Inflation and Stock Prices

What is the Relationship Between “Inflation and Stock Prices”?

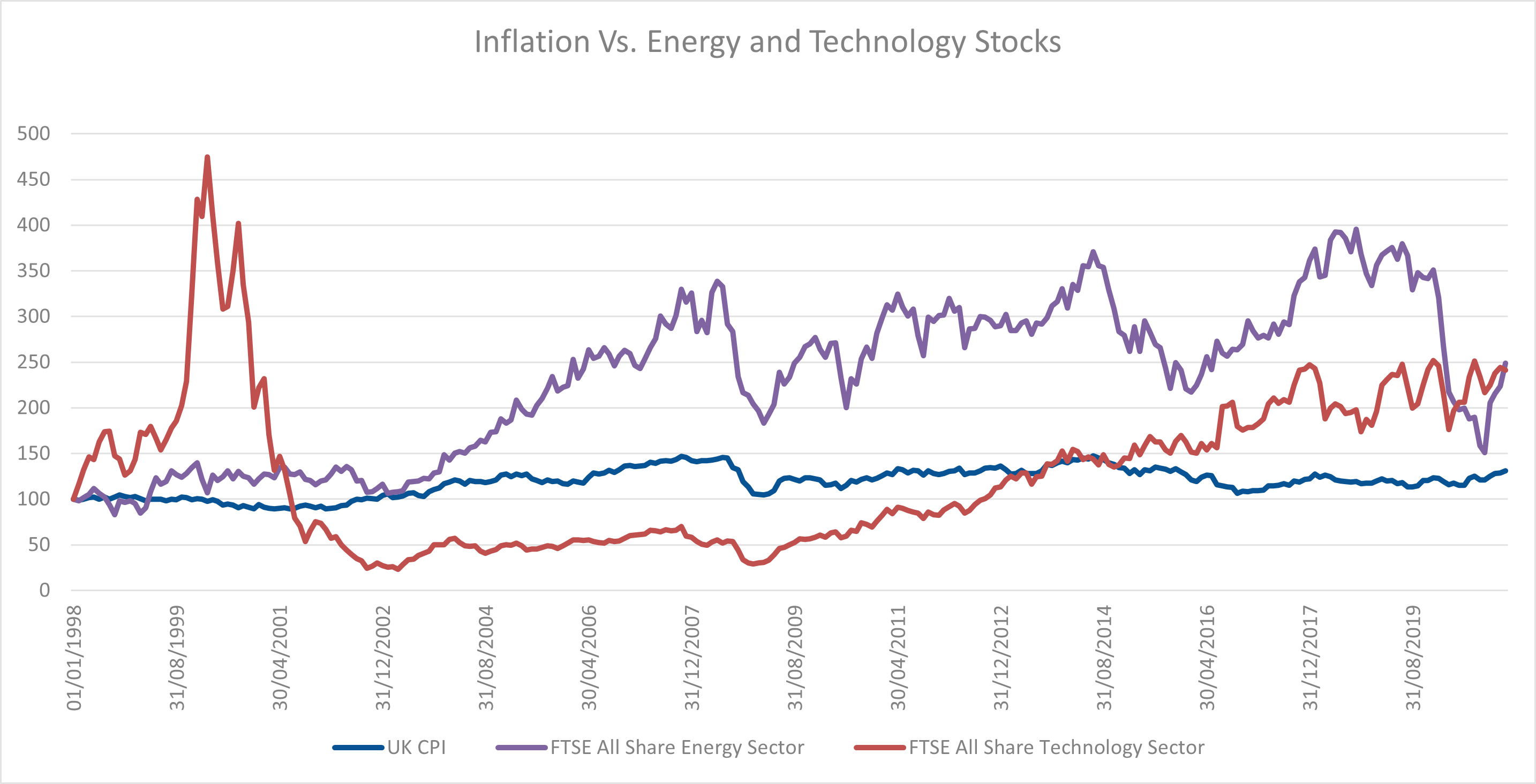

Traditionally, equities are viewed as an investment asset class hedge against inflation over the long-term. Sectors such as energy and metals have historically provided good inflation protection features and returns above the level of inflation. However, studies also show that they might not be as efficient over the short-term, where the company’s ability to respond to higher input prices is critical.

The relationship between stock prices and inflation could be either strong or relatively weak depending from which perspective the correlation is assessed. One of the big fears for investors is losing purchasing power as a result of increasing consumer prices, which could erode potential returns.

Key Learning Points

- Inflation is the increase in goods and services prices, which can in turn reduce the consumers’ purchasing power

- Central banks combat high levels of inflation by raising interest rates, which in turn can make businesses with strong current cash flows more favorable investments

- During periods of high inflation, value stocks tend to offer better capital protection than their growth-oriented peers

- Value stocks tend to perform better during times of low inflation

- Stocks can be a good hedge against inflation, but investors need to accurately determine the current point in the market cycle

- Economically sensitive and cyclical stocks such as those in the energy or materials (commodities) sectors should in theory offer inflation protection features

Investment Styles and Inflation

While relatively low risk asset classes, such as cash or bonds, struggle to beat the rate of inflation, investing in equities might be a good solution to achieve a positive real return. The tricky bit is that not all stocks have the potential to beat the rising prices and investors should be mindful of this in their investment style.

Value companies typically have high current cash flows that will slow going forward, whereas growth-focused businesses have lower cash levels that are expected to increase in the future. This can make value stocks more attractive during times of high inflation and when central banks increase their interest rates to combat rising prices. As a result, there can be a positive correlation between inflation and performance of undervalued stocks.

In addition, companies that are distributing profits in the form of dividends could also underperform during inflationary times and see their share price declining, which however may create an attractive entry point for contrarian investors.

Which Sectors Offer Optimal Protection Against Inflation?

The most obvious candidates are energy-related companies that are involved with oil and gas activities since their revenues are naturally linked to underlying energy prices. Another sector that has the potential to beat inflation on a similar principle is commodities. In fact, some investors analyze commodity markets in order to forecast forward-looking inflation rates.

On the other hand, the information technology sector is a good example for a high growth-focused segment of the market offering future capital growth, which will however be worth less in real terms compared to the current value of the money should inflation increase.