Exchange Traded Funds (ETFs)

March 16, 2021

What are “ETFs”?

Exchange Traded Funds (or ETFs) are pooled investment vehicles for which the shares of the fund are available for trading over an exchange. ETFs typically adopt a passive investment style, have very low fees compared to actively managed funds and are designed to have the beneficial features of both mutual funds (or open-ended funds) and closed-ended investment companies.

Key Learning Points

- ETFs are typically passive investment vehicles which aim to track the performance of the designated index

- ETFs have no upper limit on their size and can be traded over an exchange at any time throughout the day

- ETF shares are created through the ‘in-kind’ creation process, in which a portfolio of securities is delivered to the fund, rather than cash, in exchange for shares in the ETF

Exchange Traded Funds (ETFs)

ETFs have many of the beneficial features of the two most widely used traditional investment vehicles; mutual funds and closed-ended investment companies.

Mutual funds are open ended, meaning they can accept new money from investors and grow as large as they like. In addition, the price paid by an investor to buy a share in a mutual fund will match the net asset value (or NAV) which is calculated by dividing the market value of the fund by the number of shares issued. However, the value of the shares in a mutual fund are only calculated once per day, and investments into or out of the fund can also only be made once per day at this one price.

Closed ended investment companies only issue a pre-determined number of shares, much like any other company, and those shares can be listed on an exchange, meaning there is a share price at any time and trading can take place at any time. An investor who wishes to invest in a closed-ended investment company can only buy the shares in that company from someone who already owns them. However the share price may not match the NAV for the fund.

ETFs combine the best features of both of these products: they are open ended so grow as more investors wish to invest in them, but their shares are listed on an exchange and can be traded at any time during the day at a variable price. The value of the fund shares will match NAV, due to the ‘in-kind’ creation process (see below).

In-Kind Creation Process

ETFs are can be traded on an exchange throughout the trading day due to the way in which the fund creates or redeems investments in the fund. For tradtional mutual funds, there is only one time per day when the fund accepts new investments or permits withdrawals from the fund to reduce the need for the mutual fund manager to have to trade on behalf of the fund to invest new money, or sell investments from the fund to meet withdrawals.

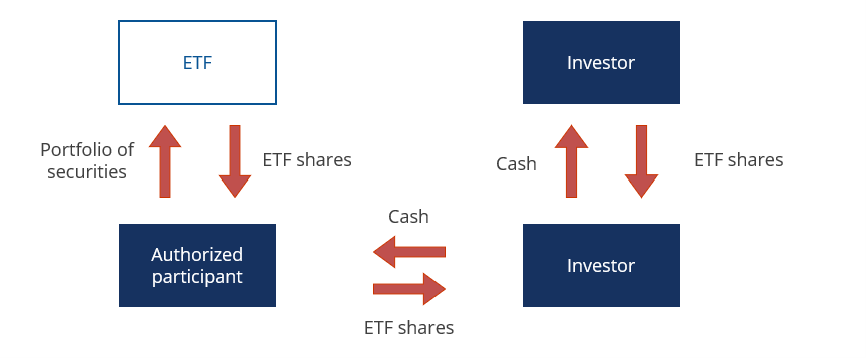

In contrast to this, an ETF does not accept money in exchange for new shares in the fund. Instead the fund must be provided with a portfolio of securities which matches the existing assets held by the fund. The same is true in reverse if the ETF shares are being sold back to the fund. This process is referred to as the ‘in-kind creation’ process and has the benefit of the fund not needing to purchase or sell securities in response to investments in or withdrawals from the fund. The fund is able to create or cancel shares in the ETF at any time through the day without any determent to the fund.

However, the ‘in-kind’ creation process is not the way in which most investors will invest in an ETF. The ETF is responsible for appointing an ‘authorized participant’ (AP), who may be a stock broker, investment bank or other large financial institution, to trade with the ETF to effect this in-kind creation process. Once the shares have been issued to the AP they can then be traded by the AP over an exchange with any investor, or can be traded between investors, just like any other listed security.

The AP will trade with the ETF when there is a mismatch between the value of the ETF shares on the exchange, and the NAV of the ETF itself. Higher levels of demand for the ETF shares by investors will drive their price higher than the NAV, which will then trigger the AP to deliver the required portfolio of assets to the fund in exchange for more ETF shares. These shares will then by sold by the AP over the exchange, increasing supply and therefore returning the price of the ETFs back down towards the NAV.

Passive Investments

The majority of ETFs are passively managed investment funds, due to the in-kind creation process. For the AP to know which assets to deliver through the in-kind creation process, they must know what assets are held by the fund. There is a requirement for holdings of an ETF to be made public daily.

The publication of the assets held by a fund, and their associated weights, is not something that most active managers would be willing to do, as it would reveal their investment strategy, allowing anyone else to match their holdings, without having to pay a fee to the actively managed fund. ETFs are generally passively managed, since there is no competitive advantage lost through the daily publication of their holdings.

Actively managed ETFs do exist, but they are in the minority. Some are fully transparent and publish their holdings daily, typically bond ETFs where the lower liquidity of many corporate bonds makes it harder for other investors to replicate the fund’s holdings. Others have approval from the SEC to operate on a semi transparent basis, the legal structure of which takes many different forms.