Cash Flow from Investing Activities (CFI)

October 15, 2020

What is “Cash Flow from Investing Activities”?

A company lists any investments made with cash on its cash flow statement. This section represents the amount of cash used or generated from investment-related activities in a specific period.

Items reported on a cash flow statement for investing activities include purchases of long-term assets such as property, plant and equipment (PP&E), investments in marketable securities such as stocks and bonds, as well as acquisitions of other businesses.

Other items to include are a sale of a division, proceeds from the sale of PP&E, and proceeds from the sale of marketable securities and other businesses.

Some companies will have items not mentioned above, so it’s important to look at the balance sheet of a company to determine the line items.

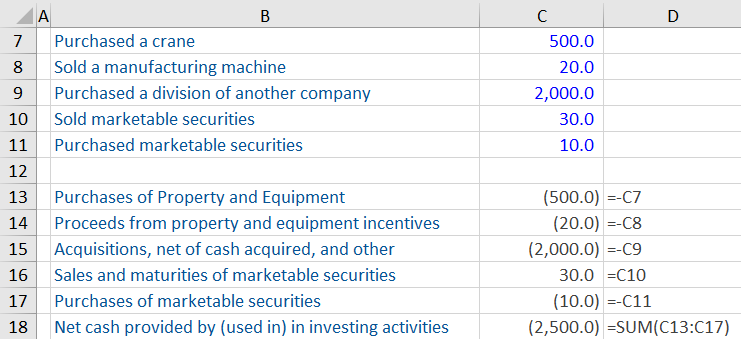

The Coca-Cola Company – Cash Flow from Investing Activities Extract

Key Learning Products

- Cash flow from investing activities represent the amount of cash used or generated from investment-related activities (purchase of PP&E etc.)

- A positive cash flow indicates the company is divesting, a negative number indicates the company is investing heavily in its asset base to help generate growth in revenue

- The net cash flow includes the sum of all investing related activities for the accounting period

Formula

Cash Flow from Investing Activities = (Purchase)/Sale of Long-Term Assets (Capex) + (Purchase)/Sale of Other Businesses (M&A) + (Purchase)/Sale of Marketable Securities

Example

Company XYZ had the following transactions for year-ending 20X7:

The above example would reflect in the investing activities of a cash flow statement as:

Points to Note

- Purchases of the crane, a division of another company and marketable securities are an outflow of cash and must be recorded using a negative sign

- Sales of the manufacturing machine and marketable securities is an inflow of cash

What Not to Include in Investing Activities

- Debt, equity or other forms of financing

- Interest payments or dividends

- Income or expenses related to regular business operations

- Depreciation and amortization expenses on non-current assets

Why is Cash Flow from Investing Activities Important?

Although a company may report a negative cash flow in investing activities, it doesn’t necessarily mean that it’s going to have a negative impact on the business.

In the short-term, the company has faced a negative impact on cash flow due to the purchase of property, plant and equipment, but in the long-term the assets could help generate growth in a company’s revenue.

In summary, investing activities provide an insight into how effectively the company is keeping its asset base up to date, and investing for future growth.