Fundamental or Bottom-Up Investing

May 18, 2021

What is “Bottom-Up Investing”?

Bottom-up is an investment approach that focuses on the fundamentals of the individual company rather than the overall macro environment. Its objective is to pick companies with strong fundamentals that have the ability to perform well regardless of the industry it operates in or the current point in the market cycle. Financial factors that can influence investors’ decisions include a healthy balance sheet, diversified and stable earnings streams, efficient debt and risk management. Operational and strategic factors such as management structure, business model, and competitive products or services are also considered.

Key Learning Points

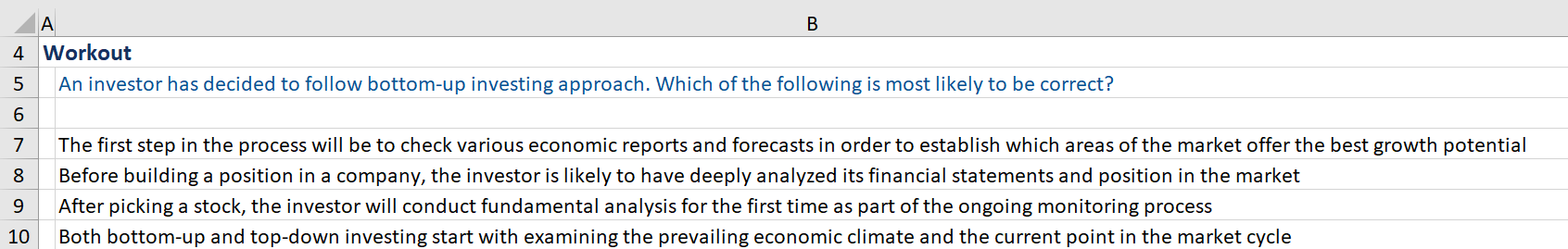

- Bottom-up or fundamental investing is an approach that focuses on the merits of individual companies first instead of macro or industry ‘top down’ trends

- Its main objective is to select quality companies that have the potential to deliver strong returns regardless of the sector they operate in or the current point in the market cycle

- In order to select “potential outperforming stocks”, investors analyze the financial strength of the company, its management structure, and business model along with its competitiveness relative to peers

- Bottom-up investing is the opposite of the top-down approach in which investors prioritize analyzing the macro and market specifics

The Basics of Bottom-Up Investing

The philosophy of bottom-up investing is concentrated around finding the best companies that could outperform relative to their peer group and the broader market over the long-term. These strategies might include identifying high quality companies based on fundamental analysis and holding them for the long-term. By using this approach, investors apply various metrics in order to find the intrinsic or fair value of the company’s shares and its future growth perspectives. Bottom-up investing may also focus on finding stocks that have been ignored or unloved by the market and further analysis suggests the company may be due a positive correction in its stock price. During this process, investors develop a deep understanding of the individual company’s financial position, the strength of its operating model and management and other factors such as product or service competitiveness.

Fundamental Analysis

The idea generation for bottom-up investors requires fundamental analysis of individual stocks in order to pick those with the strongest future potential. The process includes screening the universe and applying multiple quantitative filters as well as establishing the intrinsic (or fair) value of the companies that could potentially be included in the portfolio. Along with analyzing the financial statements of the company and its earnings, investors also pay attention to the operations and management strength. Examples of the financial ratios and techniques that bottom-up investors use include Discounted Cash Flows (DCF), Return on Capital Employed (ROCE), Dividend Yield, and Price-to-Earnings ratios (P/E).

Advantages and Disadvantages

The advantages of bottom-up investing include the strong growth potential for investors to outperform the broader market should their stock selection process prove successful. Being familiar with companies also allows investors to better monitor their holdings and react if the fundamentals (or other corporate components) alter or deteriorate.

On the other hand, overlooking important macro events and data might prove challenging for bottom-up investors since those factors could still have an impact on companies. In addition, this approach is considered to be riskier as it ignores larger industry or sector trends – picking a winning stock within a poorly performing sector could deliver total returns, but might not be enough to outperform the market on a relative basis.