Bankruptcy

September 29, 2021

What is “Bankruptcy”?

Bankruptcy is a legal process involving corporations that are unable to repay their outstanding debt to their creditors. Typically, the bankruptcy process begins with the debtor filing for protection under a country’s bankruptcy laws. In the US, the “bankruptcy code” governs the procedures to be followed when filing for bankruptcy. Enron, Lehman Brothers, and WorldCom are prominent examples of bankrupt companies.

Key Learning Points

- Bankruptcy is a legal process where a corporate (or individual) formally acknowledges that it is unable to pay its debt commitments and seeks relief.

- Bankruptcy proceedings can be initiated by the company or the debtor who is looking to recover their investment

- In the US, bankruptcy procedures are governed under the “bankruptcy code”.

- Two chapters deal with corporate bankruptcy: 1) Chapter 11, and 2) Chapter 7

- Chapter 11 gives a chance to companies to continue their operations and restructure their debt

- Chapter 7 bankruptcy applies to firms beyond the stage of restructuring. Companies filing a chapter 7 bankruptcy halt their business operations and liquidate their assets to pay off debt

US Chapters of Bankruptcy Explained

When it comes to corporate bankruptcy, there are two chapters in the US.

Chapter 11 (Reorganization Bankruptcy)

Under chapter 11 bankruptcy, companies can still run their business and reorganize the corporation to become profitable. Further, this chapter prevents companies from closing their businesses and gives them time to restructure their debt. While working with a company to develop their reorganization plan, the government also appoints one or more committees that represent the interests of creditors and investors interests.

Creditors and stockholders should accept the reorganization plan. Even if they reject the plan, the court can still confirm the changes if it is convinced that creditors and stockholders are getting fair treatment. Upon confirmation of the plan, the company must file a detailed report with the SEC.

Chapter 7 (Liquidation Bankruptcy)

Under chapter 7 bankruptcy, the company halts its business operations and ceases to exist. Companies filing for chapter 7 bankruptcy are beyond restructuring and need to sell their assets, in order to pay off creditors. A government-appointed trustee is responsible for selling the company’s assets and using the money to pay off debt. Assets are divided among creditors in the following order:

- Secured creditors (such as banks)

- Unsecured creditors (such as suppliers or holders of unsecured debt)

- Stockholders (equity)

Stockholders are the last in line, and they get repaid only after secured and unsecured creditors’ claims are settled. Sometimes, stockholders can lose their entire investment.

Leverage Ratios and Bankruptcy

Leverage ratios are used to measure the proportion of debt owed by a company as a percentage of its total financing. These ratios also help measure a company’s ability to support interest payments or principal repayments on its outstanding debt. High leverage ratios indicate that a company has aggressively relied on debt to meet its financing needs.

This can affect a company in two ways:

1) If the ratio gets uncomfortably high, lenders will not be willing to extend further credit to the company, resulting in a potential cash flow shortage for the firm.

2) High debt means the company is incurring high-interest expenses, leading to high cash outflows. Both these scenarios can lead to bankruptcy.

Given below are the widely used leverage ratios:

Debt to EBITDA Ratio

The debt to EBITDA ratio analyses the relationship between a company’s debt and its earnings before the impact of depreciation and amortization. Lenders prefer a low debt-to-EBITDA ratio.

Debt to Equity and Debt to Capital Ratios

The debt to equity and debt to capital ratios examine the proportion of debt financing in a company’s capital structure. When this ratio is high, it indicates that a company is more reliant on debt than equity for its financing needs.

Interest Coverage Ratio

Interest cover is calculated as EBITDA divided by interest expense. A high-interest coverage ratio indicates the company has adequate profits to cover its interest expenses.

Example 1: Leverage Ratios and Bankruptcy

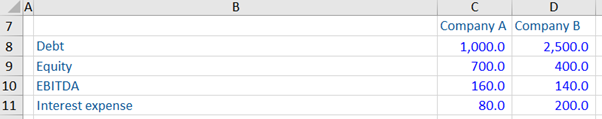

Based on the information given below, the leverage ratios of two companies have been calculated and the company that has a greater risk of bankruptcy has been identified.

Company B has a much higher debt in relation to its EBITDA and equity capital than company A. Further, it also has a much higher proportion of debt in its total capital. Such high leverage will limit Company B’s ability to raise further debt should it need additional capital.

The high leverage is also reflected in Company B’s low-interest coverage ratio. Its interest expenses are more than its EBITDA. Unless its earnings increase substantially, these interest commitments will have to be met from the company’s cash reserves. All these factors put company B at a higher risk of bankruptcy than company A. Learn how to identify companies in financial distress, and master they skills needed for a successful career in restructuring with the Restructurer micro-degree.