Comparable Companies

November 17, 2020

What are Comparable Companies?

Comparable companies are businesses that operate in similar industries and are used as a benchmark to extrapolate the value of another business. Comparable companies are used in trading comparables analysis.

Comparable companies share key metrics such as growth, operational drivers and risk. Often a group of companies is used in the analysis (often called a peer group) to produce a range of multiples.

It is important to remember that no two businesses are the same so the degree of comparability of the peers is always subjective.

Key Learning Points

- Comparable companies are similar businesses who share key metrics such as growth, operational drivers and risks

- A group of comparable companies is used in trading comparables analysis, this is often called a peer group

- Generally, a peer group contains a set of similar companies, however, it may also be appropriate to includes outliers for reference

- Finding comparables is challenging and when assigning a multiple to a company it is important to think about the drivers of multiples (returns, growth and risk)

Selecting Comparable Companies

The starting point for selecting the peer group is to understand the business being valued. The analysis should include market segments, products or services, customers, end markets, distribution channels, geographical exposure, cost structure, size, growth rates, margins, leverage and credit profile. Once this is done the peers should then be identified.

The best source for peer group identification is past analysis. When starting from scratch, the management discussion and analysis section of the financial statements often state the businesses’ own view of competition. Other sources include research and data providers who may list the sector players. Finally, the fairness opinion of recent M&A transactions will often detail the peer group used in forming a view of the transaction offer price.

Generally, it is best to start with a larger universe of possible peers and narrow the list down to those who are most closely comparable. A smaller number of good comparables is more useful than a longer list of variable quality. It may be useful to have a primary and secondary reference group. For example, if the business operates only in the US then the primary group should be US based comparables but there may be a few non-US based businesses which offer an interesting reference point. This depends on the detailed reason for the valuation assignment but the secondary reference group may shed some light on the value associated with geographic diversity of end consumers or the possible growth opportunities associated with overseas expansion. In the chemicals sector, for example, specialist chemical business tends to trade at a premium compared with the broader universe of chemical businesses.

Comparable Companies Analysis

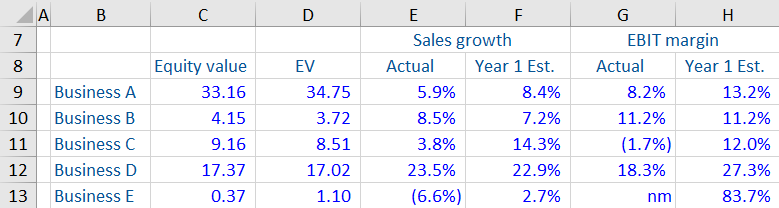

The matrix below gives information regarding 5 competitors operating in the same space. Comment on comparability.

Business E looks like it has come out of restructuring, with very low EV, accompanied by negative sales growth and non-meaningful EBIT margin in the actual year.

Followed by extremely high forecast EBIT margin for Year 1. Probably not comparable to the rest of the companies.

Business D seems to be a high growth company, with sales growth over 20.0% for 2 years in a row, and relatively high margins in comparison to companies A to C. It is, therefore, probably not comparable to the rest of the companies.

Business A has sales growth in line with peers, but EBIT margin seems to grow fast from actual year to Year 1. If this were a retailer, an increase like this would be unusual.

It is also much larger in size, from looking at EV, although the difference in size does not necessarily make it non-comparable.

On balance, Business A may be comparable to business B.

Business C has negative EBIT margin in actual year, followed by high EBIT margin in Year 1. It also has low sales growth in actual year followed by very high sales growth in the following year.

In conclusion, it is often the case that finding comparables is challenging. When assigning a multiple to a company it is important to think about the drivers of multiples – returns, growth and risk.