Economic Value Added (EVA) Template

December 15, 2025

Download the Economic Value Added Template

Download Financial Edge Training’s free Economic Value Added template using the US-listed company Nvidia to calculate the EVA calculations. This template is designed to be user-friendly and allows for easy input of financial data, making it accessible for both professionals and students.

Download the Free Template

Enter your email in the form and download the free template now.

What is Economic Value Added (EVA)?

Economic Value Added (EVA) is a financial metric that measures the amount by which a business is generating returns above its cost of capital.

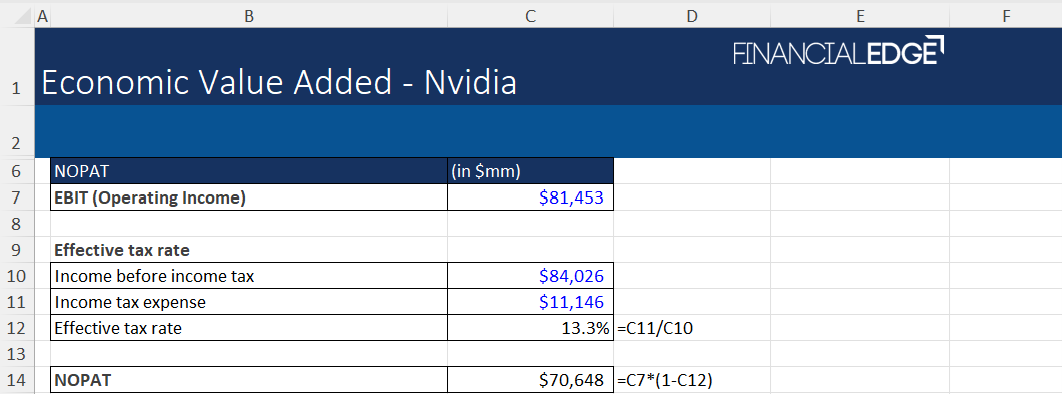

The Economic Value Added (EVA) template is a structured spreadsheet designed to help users calculate EVA for a company, division, or project. It typically includes sections for inputting financial data such as EBIT (Earnings Before Interest and Taxes), tax rate, invested capital, and the weighted average cost of capital (WACC). It guides users through each step of the EVA calculation, ensuring all necessary adjustments and formulas are applied correctly.

This template includes an example calculation based on the USA company Nvidia to illustrate the EVA calculation.

Steps for Using the Economic Value Added (EVA) Template

- With a streamlined layout and editable inputs, the EVA template allows you to clearly assess whether a company is generating returns above its cost of capital.

- Download the template and replace all the hard coded placeholder (blue) financials with your company’s figures (EBIT, Income before tax, tax expense, WACC and all the components of debt).

The template will now automatically calculate the EVA showing how much economic profit the business is generating after accounting for the cost of capital.

Economic Value Added (EVA) Formula

EVA = NOPAT – (WACC x Invested Capital)

Where:

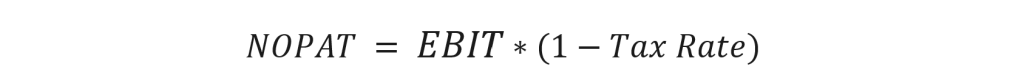

NOPAT (Net Operating Profit After Tax) Formula

NOPAT = EBIT*(1-Tax Rate)

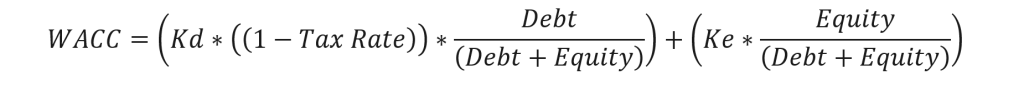

WACC (Weighted Average Cost of Capital) Formula

WACC= (Kd * (1-Tax Rate) * Debt / ((Debt + Equity))) + (Ke * Equity / ((Debt + Equity)))

Kd= Cost of debt

Ke = Cost of equity

Invested Capital Formula

Invested Capital = Interest-Bearing Debt + Long-Term Operating Leases + Shareholders’ Equity