Information Required for Transaction Comparables

May 10, 2021

What “Information is Required for Transaction Comparables”?

Transaction Comparables, also known as deal comps or precedent transactions, is a market-based valuation methodology i.e. a relative valuation methodology. It uses previously completed mergers and acquisitions (M&A) deals involving similar companies to value a comparable company today. It uses prices paid for similar businesses in an acquisition of a controlling stake (i.e. it uses a market price as a starting point) and hence informs the market’s view of the valuation. The comparable or similar companies share key markets, growth prospects, operational drivers and risks.

To perform the Transaction Comparables analysis, the process begins by searching for relevant or comparable transactions that have occurred in recent years and are usually in the same industry. Having stated this, the information required for transaction comparables refers to the information required to calculate the value (e.g., enterprise value) and value drivers (i.e. factors that drive a company’s performance, growth and hence value) to analyze the comparability of transactions.

Key Learning Points

- There are many sources to identify a list of comparable transactions.

- For each comparable transaction, analysts require several bits of information to calculate the enterprise value and equity value of comparable companies

- Overall, primary sources of information are considered the most reliable.

Information Needed for Transaction Comparables

Comparable Transactions

There is no shortcut method for the compilation of a list of comparable transactions. The most common approach is to review several sources, including:

- M&A databases

- Research reports within the sector

- Acquisition and divestiture history of the target and its comparables

- Fairness opinions (within merger proxies or merger-related filings with the regulators)

- Existing precedent transaction analysis and or pitch books (pitches made to potential investors)

- Industry teams

- News runs

Deal-Specific Information

From the universe of 10 or 20 comparable transactions, analysts will require specific information for each deal. The information required for both public and private companies is largely similar. Notably, all information should be at the time the offer was made and not at the time of completion of the deal.

The analysts will require the following information for each of the transactions being analyzed.

| If Publicly Traded | If Private |

| Offer price | Offer price or enterprise value |

| Unaffected share price | NA |

| Date of offer | Date of offer |

| Date of completion | Date of completion |

| Diluted shares outstanding | Diluted shares outstanding (if available) |

| Total debt and equivalents | Total debt and equivalents |

| Cash and non-core assets | Cash and non-core assets |

| Recurring LTM EBITDA | Recurring LTM EBITDA |

The offer price and unaffected share price are used to calculate the premium paid for the transaction as well as the synergies earned. Diluted shares outstanding are multiplied by the offer price to calculate the equity value.

Offer price x Diluted share outstanding = Equity value of the offer

Using the equity value, analysts can calculate the enterprise value for which they require information related to debt and cash.

Once the implied enterprise value is calculated, it’s divided by the recurring last 12 months EBITDA. The result is an EV/EBITDA multiple of the deal as of the offer date.

Hierarchy of Information Sources

The following information sources are meant to provide details of a company’s financials and specifically the details regarding an acquisition.

Primary Sources of Information

- Regulatory filings

- Financial statements

- Company presentations/press releases

Secondary Sources of Information

- M&A databases

- Equity research

- Trade publications for sector deal information

- Press

Example: Basic Transaction Comparables Workout

Given below is some information about a recently acquired company. All information is given at the time of the deal announcement or the most recent filing prior to the deal announcement. The Equity & Enterprise Value, EBIT, EBITDA multiple, EV/EBIT and EV/EBITDA. and the control premium have been calculated from this information.

Calculating Equity & Enterprise Value

Using the diluted shares outstanding and the offer price, given below is the calculation of acquisition equity value of the acquired company.

Next, based on the equity value and the net debt (debt less cash and cash equivalents), the enterprise value has been calculated.

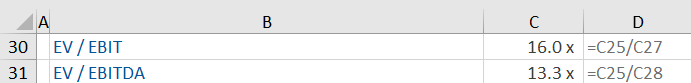

Calculating EV/EBIT & EV/EBITDA

First, we calculate the EBITDA using the LTM EBIT and LTM depreciation and amortization.

Next, we calculate the EV/EBIT and EV/EBITDA.

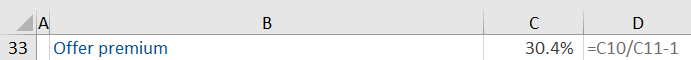

Calculating Offer Premium

We calculate the offer premium for this acquisition by comparing the offer price and the unaffected share price.

Analysts calculate these metrics for each of the transactions in their universe of comparable deals. Thereafter, they will use this data to decide or recommend whether to invest in the target company or not. Typically the multiples can be put into ‘ranges’ to suggest when an offer is likely to be accepted or rejected. It is important to also consider whether past deals have offered big synergies to the purchasing company (meaning they are willing to pay more). Also, analysts must consider at what stage in the economic cycle that offers have been made and accepted (or rejected).