Capital Gain

May 10, 2021

What is a “Capital Gain”?

A capital gain is a profit or a gain realized by selling a capital asset at a price above its purchase price. Capital gains can be made on all types of capital assets, including equity shares, real estate, bonds, gold, and even cryptocurrencies. Capital gains can be classified based on the asset’s holding period (short-term vs. long-term capital gains) or whether the gains have been realized or exist only on paper (realized vs. unrealized capital gains).

Key Learning Points

- Capital gain is a gain realized from selling a capital asset

- A capital gain is realized when an asset is sold above its original purchase price

- Capital gains can be classified as short term vs. long term and realized vs. unrealized

- Short-term capital gains are realized when assets are sold within a year of their purchase. Long-term capital gains are realized on assets held for more than a year

- Realized capital gains are gains realized when an asset is sold

- Unrealized gains are paper gains or gains made through an increase in the market price of an asset that has not yet been sold

- In most countries, capital gains are included in a company’s taxable income and are charged at the prevailing tax rates

Capital Gains Explained

Suppose a business had purchased a real estate asset for $500,000. After 5 years, they sold the asset for $800,000. In this example, they made a capital gain of $300,000. Here is an explanation of the various types of capital gains:

Types of Capital Gains

Short-Term vs. Long-Term Capital Gains

Short-term capital gains arise on short-term capital assets or assets held for less than a year. Long-term capital gains are realized on long-term capital assets or assets held for more than a year.

Realized vs. Unrealized Capital Gains

Realized gains are capital gains realized on the actual sale of an asset. Realized gains are calculated as the selling price less the purchase price. Realized gains are taxable.

Unrealized gains are gains resulting from the appreciation of an asset’s market price but are not realized as the company still owns the asset. Unrealized gains are sometimes also known as paper gains. Such gains are not taxable.

Capital Gains and Corporate Tax Rates

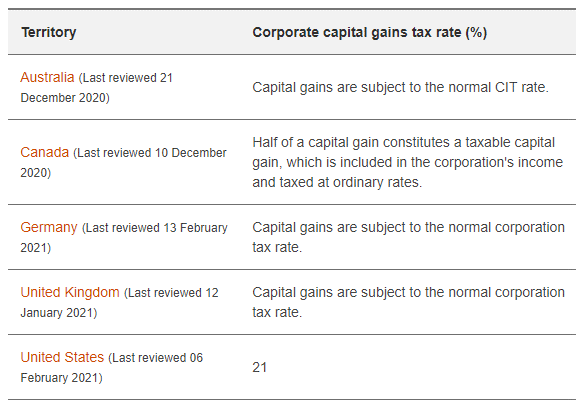

In many countries, capital gains are generally included in a company’s taxable income. This means capital gains are taxed at the marginal tax rate, which is the statutory tax rate in the country where a company operates. Examples of such countries include the UK, the US, and several European countries.

However, there are exceptions. For example, in Canada, half of capital gain is considered as a taxable capital gain. It is taxed at a corporation’s ordinary tax rates. In some cases, tax rates may vary for short-term and long-term gains. For example, in Italy, capital gains made on the sale of an investment are 95% tax-exempt if the investment was owned for more than 12 months.

Here is a snapshot of the corporate capital gains tax rate for different countries.

Source: PricewaterhouseCoopers

CIT refers to the normal corporate income tax rate.

Example: Capital Gains Tax

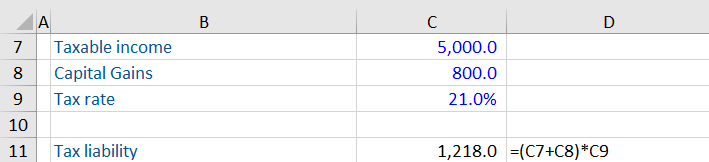

Based on the information below, we have been asked to calculate the total tax liability of this company.

The total tax liability will be calculated on the sum of the taxable income and capital gains.

Here the tax liability is calculated using the prevailing tax rate on the total taxable income.