Hedging – Definition, How It Works and Examples

March 4, 2022

What is “Hedging”?

Hedging is a financial strategy implemented by investors to protect their investment portfolios from the risk of adverse price movements that could lead to the loss of value. Investors employ these strategies by taking what are viewed as offsetting positions – these are usually in the same or related assets. These strategies can involve derivatives such as options and futures contracts.

A derivative is a financial instrument whose value depends on an underlying financial asset or set of assets. These financial instruments are used by investors and portfolio managers to hedge stocks, commodities, interest rates and currencies.

Key Learning Points

- Hedging is a financial risk management strategy used by investors to potentially offset losses in their investments by taking opposite positions in the same or related assets

- Hedging strategies can limit the risk of loss but also limit the profit potential of a given investment through the use of derivative contracts

- Derivatives are financial instruments whose value depends on an underlying asset or group of assets

- Investors can use hedging strategies to limit losses in one investment by realizing gains in another investment

- Hedging through diversification involves investing in a variety of stocks whose performances are not affected by the same risk factors

How does Hedging work?

Hedging can best be thought of as a form of insurance against unforeseen circumstances which may have financial ramifications. In the event where the unforeseen circumstance manifests itself, a properly hedged position reduces the potential losses that could have been realized. An everyday life example is car insurance which hedges the driver against car theft and accidents among other risks.

One of the common forms of hedging is through derivative contracts. Portfolio managers, individual investors and companies enter into derivative contracts to reduce their exposure to adverse price movements. Options and futures contracts are the two commonly used derivative securities in hedging investments. An option is a financial contract which gives the holder the right to buy or sell an asset at a given price known as the strike price within a specific time period. A futures contract on the other hand obliges the holder to buy or sell a specified amount of an asset at a predetermined price with an agreed expiry date at which the contract must be fulfilled.

Investors can protect their investments from potential losses by entering derivative contracts whose gains will offset the losses realized in the event of unfavorable price movements. If an investor is long the stock of a particular company but due to short term losses suspects the price will drop, buying a ‘put option’ is one of the ways to hedge against potential downside risk.

Suppose further that in the future the price of the stock actually declines resulting in a loss of value of the stocks which the investor holds, exposing them to huge losses. However, the put option gives the investor the right to sell his now devalued stocks at a strike price that is higher than the spot price which is the current price of the stock in the market. The gains from exercising his right on the option will (partially) offset the losses realized on the stock.

Hedging by diversification is another hedging strategy commonly employed by portfolio managers. When picking stocks to include in a portfolio, portfolio managers should include stocks which have little to no correlation in order to mitigate portfolio risks. For instance, an investor might include cyclical and counter-cyclical stocks in a portfolio such that factors which affect the performance of one stock do not affect the entire portfolio.

It is important to note that hedging does not increase potential gain but rather is used to reduce potential loss. To obtain a derivative contract for a hedge, the investor has to pay a premium. In a case where the price movements favor the investor, he realizes the full gain of his investment or original position but loses the premium paid for the option used to hedge his position. Hedging contacts may also be purchased in anticipation of events that do not occur which will also add an element of cost into the portfolio. This is usually viewed as an acceptable price to pay to mitigate any potential downside if an adverse event occurs.

Hedging, although similar to insurance, can be complex and requires careful consideration from risk managers. It is very difficult to come up with a perfect hedging strategy in the real world and risk managers aim to achieve just that to minimize their exposure to risks resulting in loss of financial value. By employing such strategies, investors must consider whether the potential benefits outweigh the expenses.

Example

Alex is an investor who strongly believes in the potential of social media company ABC Ltd and has purchased (is long) 100 shares with a stock price of US$100. However, the recent news developments revealing mishandling of users’ private information spells bad news for ABC Ltd. Alex believes this news will spur bearish sentiments in the market regarding ABC Ltd’s stock. In order to protect himself from the potential downside risk, he buys a ‘put option’ for US$5. Since options are levered investments, each contract gives the holder the right to buy or sell 100 shares of the stock.

Suppose at expiry of the option, the underlying spot price is US$90. Alex stands to lose US$10 in the underlying market (US$90 – US$100 = -US$10). However, he has the right to sell his shares for the agreed strike price of US $100 as purchased via the put option. This does not imply he gains $10 on the put option because he paid $5 to obtain the put option ($100 – $90 – $5 = $5). As a result, the hedging strategy reduced his potential loss from $10 to $5 (-$10 + $5 = -$5).

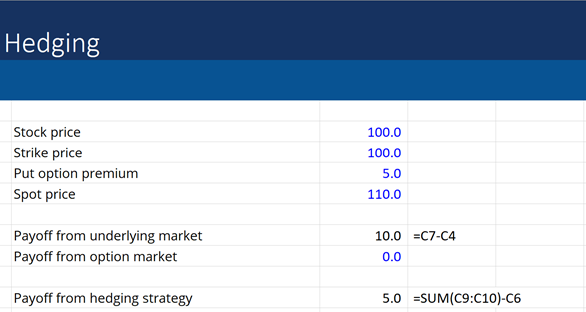

On the other hand, suppose that at expiry of the option, the underlying spot price is $110. Alex profits $10 in the underlying market ($110 – $100 = $10). The put option will expire worthless as it is not beneficial for Alex to exercise the right to sell at $100 when the spot price is $110. However, as a result of the put option he bought for $5 to protect himself from downside risk, the overall profit from the hedging strategy is reduced to $5 ($10 – $5 = $5).

It is clear to see from the example that hedging is a strategy employed by investors to limit potential losses but it also results in a reduction of potential gain. Investors, therefore, have to determine whether the benefits of hedging can justify the cost.

Conclusion

Investors, portfolio managers and corporations implement hedging strategies to mitigate the risks that may arise from adverse price movements. These strategies are far from perfect but are constructed in such a way that they minimize the potential losses that could be realized if price movements are unfavorable to the original investment.