Debt Schedule

July 14, 2021

What is “Debt Schedule?”

The term debt schedule is in the context of an LBO transaction. It refers to the calculation of the annual principal and interest payments due each year, following an LBO transaction. In an LBO transaction, multiple debt instruments are involved. The purpose of the debt schedule is to make sure that all the repayment obligations related to such debt instruments are met.

Key Learning Points

- The sources and uses of funds at the entry of an LBO deal and debt structure need to be known, to comprehend the debt schedule;

- The debt schedule should be set up in order of seniority

- The Initial amounts of debt should be driven from the sources and use of funds table.

Debt Schedule – Sources of Funds and Debt Structure

Sources and uses of funds at the entry of an LBO deal help to organize what funds a company has, what interest rates it needs to pay etc. Regarding the source of funds, the major items are debt financing and equity financing from private equity funds. Regarding debt, there are a number of items – revolver, term loan A and B, mezzanine loan, or a PIK note paid in kind and senior secured notes.

The debt schedule should be set up in the order of seniority, starting with revolver, followed by senior secured loan, subordinated loan, PIK note, and followed by cash balances. The initial debt amounts should be driven from the sources and use of funds table.

Cash Sweep – Debt Schedule Revolver

The cash sweep assumes that all available cash is used to repay debt, in order of priority – the senior most tranches first, followed by the subordinated or junior tranches.

Cash flows available for debt repayment drives the amount of debt repaid each year.

The LBO model should account for three possible outcomes for the revolver. First, repayment up to the level of surplus cash, second, repayment up to the beginning balance of the revolver, and lastly, issuance equal to any cash shortfall.

Cash Sweep – Long-Term Debt

Any cash remaining after revolver repayment is available for accelerated repayments of long-term debt. The scheduled amount of each debt repayment should take into account earlier accelerated repayments, otherwise the debt is likely to be overpaid.

Accelerated debt repayments are made, if there is surplus cash available and there is an outstanding balance of the debt tranche. The smaller of these two amounts is the accelerated repayment.

If there is more than one tranche of long-term debt, seniority determines the order of the accelerated debt-related repayments. Cash available for acceleration is used to accelerate repayments on the most senior debt first.

Cash Sweep – Debt Schedule Interest Calculations:

Upon completion of the cash sweep, interest is calculated by either using beginning balances in debt issuances or average balances in the same.

Usually, the following components are used to calculate interest on average balances: cash, revolver, including revolver commitment fee, Term A, B and C, second lien and high-yield notes.

Model – Debt Schedule, Principal Repayment Example

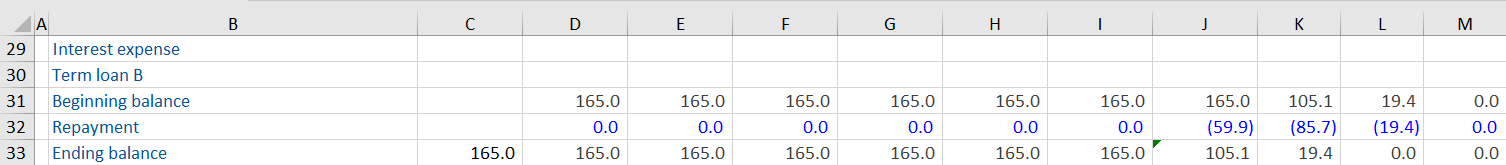

Given below is an example to understand how to forecast ending balances for individual debt instruments. Year 0 is historical and Year 1 to 10 are projected years.

For debt repayments to work properly, one needs a debt schedule that is all filed in. Given below is an example that covers only the revolver, term loan A and B and focuses specifically on principal repayments.

We start with our revolver, the beginning balance of which is zero. The repayment made, which is also zero, is taken from the cash flow statement. For all the years the ending balance is zero.

Next, in the Term Loan A, we have 425 as the beginning balance in Year 1. Then we go to the cash flow statement to get the repayment of 50.9 and subtract the same to get 374.1, which is the ending balance of Year 1.

We do likewise for the following years, the Term Loan A gets fully paid in Year 7 (the ending balance is zero). Here we notice that Term Loan B starts to be repaid from this same year (notice, before Year 7, repayment on the Term Loan B was zero) and gets paid fully by Year 9. We get data on repayment again from the cash flow statement.

Conclusion

Modeling the debt schedule is a key step when analyzing an LBO transaction. The sources and uses of funds and the debt structure of the deal must be fully understood before building the debt schedule. An LBO deal can involve multiple debt instruments and modeling all instruments can be quite challenging. However, the purpose of the debt schedule is to make sure that all the repayment obligations related to such debt instruments are met.