differ in timing, hiring criteria, steps, and interviews.

On-Cycle Recruiting Process

The on-cycle process is mostly meant to hire the top associates from bulge bracket and elite boutique banks. However, as the industry continues to grow, PE firms now also conduct on cycle recruitment for Summer Analyst (i.e: internship) and Full-Time Analyst programs.

- For associate positions: The on-cycle process can start as early as July to October, only a couple of months after analysts at bulge bracket or elite boutique banks start their jobs. If you are offered a job, you can only start the position in the next 1.5 – 2 years. The process is conducted rapidly and the executive recruiter is a powerful figure whom it will be vital to impress.

- For intern and analyst positions: Interns and analysts are not a recruiting priority and the process can vary year by year. The interview process is not as exhausting as that for an associate role and interview questions skew towards fit questions more than deal experience and case studies.

Off-Cycle Recruiting Process

The off-cycle process is conducted by middle market funds recruiting for associate positions, roles outside the US, and positions for which IB experience is not required. Candidates hired during the off cycle can begin work immediately.

The off-cycle recruiting process will start earlier than the on-cycle, typically in January. However, off-cycle interviews can be much more difficult to convert into an actual offer. There’s no rush for the firms, so the duration is longer. Recruiters want to assess “fit” and critical thinking abilities on deeper levels. Interviews require more thought and you may need to prepare a real investment thesis. Headhunters have little power here, although it’s worth reaching out to them on the chance there could be an open position.

Once an offer is extended, you’ll begin work within weeks rather than waiting for 1.5 – 2 years.

Private Equity Recruiting Timeline

The main cycle of private equity recruitment begins around mid-February, and it’s been moving earlier every year.

Indicative Timeline:

September – November: Prepare the first version of your resume for headhunters, begin refining your story, and schedule headhunter meetings.

October – December: Headhunter meetings.

November – January: PE firm info sessions/dinners. A few small firms may try to jump the main process, participate in interviews, and practice for modeling tests.

January – February: main recruiting cycle

Figure 2: PE recruitment timeline

How to Prepare for Private Equity Recruiting

Prepare for behavioral questions

Recruiters want to learn how your previous academic and work experience is applicable to the private equity space and will attempt to do so through behavior-based questions. You should prepare stories that reflect your achievements, experience, transferable skills, and leadership, as well as answer questions related to strengths and weaknesses. Behavioral questions are intended to show how you might react in particular situations.

Prepare for technical questions

Technical and in-depth private equity questions will allow hiring managers to assess your knowledge of the field. They aim to get a better idea of how much you know.

Private Equity Resumes

As with any other professional role, the resume is the “first impression.” PE hiring managers are insanely busy and if they don’t see what they’re looking for within 30 seconds, the resume will be passed over. The ideal PE resume should:

- Briefly include educational credentials (University, GPA, SAT scores).

- Primarily focus on relevant investment banking and deal experience.

- Mention previous internships and jobs briefly and only if relevant.

- Very briefly mention skills/activities/interests.

Private Equity Interviews

Once the resumes have been reviewed, you will receive an official invitation to interview. Almost all private equity interview processes are similar and there are some things you should be aware of before the first interview.

- Timing: With the mega-funds, the recruitment process takes several months from start to finish. In contrast, at smaller PE firms, interviews start later and the entire process lasts for several weeks.

- Multiple Interview Rounds: The number of rounds depends on the firm. Typically, there will be at least 2-3 rounds of interviews with junior to senior professionals at the firm. Most PE firms will have a mix of first-round interviews, a modeling test/case study, and a final round with the p But each firm has its own unique practice.

- Interview Topics are diverse, so having some idea before going into the process can be helpful. During a private equity interview, you will have to answer many types of questions, for instance: technical questions, fit/background questions, deal/client experience questions, firm strategies and portfolio questions, and market/ industry questions. You will also complete case studies and modeling tests. In the large fund on-cycle process, the focus is likely to be on modeling and deal/client experience. In smaller funds and in off-cycle interviews, the focus will be more on your practical experience with clients and deals. You may also be asked to explain your reasoning for completing case studies or modeling tests.

Join Nik Malik, co-founding Partner of a Captive Private Equity Firm and former Investment Professional, and Orlando Whippy, a top-level Private Equity Recruiter, as they help you to prepare for your next interview with the Private Equity Associate, and learn everything you need to succeed as a PE Associate.

Conclusion

Private Equity recruitment is the process that PE firms use to source, interview, and hire candidates and is notoriously intense. There are two types of recruiting processes, on-cycle and off-cycle. The on-cycle recruitment process applies to analysts at elite banks and occurs within a few months of their start date in the analyst role. Offers from private equity firms are given for 1.5 to 2 years out. The off-cycle recruitment process applies to analysts at smaller firms/banks and applies to candidates who don’t work in banking, or for roles outside NYC. In this process, job offers are for positions that begin immediately.

Additional Resources

Private Equity Interview Questions