PEG Ratio (Price/Earnings-to-Growth) Template

December 17, 2025

What is the Price/Earnings to Growth Ratio

The Price earnings-to-growth (PEG) ratio helps investors determine whether a stock is overvalued, undervalued, or fairly valued relative to its growth potential.

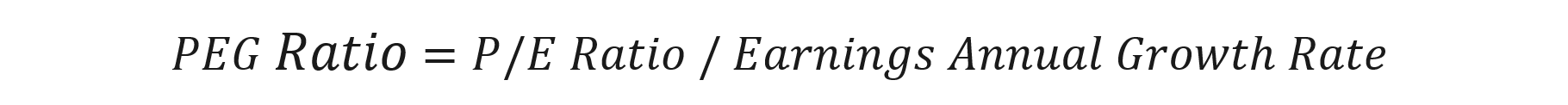

What is the PEG Ratio Formula?

PEG Ratio = P/E Ratio / Earnings Annual Growth Rate

Where:

- P/E Ratio = Price Per Share / Earnings Per Share (EPS)

- Earnings Growth Rate = Expected annual growth in EPS (usually expressed as a percentage)

Example of the PEG Ratio Calculation

A PEG ratio < 1 may indicate undervaluation relative to its growth expectation, while a PEG ratio > 1 could suggest overvaluation relative to its growth expectation.

Here’s a simplified example:

- Company A:

- P/E Ratio = 10

- EPS Growth Rate = 10%

- PEG Ratio = 10 / 10 = 0

- Company B:

- P/E Ratio = 11

- EPS Growth Rate = 15%

- PEG Ratio = 11 / 15 = 73

In this case, Company B has a lower PEG ratio, suggesting it may be undervalued relative to its growth potential compared to Company A.

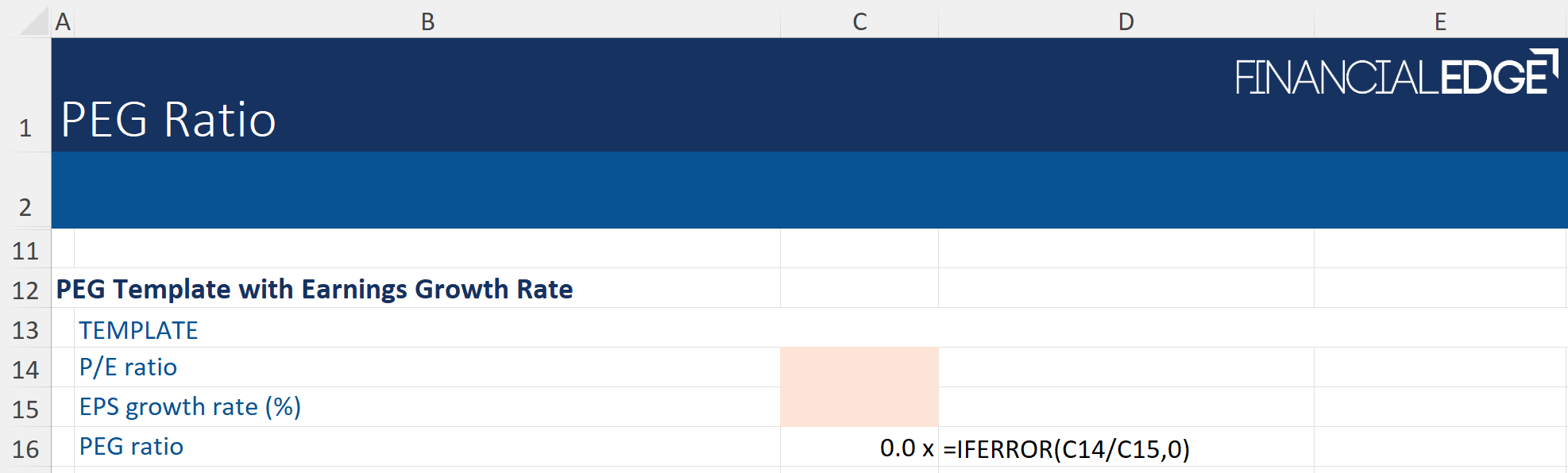

Download the Price Earnings-to-Growth Template

Download the free Excel template to calculate the PEG ratio. In this template, you can enter the figures for a firm in the shaded cells, and the PEG ratio is automatically calculated. There are two alternative templates depending on whether you have an expected growth rate or historic EPS figures.