Credit Committee in Banking

August 16, 2022

What is a Credit Committee in Banking?

A credit committee reviews applications for loans and other types of credit. They are generally composed of senior managers or executives, experienced finance managers, and sometimes external leaders. All committee members must satisfy any independence or membership requirements for credit, loan, or similar committees in accordance with applicable laws, rules, or regulations as may be in effect including those promulgated by the Federal Reserve Board of Governors.

Credit committees are responsible for decisions on loan requests that go beyond the authority of the bank’s loan officer or otherwise require special attention. These loans are normally commercial requests. The committee reviews the requests and relevant information to determine how to proceed. Ensuring alignment with standard lending policy and evaluating risk exposure, the lending committee determines whether to approve or deny the application. The credit committee is also responsible for reviewing the credit on maturing loans and directing collection efforts on past due loans.

Key Learning Points

- Credit committees review applications for loans and other forms of credit.

- Credit committees are responsible for reviewing and approving credit-related strategies and policies for the bank, and its divisions and subsidiaries.

- The credit committee is tasked with identifying the applications with the highest probability of repayment.

How does the Credit Committee Work?

The credit committee reviews and analyzes financial statements, credit statements, and other associated information accompanying a loan application. A review of the bank’s statutory obligations and lending policy is part of this process to ensure the loan request satisfies both criteria. The credit committee may also analyze the applicant’s industry for potential risks in relation to the loan request. Upon review, the committee will vote, and if unanimous will then sign off on the loan for disbursal.

Credit committees meet regularly to consider new applications for financing and/or decide whether to amend existing finance arrangements. Below are some of the key factors that credit committees may take into account when reviewing credit applications:

- The credit risks to the bank

- The market risk associated with an adverse change in market conditions

- The operational risk in the bank’s operations

- Legal risk of recovering the debt

- The impact on the bank’s capital adequacy.

- The bank’s lending policies.

- The motivation and rationale for the transaction being financed,

Oversight Responsibilities

Aside from the primary function of reviewing loan requests and initiating action against mature or past-due loans, the credit committee often has other important responsibilities as well. Compliance is a major concern for banks, and lending policy must be in accordance with regulatory authorities. The loan committee often conducts periodic reviews to ensure regulatory compliance of bank policy. Additionally, the committee will also ensure all regulations are followed in the approval and disbursement of previous loans.

The credit committee performs the following functions with respect to the Bank’s lending activities:

- Credit risk management: The committee oversees the bank’s credit risk management by reviewing the credit policy and approving the policies that are deemed as “Critical”.

- Credit strategies and performance: The committee reviews the strategies to achieve the bank’s credit and lending goals and makes appropriate recommendations to the Board.

- Lending authority: The committee considers loans above the Management Credit Committee’s authority limit, as determined by the Board from time to time. It also conducts quarterly reviews of credit granted by the Bank to ensure compliance with the internal control systems and credit approval procedures.

- Credit review: The committee reviews the bank’s internal control procedures in relation to credit risk assets and ensures that they are sufficient to safeguard the quality of the bank’s risk assets; The committee also ensures that the bank complies with regulatory requirements regarding the granting of credit facilities.

Example

A credit committee does not rewrite the future; its sole purpose is to protect bank capital and deposits by reducing the risk of default by a borrower. The loan application is more likely to be approved if the entity in question has a stable history and relationship with the bank, if the pledged assets provide a sufficient margin of safety, and if there is a track record of successful execution of prior expansion projects.

For example, a new technology company proposes to form a team of bankers and technologists, transforming the SME industry to set up a peer-to-peer lending platform, using cutting-edge innovative technology to underwrite and approve loans in less than 3 hours. Most committees will decline this proposal.

Conclusion

Credit committees on banking approval usually determine the terms on which financing is made available, including any security that may be required from the borrower or other obligors. The committee’s purpose is to provide oversight of credit risk in a fair and consistent manner within the bank’s lending and credit-related activities. Credit committees interpret and implement bank loan policy and lending guidelines

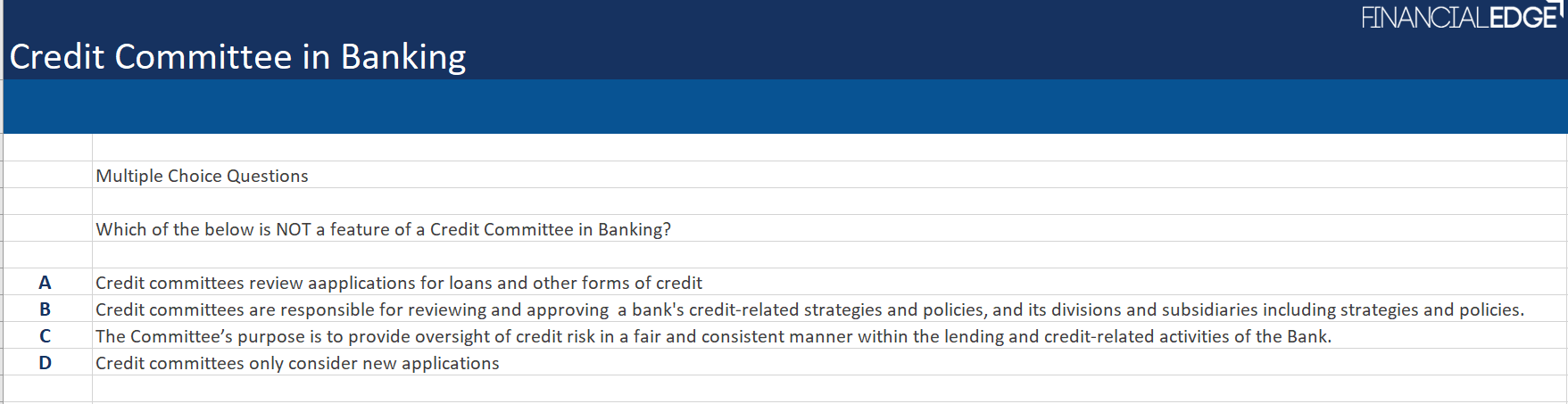

Credit Committee – Multiple Choice Question

Download the Excel files for the answer.